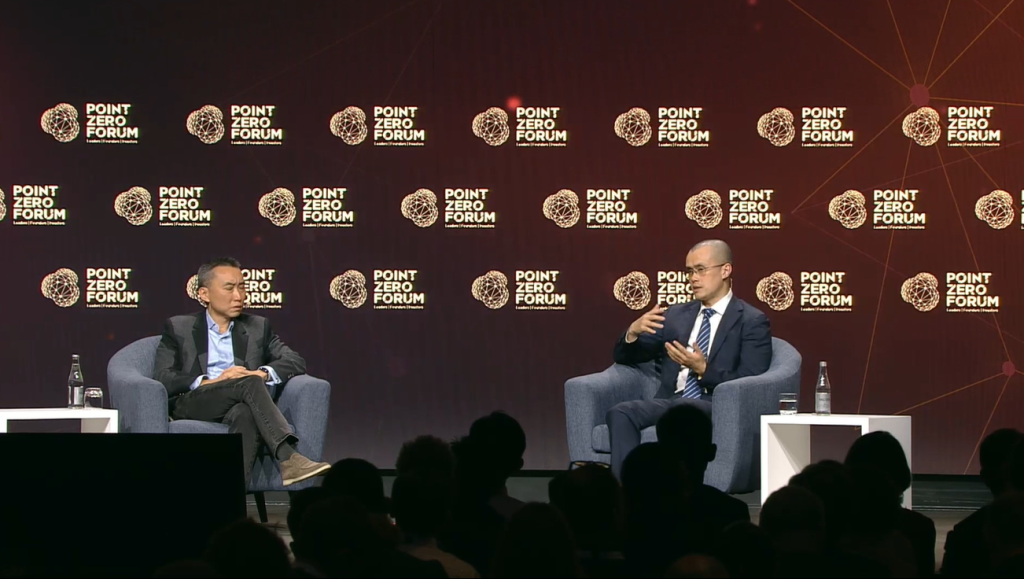

At the Point Zero Forum in Zurich held on June 22, Changpeng Zhao (CZ), Founder and CEO of Binance, was invited to speak on weathering the storm and the next phase of growth.

The storm triggered by higher than expected CPI caused a tsunami of sell-offs on top of the collapse of Terra LUNA. The market took a nose dive and brought down many big players like Celsius and Three Arrows Capital (3AC).

To clear up some uncertainty, CZ touched on five key points on weathering the storm:

1. Only the strong will shine

The crypto market is going through a market cycle and is currently on a downtrend. The difference between the current liquidation event and the 2018 bear market event is the type and amount of leverage in the crypto space.

There are a lot of so-called slow leverages in the current crypto system. Slow leverage is a form of leverage made available because of DeFi and lending from fund houses.

Slow leverage is good until one fund faces liquidity issues. What happens is that when one fund meets a liquidity issue and topples? It will cause a domino effect where the other funds will slowly feel the loss’s pain.

Read More: Nobody Is Too Big To Fail; The Fall Of Celsius And 3 Arrows Capital

This cascading effect is still ongoing in the current market, but the magnitude is smaller because it is spread out among smaller players.

CZ added that he thinks the worst is over because of the sharp draw, but the industry still needs a long time to recover.

We are already seeing this in the current market. Many projects broke during the mass liquidation event and did not work as intended. But some OG projects like MakerDAO were more resilient and did not break under pressure.

2. Education is the best way to protect users

Education is key.

— CZ 🔶 Binance (@cz_binance) June 22, 2022

What's your go-to article or website to send to someone who's new to crypto?

There are a lot of bad apples in the crypto space with poorly designed products managed by poorly managed teams.

Sadly these projects can attract many users through inflated incentives, marketing gimmicks, or pure Ponzi schemes.

The best way to protect users from these projects is through education. Industry players need to educate users so they would not fall victim to all these “bad” projects.

I do agree that education is the best way to protect users. There are only so many regulators who can do this, and there is no better way to protect yourself than by educating yourself.

By learning and understanding more about crypto, it will be easy to differentiate the good from the bad. Users can spot telltale signs of a bad project by evaluating the tokenoimics, the team, and the product itself.

Chaindebrief believes learn2earn might be the next wave in ushering adoption from the masses. Education is the cornerstone of every successful industry. We want to extend our resources to anyone keen on honing knowledge, from beginners to advance. You can check out our new earn and learn program – Nexus.

3. Welcome regulations

Large players in the industry more than welcome regulations as they are needed to weed out the bad actors in the industry.

But the crypto industry is still relatively young, and it will take years and decades before regulations take shape.

Most current regulations are focused on centralized exchanges, but there is more to crypto than just centralized exchanges like DeFi and metaverse. Many have not fully taken shape yet, and regulators cannot act on them because the ecosystem is not fully developed.

There is good progress in regulations, but more licenses have to be in place so that the players in the industry have a clear direction to follow.

I reckon that regulating the crypto space can be tricky. Regulators have to find a balance such that the regulations would protect the vulnerable while at the same time doesn’t restrict innovation.

Over-regulation would do more harm than good as it would inevitably kill off innovation and see many bad actors exploring the system. It may also steer crypto away from being truly decentralized, with regulation posing like a set of boundaries and limitations.

4. Founders weathering the storm

It is the best time for founders to keep their heads down and build. It is also easier to hire talents as their expectation is much more reasonable in the current situation.

While raising money in the current climate is more challenging, it is still doable, and strong projects can increase a reasonable amount of funding.

It is important to focus on fundamentals with a sustainable model. Attracting users by pure incentives is not sustainable, and the project will run out of funds in no time.

A sustainable model requires users’ activities, who spend their coins in the ecosystem. The business model will be sustainable as long as users spend more than they receive.

I do agree that this is the best time for founders to build. There is a consolidation of the talent pool and much lesser ‘noise’ in the market.

Both are vital ingredients in building an innovative product that could be the next big thing that would revolutionize the crypto space.

5. What will drive mass adoption?

It is hard to predict what will trigger growth and drive mass adoption. Certain mega trends like NFTs have brought many users into the crypto world.

CZ mentioned that countries should not shy away from ICO (Initial Coin Offering) & IEO (Initial Exchange Offering) as those are a form of foreign direct investments.

ICO & IEO are efficient and direct ways for founders to raise money from all over the world. This would inevitably help drive growth in the country and, at the same time, encourage adoption within the country.

Another issue he pointed out another issue hindering mass adoption: the current process to on-ramp from fiat to crypto. There is a lot of friction in the process, and it is not fluid.

This could easily be solved with a solid regulatory framework that gives a clear direction to financial institutions on how they can work with crypto exchanges.

I think the global adoption of crypto lies on the back of CBDCs (Central Bank Digital Currencies). CBDCs will be the first step for many into the crypto world, and they will slowly explore what DeFi has to offer.

Many protocols will be built around the CBDCs, and they will spearhead the next massive trend that will onboard millions into crypto.

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief

Also Read: Surviving The Bear; 6 Aspects Every Project Needs For The Crypto Winter