In a recent survey, Indonesians were noted to have one of the highest crypto adoption rates globally. As more and more users eventually transition into crypto, they will have to look for great exchanges to on and off-ramp.

For those unfamiliar with these terms, they refer to methods of depositing your funds into Centralized Exchanges, swapping them for crypto and vice versa.

Choosing where to buy and sell Crypto differs from person to person, but there are a few main factors we should consider. Ideally, they should have a great user interface, low fees, and quick response times

In this article, we will go through five CEXs for those in Indonesia, along with their Pros and Cons.

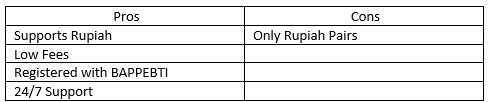

1. Indodax

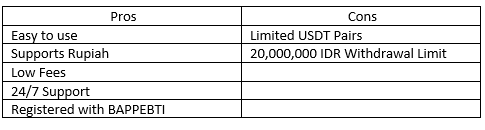

Established in 2014, Indodax was one of the first few CEXs to operate in Indonesia. Recognized by the Commodity Futures Trading Regulatory Agency (BAPPEBTI), they also support Rupiah and allow for easy on-ramping, even via methods such as vouchers.

2. LUNO

Well-established in Asia, LUNO offers lower fees in Indonesia compared to other regions. In fact, users are now incentivised with a 0.2% Maker fee, to enhance liquidity on the platform. However, the platform is limited to $BTC and $ETH and is therefore not very good for on-ramping other cryptos.

3. Bitcoin Indonesia

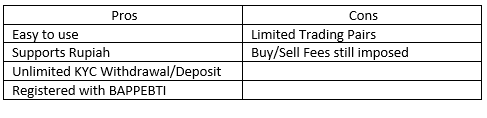

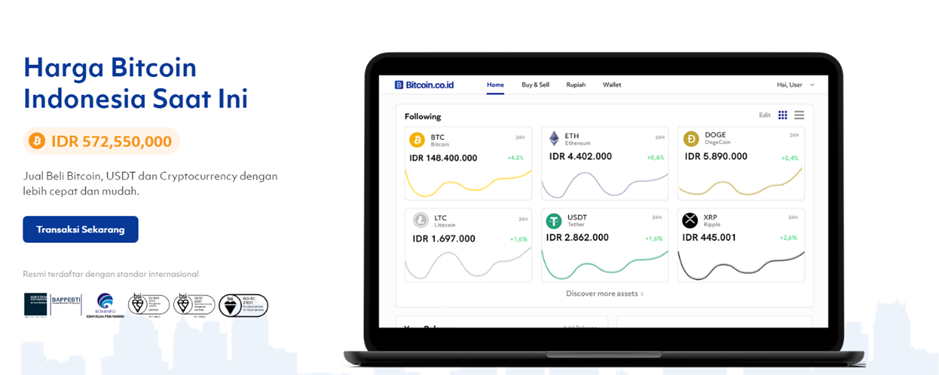

Mainly operating only in Indonesia, this CEX shot to number one thanks to their non-KYC accounts. While that feature has since been shut down, their zero-fee system, interoperability with Indodax, as well as cold storage options still make it an attractive place to trade.

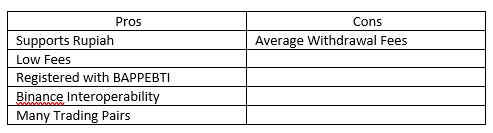

4. TokoCrypto

A leading CEX in Indonesia, Tokocrypto Exchange recently received investments from Binance – cementing it as a giant in the region. Their familiar interface, low fees, and CeFi + DeFi opportunities make them a no-brainer to try.

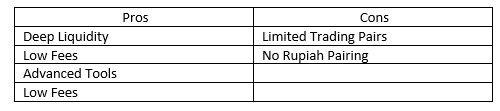

5. OkCoin

One of the largest CEXs in Southeast Asia, OkCoin’s smooth interface, advanced trading tools, and low fees help them stand out. More experienced users may find this platform more attractive, with deep liquidity and free analytics.

What’s The Best Exchange for Me?

Every CEX has its pros and cons, and therefore different use cases. It is probably best to go for one recognized by the Indonesian BAPPEBTI for the safety of your funds.

Making a decision should be mostly based on fees and user experience. Trying them out one by one is, of course, still the best way to understand which is best for you. Using multiple exchanges may also be good, given how uncertain regulation is in the crypto space.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Also Read: Profiting During A Crypto Crash; A Beginner’s Guide To Short Bitcoin On FTX Pro (Mobile)