Bitcoin has long since been heralded as an “inflation hedge” due to its decentralized nature and limited supply.

However, it’s recent price action has indicated that it is far from being worthy of that status.

YTD, the leading cryptocurrency is down almost 70% from its peak, dragging down the rest of the crypto market.

Buffet’s Safety Bills

While crypto investors are scrambling for investment strategies, billionaire investor Warren Buffet has a new strategy.

The CEO of Berkshire Hathaway, who previously called Bitcoin “rat poison squared”, has put most of his firm’s spare cash in short-term Unite States Treasury Bills.

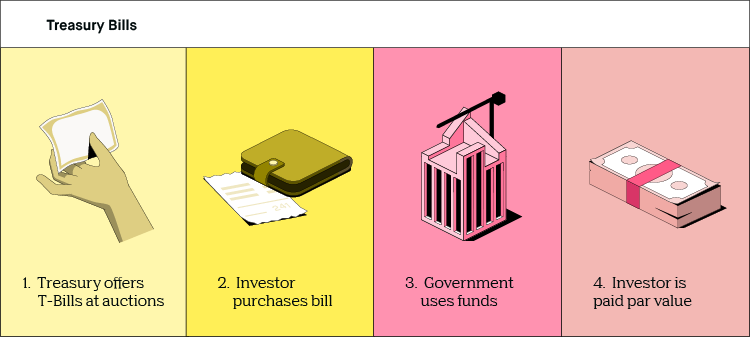

Treasury Bills are short-term securities, usually sold by governments that are sold at a discount. Investors receive the full face value at maturity, usually within 6 to 12 months.

While this does not directly affect the crypto markets, the decision strongly reflects overall market conditions.

Down Only?

Since the United States Federal Reserve raised interest rates, bond yields have been skyrocketing.

With some offering up to 3.27% in yield for what is essentially a risk-free asset, they are the optimum yield farm for the short term.

In fact, current T-Bond yields match those offered for stablecoins on Aave, even with Opimism’s incentives.

Factoring in smart contract risk, gas fees, and other miscellaneous costs, it is almost a no brainer to withdraw your funds and put them into short term bills.

“I don’t have any Bitcoin. I don’t own any cryptocurrency, I never will”

With risk-on assets taking a dive, and Buffet’s successful track record, it may not be long before a large number of investors start to copy trade him.

However, it is notable that a majority of Berkshire Hathaway’s portfolio still remains long on stocks that provide some form of technology infrastrcuture.

Furthermore, names within the portfolio like Mastercard and Bank of America are actively pursuing steps into Web3.0.

Also Read: TradFi X DeFi: MakerDAO Finalizes 100M Loan To US Bank

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: ChainDebrief