In the last 48 hours, we saw billions in value wiped from the cryptocurrency market. At the center of it was all was Terra’s $LUNA, and its algorithmic stablecoin, $UST. In one of the most disastrous days for crypto, many lost their entire life savings, and others may very well leave the space for good.

At the time of writing, $LUNA was worth US$0.69, 99.3% down from its all-time high of US$119.18 that it hit just a month ago.

With $LUNA price falling more than 90% in a single day and $UST still struggling to repeg, it may be time to reconsider our outlook on just about everything.

What is Terra?

Terra’s ecosystem revolves around $UST, minted via burning $LUNA.

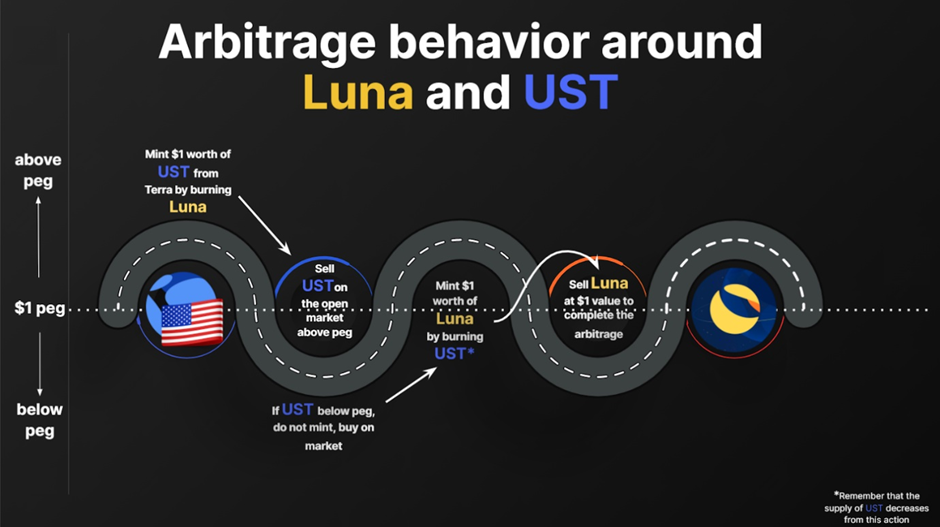

Unlike stablecoins such as $USDT and $USDC, $UST is not backed by any physical assets. Instead, it maintains its peg via arbitrage.

Simply put,

$UST above peg à burn $1 of $LUNA to mint $1 of $UST, sell $UST above peg, and repeat.

$UST below peg à burn $1 of $UST to mint $1 of $LUNA, sell for more than $1, and repeat.

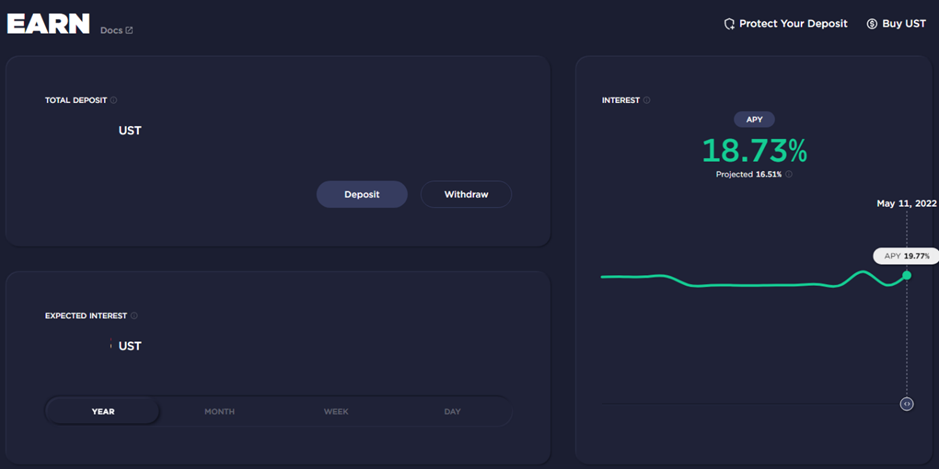

The second part of Terra’s plan was introducing a use case for $UST, Anchor Protocol.

Touted as a savings bank, Anchor promises roughly 19% APY on stablecoins. They maintained this by artificially inflating lending rates through the foundation’s reserves.

At its peak, Anchor saw US$17 billion in deposits.

While similar algo-stables have failed in the past, many saw Anchor as a good reason $UST would not collapse. With such high TVL, they would eventually branch out their use cases and become “too big to fail”.

How it collapsed

The @LFG_org is creating a #Bitcoin reserve to defend the peg of @terra_money stablecoins like $UST.

— danku_r (@danku_r) March 30, 2022

The question is: How does it work & what effect will it have on $LUNA, the Terra ecosystem, or even $BTC?

Let´s check the governance proposal by @jump_ & make a deep dive 👇🧵/n pic.twitter.com/JGvgxLQfHU

To add to the credibility of $UST, Do Kwon, the CEO of TerraForm Labs, publicly announced a US$10 billion Bitcoin buy. The idea was to diversify the backstop for $UST away from $LUNA while earning support from the wider cryptocurrency community.

Ironically, this may have been the downfall for Terra.

One of the worlds most credit worthy firms:

— napgener 0xBullMarket (@napgener) May 9, 2022

Borrowed 100k $BTC

Shorted into Kwons Twap buying

Swapped 25k $BTC to TaeKwonDo for $UST

Aggressively dumped the remainder on spot over past week.

Started unloading $UST near bottom

Please welcome @Citadel to crypto

Give it up for Ken https://t.co/Hs6o6oE4le

While unconfirmed, there was likely a concentrated attack on Terra. Heavy shorting led to the foundation’s $BTC being worth less, which they had to sell to protect the peg, compounding the effect.

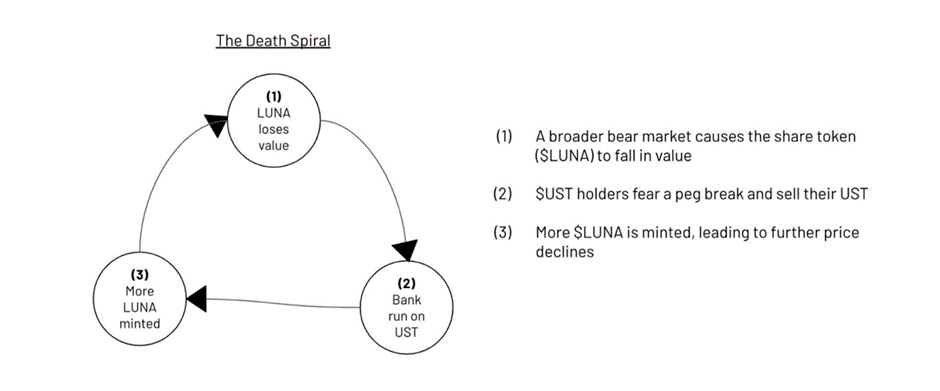

As $UST’s peg became an uncertainty, TVL started to exit Anchor. Burning $UST for $LUNA and selling it on the open market led to the peg falling even further, causing the “death spiral”.

Furthermore, there was heavy leverage in the ecosystem, thanks to subsidized borrowing. Anchor also faced front-end issues, and many were unable to change their Loan-To-Value ratios to avoid liquidation.

The cherry on top was that everything happened on the day that Terra was moving funds in Curve, the top DEX for stablecoins. This meant thin liquidity, one of the worst conditions for a bank run.

All these combined meant one of the worst liquidation cascades in cryptocurrency history.

Moving forward

There is a rumor spreading about Jump, Alameda, etc. providing another $2B to “bail out” UST. Whether this rumor is true or not, it makes perfect sense for them to spread. The biggest question here is, even if they can get it to $1 by some miracle, the trust is irreversibly gone

— Larry Cermak (@lawmaster) May 10, 2022

Terraform Labs is currently scrambling to salvage the situation. While rumors of a bailout were circulating, investor confidence may already be damaged beyond repair.

6/ Before anything else, the only path forward will be to absorb the stablecoin supply that wants to exit before $UST can start to repeg. There is no way around it.

— Do Kwon 🌕 (@stablekwon) May 11, 2022

We propose several remedial measures to aid the peg mechanism to absorb supply:

The current proposal to stabilize peg would accelerate the dilution of holders. At current prices, it also means giving up a large portion of the treasury, stunting future growth. This may still not be enough as the $UST market cap is currently about 10x of $LUNA’s, rendering it insolvent.

DO KWON BEHIND FAILED STABLECOIN BASIS CASH: COINDESK

— db (@tier10k) May 11, 2022

An exposé on Do having run a failed algorithmic stablecoin project previously has also emerged.

Closing thoughts

There are many negative implications of Terra’s failure.

Regulators will be sure to leverage this event, and U.S Treasury Secretary Janet Yellen already called for increased stablecoin legislation by year-end.

Other ecosystems are facing heavy price downtrends due to the heavy Bitcoin selling, parallel use cases, and $UST’s widespread use.

Institutions farming $UST may also have been affected. This may be the most alarming cause for concern and lead to worsening markets. While there is no news yet, a single institution becoming insolvent will cause further fear and panic.

Feel sorry for those that lost everything, unfortunately going to be lots of normal people that cannot stomach those losses, it’s very bleak

— Cobie (@cobie) May 11, 2022

The saddest reality is the billions in retail money lost. While $UST holders may have a glimmer of hope, most borrowers have been liquidated. Some may have lost their life savings or even more than they could afford to. Many will not come back to the space.

The market is quick to humble us. As it turns increasingly bearish, it may be wise to stay risk-off until better conditions arrive.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Also Read: LUNA Falls to a 9-Month Low of US$25: A Summary Of The Crash And UST Depeg

Was this article helpful for you? We also post bite-sized content related to crypto — from tips and tricks, to price updates, news and opinions on Instagram, and you can follow us here!