2023 has a lot in store for anyone involved in Web3 to be excited for. The start of the new year was heralded with a 43% move by Bitcoin off it’s recent lows, followed strongly by many altcoins moving double, or even triple digits across the board.

More importantly, 2023 marked the end of a disastrous year for Web3, given the collapse of CeDeFi, an entire Layer 1 ecosystem, as well as more than $3 billion in hacks across a range of platforms. The collapse of FTX will also be ingrained in the minds of every crypto proponent as a reminder that no single entity will ever be too big to fail.

Despite the tragic events that befell us this past year, every cloud has its silver lining. With bad actors being flushed out, those who took precaution are able to keep their heads down and continue building despite the turbulent times.

With the market finally breaking out of its lows, however, many are unsure of what the future holds – and who better to ask about the state of crypto than those with a finger directly on the pulse of Web3?

Also Read: Here’s What The Top Crypto Market Reports Say About Web3 Gaming In 2023

Fear, Greed, and Macroeconomics – Where are We in The Market Cycle?

The recent bull market featured a variety of narratives that seemed to rotate seemingly to no end. From Alt-L1s to algorithmic-stablecoins, “hype” was the driving factor for capital to flow, often without sound fundamental analysis to back it up.

How did your portfolio perform in 2022?

— Chain Debrief (@ChainDebrief) December 29, 2022

However, the rise of demand for “real yield”, instead of inflationary governance tokens, has signaled a shift in what investors are looking for in 2023.

“The previous year will be remembered as a landmark for the crypto industry, marked by a decline in asset prices and failures of projects and organizations among others. Despite this, the current bear market presents an opportunity to forge ahead and transition from a speculative phase to a phase focused on utility …”

–Raagulan Pathy, Vice President of Asia Pacific for Circle

In fact, the industry has not only moved past speculative investments, but has also evolved to require more accountability and transparency in areas other than tokenomics. Market participants at all levels have also stepped up their own due diligence, choosing to act on statistics and proof, instead of only good faith.

As these entities continue to ramp up their transparency reports, faith in the ecosystem has returned, with Leonard Hoh, APAC General Manager at Bitstamp noting that “Trading activities from retail and institutional investors have returned to CEXes and reputable exchanges, with trading volume on Bitstamp having doubled since the end of 2022”

This corresponds to data from CryptoQuant, which shows a slight uptick in Exchange Netflow following the implosion of FTX. Exchange Netflow is an indicator that track the difference between coins flowing in and out of various exchanges.

Despite the faith in centralized exchanges being shaken following the collapse of many centralized institutions, those that commit to transparency and proper risk management have remained trustworthy in the eyes of the public.

Although the industry has somewhat seen a return to normalcy since the beginning of the year, Web3, and many other risk-on investments, are clearly not out of the woods yet. One common factor all polled industry leaders mentioned to keep an eye out for was the uncertain Macroeconomic environment awaiting us in 2023.

Bitstamp’s Leonard Hoh reflects on the recent Bitcoin rally as one driven by rates and “positive inflation data coming from the US and the FOMC”, but reiterates that we should look beyond asset prices and question whether “the trust and confidence necessary to sustain this rally is coming back”

Painting The Picture For NFTs

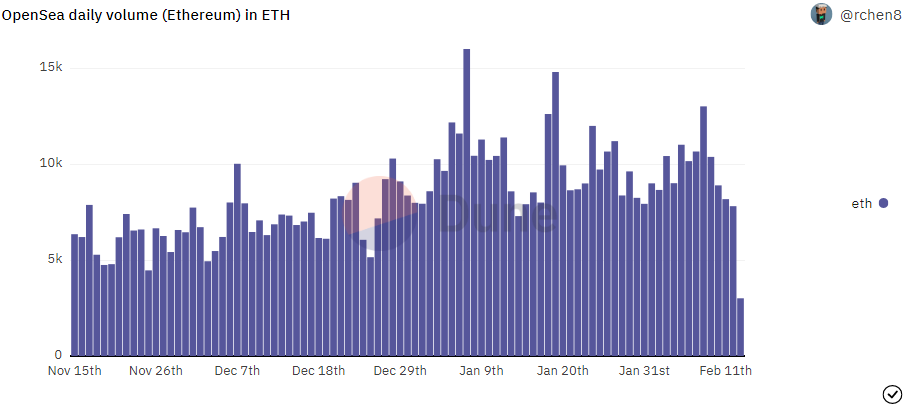

While NFT (Non-Fungible Tokens) transaction volumes are a far cry from the bull market highs, monthly volume on Ethereum has picked up substantially since the end of last year.

Leading the rise were projects such as Bored Ape Yacht Club with their latest release Sewer Pass, Pudgy Penguins, Doodles, and Checks, a generative art collection inspired by Twitter’s “verified” check marks.

The recent launch of NFTs on the Bitcoin Network, which have come to be known as “Ordinals”, have also brought about renewed interest amongst JPEG collectors.

Dan Tran and Tony Ling of NFT analytics and trading platform NFTGo helps us dig into the data further, noting that “the current volume of the NFT market is similar to the volume of the crypto market in 2017 … dropping a quarter of the total market value in two weeks, and then took a longer time to repair and start a new upward market“.

Are you looking forward to the NFTGo NFT annual report 2023? 🤩

— NFTGo.io|Download 2023 NFT Report 🔥 (@nftgoio) February 9, 2023

🆕 The early bird report access is now open to our top supporters and core users! 🐦 ✨

Join the celebration party with limited rewards up for grabs. 💃

🔗 https://t.co/YV3vHkIgAp

Details 🧵 ⬇️ pic.twitter.com/Vqz1oczuS2

However, the question of how exactly NFTs should be valued still often faces lackluster answers due to their status as a nascent asset class. Despite this, NFTGo believes that these question marks will eventually be addressed in the coming year, especially with large technology companies like Apple and Meta potentially bringing millions of users into the NFT space.

A Stronger Move Towards Mass Adoption in 2023

The new year served to quell much of the hype and mania that the bull run was plagued by. And while those with vapid motives are worried, the builders have and will continue to deliver real utility to Web3.

“We need better consumer facing products and we need to build for a different demographic of user who [are] finding themselves on-chain versus the more tech and/or finance focused users of previous cycles. “

– Eric Dadoun, Co-Founder @ Dezy

While these comments may have already materialized with “real-yield” products such as GMX, we are still far from achieving the types of applications needed for proper mass adoption.

Top 4 RWA protocols market cap – $170M

— Chain Debrief (@ChainDebrief) February 2, 2023

Their active loans – $385M

Average APY for loans – 11%

With MakerDAO making a $100M loan to a US Bank, the intersection of Defi and Real World Assets (RWAs) seem inevitable.

Will RWAs be the top narrative for 2023? Let's explore 👇

In line with this, a key building block for reaching mass adoption has always been stablecoins, which are able to fulfill the requirements of cross-border transactions with their cheap fees and near-instantaneous finality.

“We believe the future is a more open platform for financial services that seamlessly connect these two worlds, with more core applications and services built on crypto and blockchain infrastructure.”

–Raagulan Pathy, Vice President of Asia Pacific for Circle

Turning inward into Web3, Ethereum’s Shanghai upgrade remains a focal point for the future of Web3 as Ethereum depositors eventually become able to withdraw their staked Ether. Although some are worried about a potential mass sell-off, Nejc Bizjak, Head of BizOps & Strategy at Bitstamp, is instead excited for “all the potential it brings in terms of capital efficiency”.

.@ChainDebrief's first-ever live webinar took place a couple of weeks ago with Bitstamp's APAC GM Leonard Hoh and leaders from @BitGo and @GSR_io.

— Bitstamp (@Bitstamp) February 3, 2023

Watch it below 👇https://t.co/9NPecOYeoZ

The ability to withdraw from staking pools could also be seen as a major risk-off event by institutions, as deposited Ether will not be locked up indefinitely. Coupled with Ethereum’s recent shift to Proof-of-Stake, the bull case for the king of Layer 1s seems to be on the uptrend this year.

Zhuling Chen, CEO of RockX, also observes that the focus of 2023 will be on “user protection and robust risk management and governance infrastructure” following the uncovering of malpractice amongst some of the industry’s leading players.

He believes that while users have begun to take control of their funds via self-custody and on-chain solutions such as DEXes, Centralized exchanges should continue to make strides in transparency as they remain the first point of contact for both retail and institutional investors.

What Should We Do During a Bear Market?

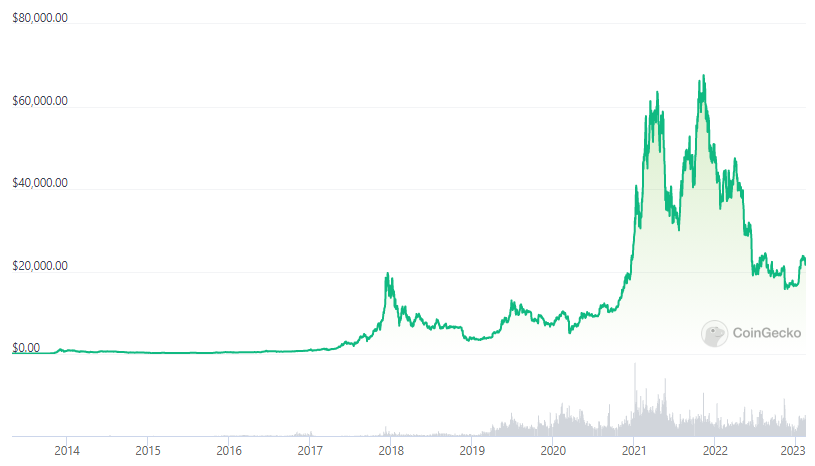

Despite Bitcoin being down 69% from it’s all-time-high, narratives such as Artificial Intelligence and Liquid Staking Derivatives have been a catalyst for massive rallies across the board.

With this being the first true bear market for many of us, it may be difficult to stomach potential losses. As the prices continues to rally, some of us may even make uninformed punts at the market for fear of missing out.

However, understanding the cyclicality of crypto can help us all make better informed decisions, even during times of irrational price movement.

“It is crucial to understand that bear markets, much like bull markets, are a normal part of market cycles and often serve to correct overvaluation and reestablish balance.“

–Raagulan Pathy, Vice President of Asia Pacific for Circle

Adding to this, RockX CEO Zhuling Chen reiterates that “Crypto is an industry that carries highly cyclical traits, and it has continued to grow leaps and bounds, despite the first crypto winter back in 2018 and 2019.”

Zooming out to the big picture, we can see that the Bitcoin has always managed to reclaim its highs following every bear market, bolstering on-chain activity and spurring growth across ecosystems.

Even when the market starts to rally, Eric Dadoun stress not to “rush or FOMO“ …” and that” you’ll know when the bulls start running again and you’ll have plenty of time to jump onboard”

On the NFT side, NFTGo reminders investors not to focus on short-term speculation, but the opportunities that crypto can bring. Instead of simply focusing on prices, building on your current set of skills and knowledge will be imperative for when the bull cycle returns.

“the current Crypto development is rapid, so that you become an ‘expert’ in the vertical track, so that you will be in the next bull market “

-NFTGo

Closing Thoughts

Although the cryptocurrency markets are known for their ever-changing narratives and 24/7 markets, Bitcoin’s current levels have given investors time to slow down and recollect themselves.

Furthermore, the decrease in speculative trends and uptick in transparency as well as audits have given investors renewed hope in the future of crypto. After all, the future of finance cannot be built in one day – it can only be built through consistent, thoughtful advancements in the industry.

While 2022 was an extremely painful year for cryptocurrency proponents worldwide, current developments and partnerships within the ecosystem remain a bullish sign, as crypto continues to progress towards mainstream adoption.

Regardless, participants in the space should remain wary of charlatans who promise risk-free, guaranteed profits and instead learn from the advice of those actively building and campaigning for a better Web3.

Also Read: 3 Key Takeaways From CoinMarketCap 2023 Crypto Playbook

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chaindebrief