There are two camps for how people view VC, the first is one often overseen for the betterment of the crypto space, and the second is where they are entities dumping on retail consumers. While you may be a victim of the latter, VCs are the ones who take the most significant risk with upfront capital.

VC bet in crypto assets, undoubtedly a high-risk play, will be rewarded with a hefty sum if the narrative plays out well, and they will utilize everything in their resources to set the project for success. With that in mind, it is not too bad to take a peek at their portfolio and derive narratives they are making bets on. ,

We look into five of the biggest crypto VC today and find out more about what they are holding and their biggest bets in 2023 thus far.

1. Jump Crypto

Out of the five, we are looking at; this portfolio is miles ahead. But do note portfolios here should be taken with a pinch of salt, as there are multiple wallets a single entity could have, and they all may not be entirely covered.

$ETH – $2.8B

$wETH – $84.1M

$SHIBA – $58.3M (wtf??)

$WBTC – $30.6M

$MATIC – $25.2M

Other smaller notable tokens include $SNX, $COMP, $LDO, $AAVE, $CHZ, $dYdX, and a tad bit of $FTM.

As you can tell, they are mega bulls $ETH, and their meme dog of choice is $SHIBA over $DOGE. I would also think they dabble with DeFi products in one way or another, with substantial holdings of DeFi blue chips.

Their dApp interaction in the last 30 days proves the above statement right, with DeFi interactions with Curve, Uniswap, AAVE and DEXs such as dYdX and Synthetix.

A few notable transactions made were $50M in BUSD redemption from Paxos made on the 13th of Feb, and since then, they are increasing their sizing for $MATIC and $SHIBA.

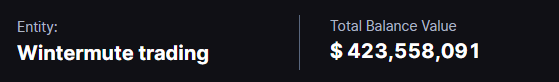

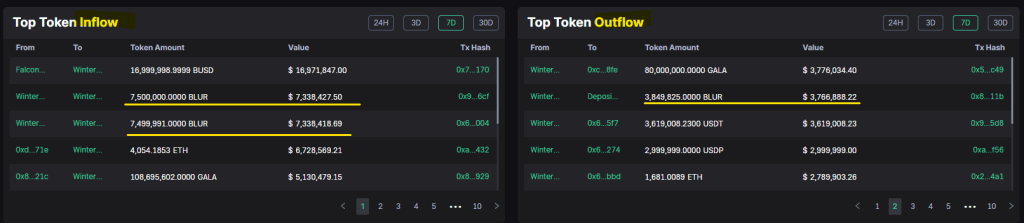

2. Wintermute trading

I first knew of Wintermute with the $160M hack last year in Sept and saw their booth in TOKEN2049 Singapore. Pretty cool stuff, though.

As my curiosity took me deeper, just like every late night with drinks, I found they play an important role in crypto. Not only as an algorithmic trading firm, but they are also market makers who provide liquidity for exchanges. Additionally, their venture arm looks into their belief to enable and empower a “truly decentralized world”.

And that becomes more evident when you look into their portfolio, not nonsense meme tokens, but diversified across DeFi tokens and layer1 projects.

$ETH – $351M

$LDO – $24.7M

$dYdX- $7.4M

$GALA – $6M

$HFT – $5.7M

$MATIC – $4.8M

$BLUR – $3.9M

$FTM – $3.9M

I also have to mention that 91% of $ETH holdings are wrapped. Wrapped ETH solves the interoperability issues that most blockchains have and allows for the easy exchange of one token for another. A closer look into what they do with this wrapped asset might give you a better idea of how they are using their largest asset holding.

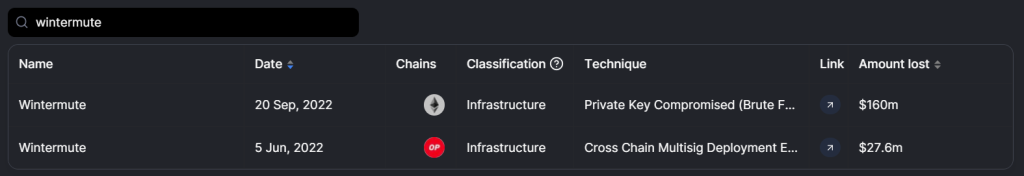

Just this year,mosty of the $GALA was acquired, bullish on the Metaverse. Maybe.

They also receive over $30M of $BLUR right around the airdrop and have seen deposited into several exchange addresses. Since then, a portion ($3.9M) of it has been stored under one of their existing addresses and the rest, probably dumped.

3. Paradigm Capital

Of all the other VCs, Paradigm is the leanest holding of assets above $10M in value. They are hyperfocused and place three eggs in one bag.

$LDO – $191.1M

$ETH – $163.6M

$MKR – $19.1M

If I would summarize their investment thesis in one word, it’s DeFi. But there might be more than meets the eye; some of their latest raises with projects include Ulvetanna, nxyz, Exponential and Blowfish.

Paradigm is one of the largest investors in Lido; as of now, 79m of their 100m LDO tokens have been unlocked and are expected to be fully vested on the first day of May 2023.

$LDO up 266% in 30 days 🔥

— Nansen 🧭 (@nansen_ai) July 28, 2022

🤓 Smart Money holders incl. Paradigm (7%), Dragonfly (1.5%), ParaFi, Wintermute, Jump, and others.

It's worth noting that the top 10 addresses (incl. Lido DAO Treasury) hold 55.4% of $LDO pic.twitter.com/PKm8cGP1E7

Furthermore, they have $2M $MKR staked for governance on MakerDAO with their initial investment with Dragonfly capital of $27.5M in 2019.

.@MakerDAO receives $27.5M from Dragonfly and Paradigm to expand into Asia

— Messari (@MessariCrypto) December 19, 2019

+ the two new investors, along with Andreesen Horowitz now own 11.5% of the MKR supply

+ move should help $DAI compete with $USDT which currently dominates Asian markets https://t.co/M8E8c4TGoM

4. DeFiance Capital

$LDO – $19.2M

$USDC- $15.8M

$AAVE- $3.2M

$ETH – $2.7M

Their were early adoptors of DeFi products such as $AAVE and Lido, which threw them into the VC scene. I do believe there more to their portfolio than the above with investments to projects such as Timeswap and Switcheo labs.

DeFiance are also backers of successful projects such as dYdX, Axie Infinity, LayerZero and Offchain labs. The CEO, Arthur Cheong, also bullish on the Azuki NFT.

It is also good to note that DeFiance is farming a large amount of $USDC on Stargate. From their website and twitter, it also seems like DeFiance is looking into play to own and web3 gaming products seriously.

0/ Play-to-Earn? Free-to-Own? Play-to-Own.

— DeFiance Capital (@DeFianceCapital) September 25, 2022

Bear markets are for long-form writing, excited to present our Web3 Gaming Thesis that has been in the works for some time.

We will offer a short primer on Play-to-Own & our Web3 Gaming thesis in this thread 🧵 :

And even looking out for interns right now.

If you are looking to join a leading crypto fund and be at the fore-front of crypto investments, @DeFianceCapital is currently looking to hire interns.

— Yeou Jie (@YeouJie) February 10, 2023

Only candidates based in Singapore will be considered.

More information can be found here: https://t.co/IkO3riEBzl

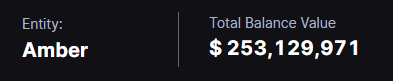

5. Amber Group

$ETH- $129.3M

$USDC- $57.2M

$FET- $21.5M

$dYdX- $8.3M

Amber group is the first amongst the others who has AI tokens on its portfolio. Their holdings are generally diverse with over 50% in $ETH, 28.8% in stablecoins and the rest consisting of tokens from various verticals.

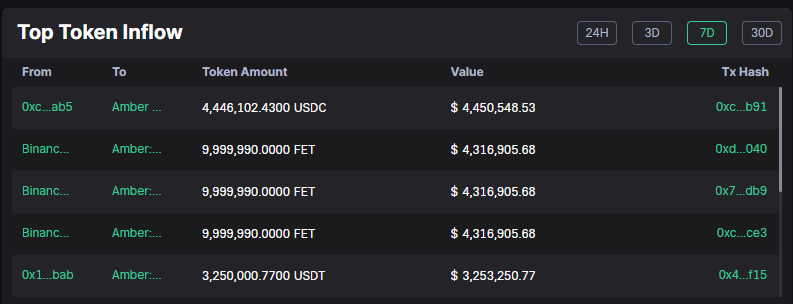

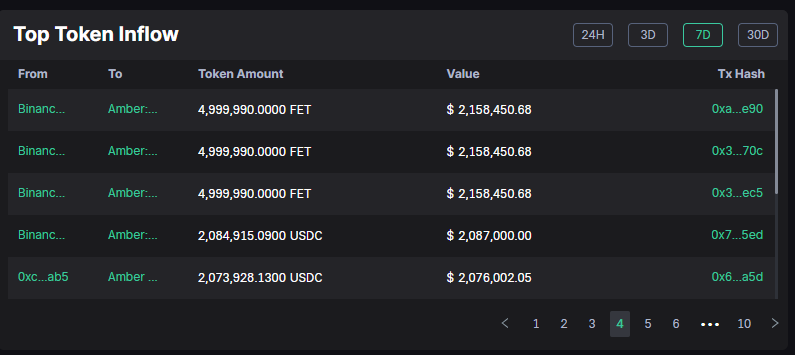

Apart from the massive inflow of stablecoins ($USDC and $USDT) they are buying tons of $FET tokens as well. Majority of their current holdings of the AI token $FET was acquired in the last 7 days.

Furthermore, with the LSD narrative, they seem to be the most convicted in $SWISE, currently holding over $2M in value.

I categorize as narrative traders, with LSD and AI rising to fame since the start of 2023, their are positioning for more upside ahead of the upcoming Shanghai upgrade, crack down in centralized exchanges staking as a service and AI trend led by ChatGPT.

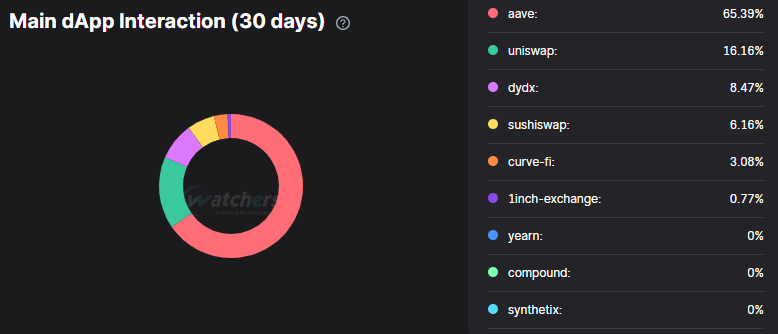

Additionally, their involvement with DeFi products has been in full swing, with majority of the activity happening on Ethereum’s biggest lending platform Aave and DEX uniswap following closely after.

Closing thoughts

Across all the VC mentioned, it was clear the bets they have involves DeFi in crypto one way or another, with little to no Bitcoin holdings. Majority of not all have large holdings in $ETH, and tokens within such as $AAVE and $LDO, tokens like $MATIC and $dYdX are also popular amongst their holdings.

These holdings are no small sum, large enough to move markets. By tracking where they move their holdings (Eg. to exchanges or dApps) religiously could give find yourself an alpha or two whether they are planning to dump or put the assets to “work”.

There is no doubt dumping their assets would havbe an averse impact on retail investors but at the same time, projects they are invested in are projects they want to grow as well. Identifying these trends VC are looking at, may give you winners in the current and future crypto narratives.

Also Read: Why The SEC’s Crackdown On Crypto Could Benefit These 3 Stablecoins

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chaindebrief