One major catalyst with every token in crypto is exchange listings. Crypto coins out there are in demand but often require investors to go through an inconvenient multiple-step process to acquire them. And people hate inconvenience.

That is where centralised exchanges, e.g. Binance, Kucoin, and Coinbase, make things much simpler. As an intermediary, centralised exchanges act somewhat as a bridge. Listing the token on their exchange would make it easier for investors to access tokens which was previously an arduous process to acquire.

When a token gets listed, floodgates are broken. Listing a token is bullish news which translates to increased trading volume and price action on the token itself. While this makes the asset highly volatile in such an environment, opportunities can be made.

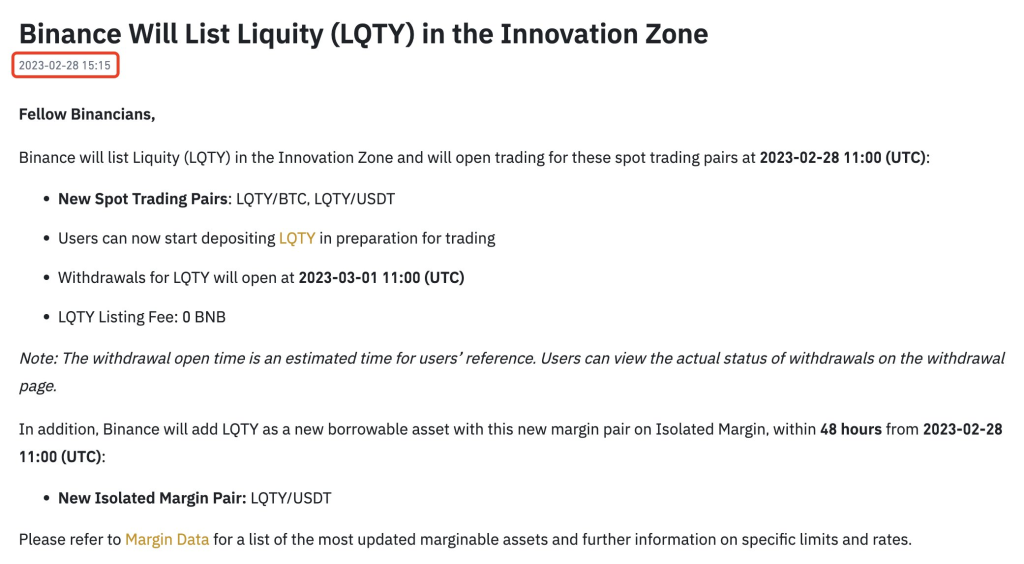

$LQTY on Binance

Recently, we saw the price of the newly listed $LQTY token on Binance more than quadruple just after the announcement of the listing on the Binance innovation zone.

Before the Binance announcement, $LQTY saw a decent run-up from $0.68 to $1.2, but that was pushed even higher to $2.35, and since then, it has been trading on over extended regions.

This chart shows us how strong an exchange listing catalyst can be. It also reveals the emotional side of investors’ trading, but when opportunities present themselves, you should take them quickly.

A 4x is a substantial gain, but who is the real winner? Those who 4x, but they do it with size.

But when you go in with size, it also means you go all in without certainty. Taking that bet is often risky unless you have a card up your sleeve. This could come as insider information before any exchange listing announcement.

Not too sure how tightly exchanges withhold this information, but those who capitalize on this will see the biggest gains. You will likely be their exit liquidity (you buy their tokens at sky-high prices, thinking they will go higher).

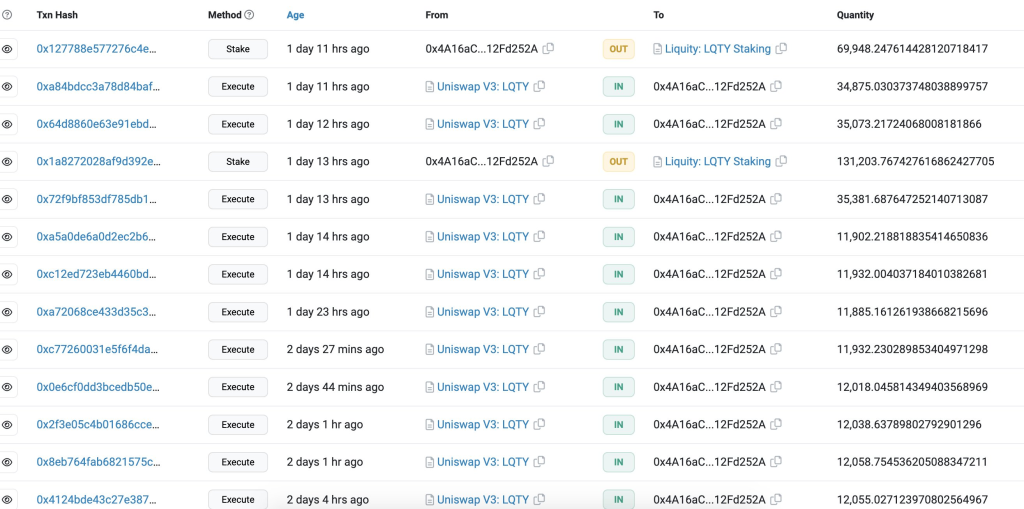

According to LookOnChain on Twitter, a whale bought 590,067 $LQTY worth $1.5M with an average buying price of $1.19.

Furthermore, it seems. Smart money could always buy tokens once the token is listed on the innovation zone of Binance and sell for a profit after the price rises.

Another smart money sold 105,384 $LQTY for $199,485 after the price rose instead of the Binance announcement. This whale made a profit of $19,485 in less than 20 minutes. Look at the time stamps identified in red.

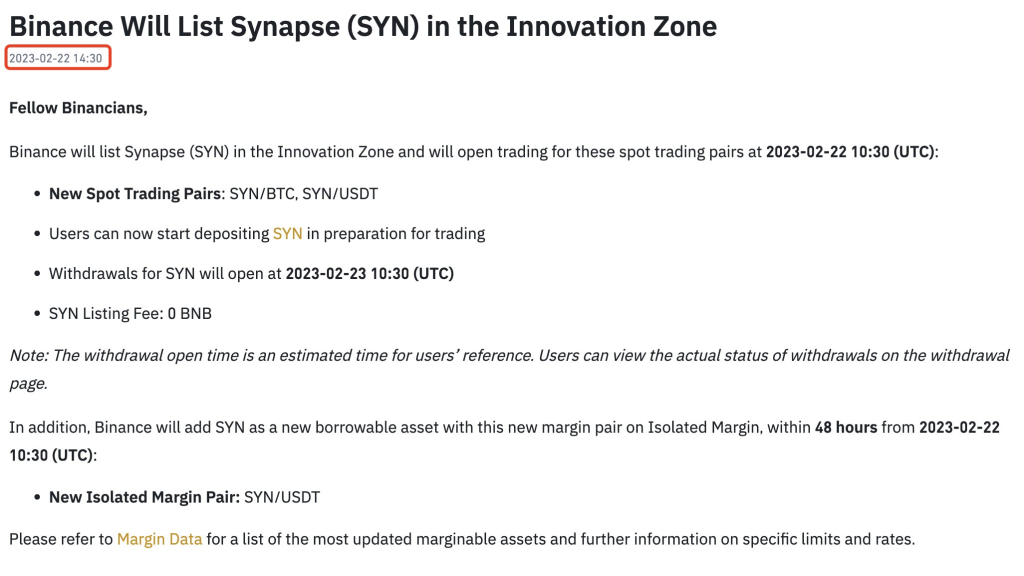

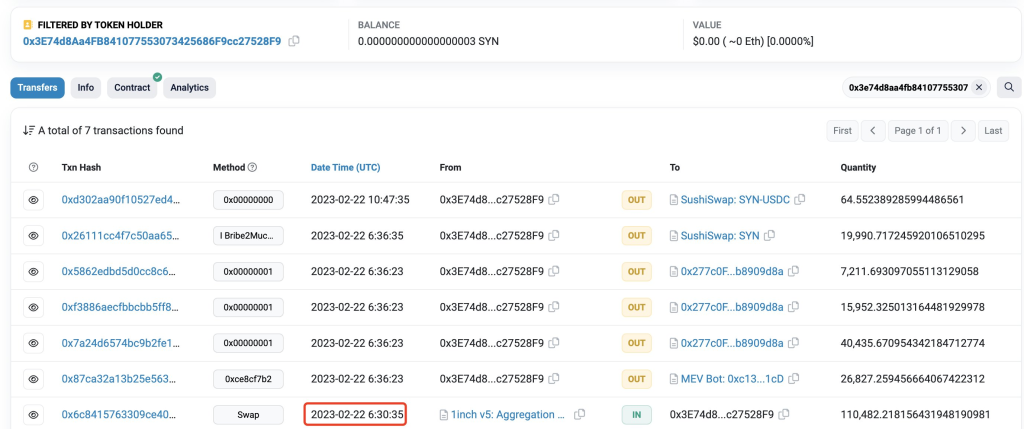

Another occasion was regarding the $SYN token, also announced on the Binance innovation zone. The Smart money bought 110,482 $SYN with $150,000 within seconds of Binance’s announcement on Feb 22.

The whale then sold it entirely for $35K in profits after the price rise. 35K in 20 mins.

$GNS on Binance

Two weeks back, similar transactions happened with $GNS upon its listing announcement on Binance.

#Binance will list @GainsNetwork_io $GNS in the Innovation Zone.

— Binance (@binance) February 17, 2023

➡️ https://t.co/4ihgh7POzE pic.twitter.com/pwOZzgEwJO

I talked about this first in our newsletter two weeks back and tried to find out whether insider trading was involved or if it was a true conviction by the trader.

According to Lookonchain, there are two addresses that bought GNS before Binance launched GNS to make a profit. 0x339…0d9f started to buy GNS from February 8th, spent $500,000 to buy 67,000 GNSs at $7.38, and sold 11,000 GNSs for $11.22 after the announcement. 0xaA…06e6 began… https://t.co/ylPx0K6fI2

— Wu Blockchain (@WuBlockchain) February 17, 2023

Here are the facts

– The first bunch of $GNS was bought 25 days ago

– Bought 25K of $GNS bought at ~$7.5 within three days

– Sold 8k of $GNS when the price dropped to $6.5

– Buys another 21K $GNS when price is ~$8

– 15mins later, sold ~10k $GNS at the same price

– News on the Binance listing happened

– Sold 27K $GNS for a hefty profit

What do you think? Find the answer here.

Closing thoughts with a tinge of alpha

We know how big of an impact exchange listings have on the price of a token, and that got me thinking if there is a way to play this narrative; by looking at coins not listed on big exchanges yet and finding any unusual transaction that is being made prior (like the whale accumulating $LQTY before the Binance announcement spurring the initial pump of the token).

More changes to non @binance list, added $RADAR (New WP incoming, one of cryptos top tools) $FLOKI (Stronk meme) $PREMIA (Options trading) & removed $SYN (Listed) $CAP $VELA (Both perps, $GNS got listed so I dont think we see any of the same for now). >> https://t.co/XFqmTMnb63 pic.twitter.com/YIZ9NYIhEI

— KryptoKami (@sircryptokami) February 23, 2023

While this could be a viable trading strategy, you must be aware of the risks of the listing not happening at all. Alternatively, you can track transactions made from these whales and find a token they all hold which have not blown up yet.

Stay frosty; not everything is as good as it seems.

Also, read Top 10 Arbitrum Protocols to Look Out for in 2023

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief