History of Ethereum Classic

Ethereum classic was created after a large-scale attack on one of its most successful ICOs, The DAO. On 17 June 2016, a loophole in the code was found and a hacker managed to drain 3.6 million $ETH affecting over 18,000 investors.

#TheDAO is under attack if you are the persons behind Congo Proposal and Beer Proposal please contact @thegrifft ASAP#Ethereum #blockchain

— The DAO (@The_DAO_Project) June 17, 2016

Due to the scale of the attack, investors proposed a reversing of the blockchain to aid investors. It affected such a large portion of the community that a majority voted in favour of a fork, which meant a split in the Ethereum network.

The newer network used the name Ethereum and uses ETH or ether as its cryptocurrency. The older one, known as Ethereum Classic, uses ETC.

Few maxis remain in the belief of Ethereum Classic, the network faced multiple hacks, all within a month.

.@EthereumClassic has suffered its third 51% attack this month – this one reorganized over 7,000 blocks, nearly double the severity of the first two attacks.

— CoinDesk (@CoinDesk) August 29, 2020

Report via @zackvoellhttps://t.co/ZlZt6VAuAc

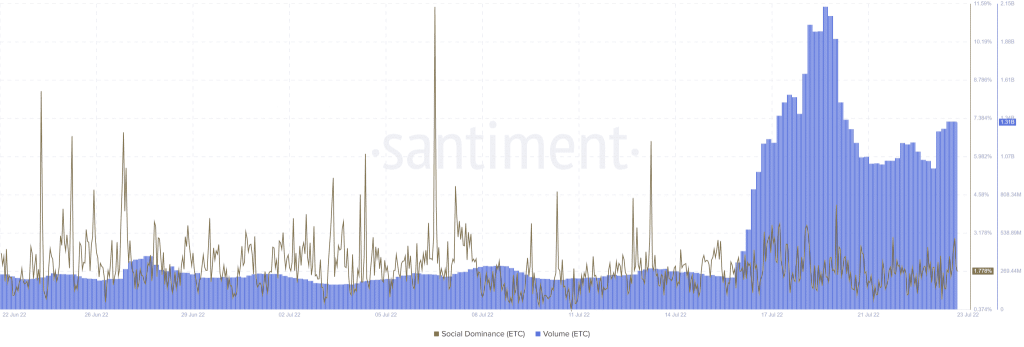

Catalysts for its recent pump

1. Words of Vitalik

Fast forward to 25th of Jul 2022, Vitalik sang praises about ETC saying “If you like Proof-of-Work, you should go use Ethereum Classic. It’s a totally fine chain.”

Ethereum blockchain’s transition from Proof-of-Work to Proof-of-Stake would mean ETC will be the largest Proof of Work smart contract network.

As crypto miners look for networks to carry out their mining, ETC might be the alternative for them.

Vitalik said in his speech on the 21st that if you like POW, you should use Ethereum Classic (ETC), which is totally a fine chain. (Live video at 35:50) Currently, Ethereum is expected to start the merge of POW to POS in September. https://t.co/nAtKh9fHyA

— Wu Blockchain (@WuBlockchain) July 25, 2022

2. S$10M Investment into ETC

AntPool, the mining pool affiliated with mining rig giant Bitmain, has invested $10 million to support the Ethereum Classic ecosystem and play, ns to continue investing more causing the price to pump to a high of US$44 from its low of US$23.

Should we keep an eye on ETC before the Merge?

Research Analyst, Dun Leavy, from Messari ran through metrics we can employ to answer the question above.

Fundamental metrics

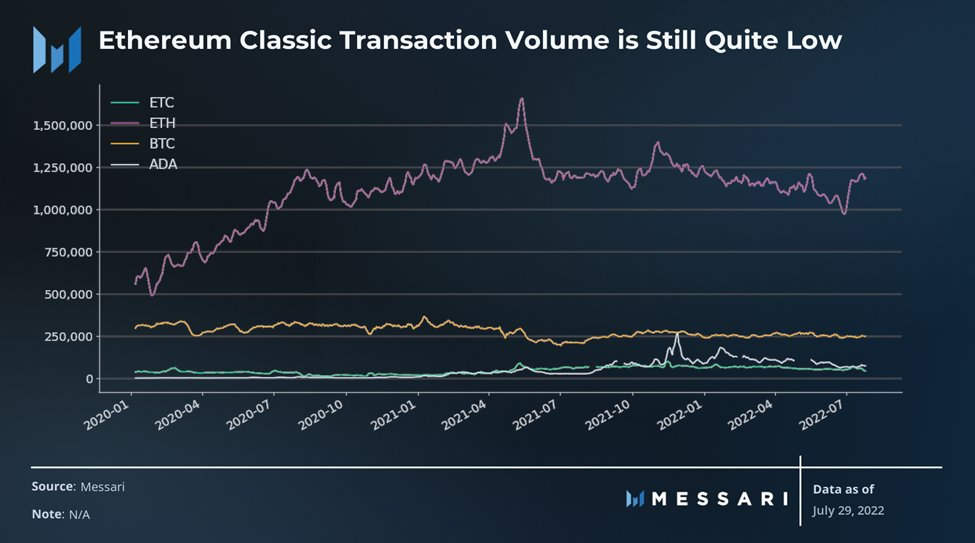

Looking at the fundamental metrics, nothing has changed for ETC.

Volumes and users have been remained on the low for years, even the applications are non-existent.

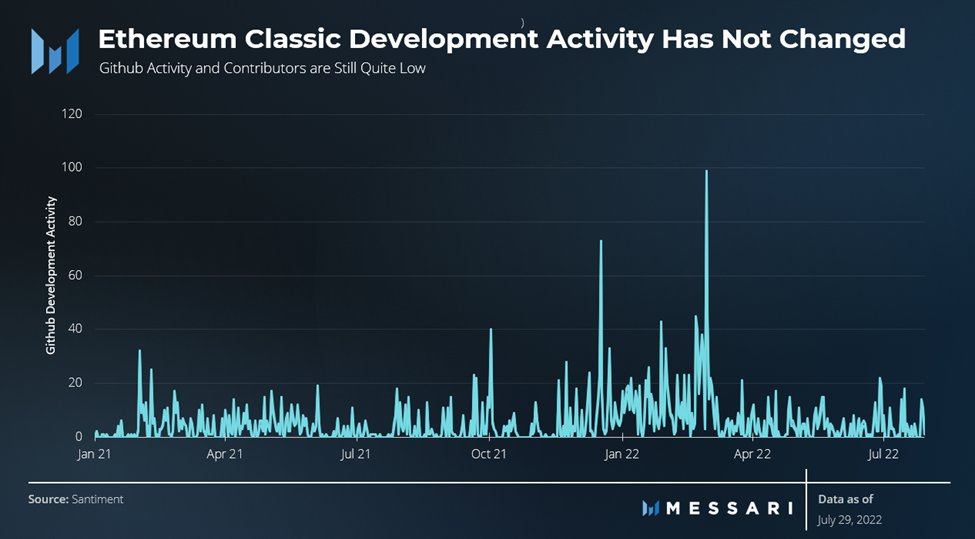

Nothing meaningful has changed for the developer activity as well.

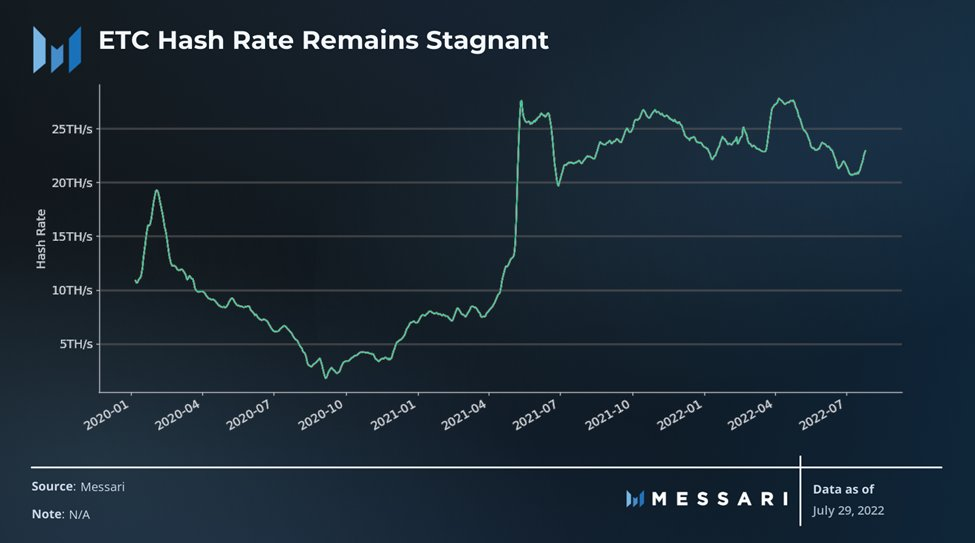

Stagnant hash rates on Ethereum Classic

As 97% of mining comes from ETH, only 2% is derived from ETC.

When miners migrate to ETC, there will be a hash rate jump potential pushing the big players in the ETC out of the money. The only way to remain profitable is if the C price jumps.

Ethereum Classic leading up to the Merge

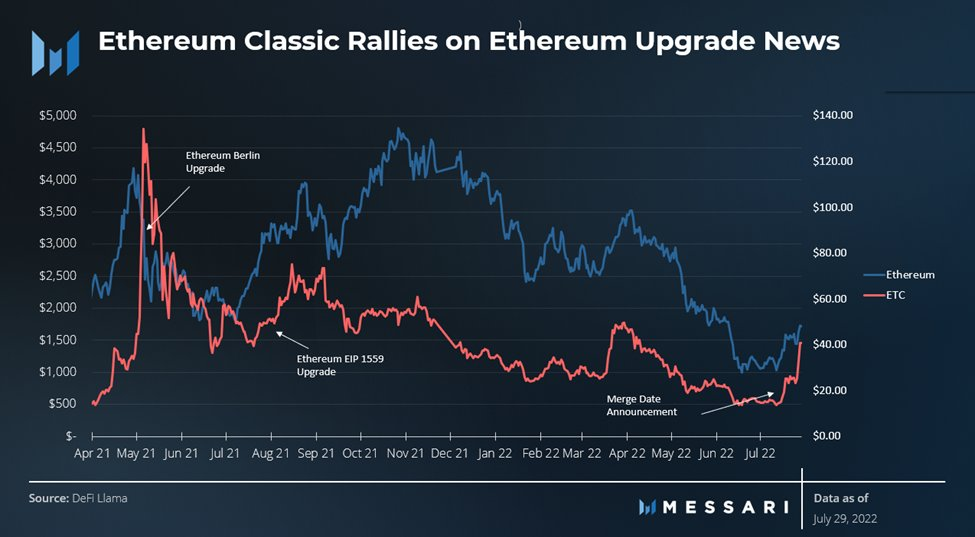

Messari planted this graph nicely, along with the milestone upgrades leading up to the Merge. It revealed interesting insights into how investors trade Ethereum upgrades.

Closing thoughts

ETC might see a comeback in popularity, especially amongst the miners looking to shift their resources. Along with the falling prices of mining rigs, there might also be a price advantage triggered by the migration of miners to the Ethereum Classic as we see the increase in popularity in ETC investment.

All this though comes at the expense of higher competition. As there is an increase in GPU mining on ETC, its hash rate will increase accordingly as well, meaning fewer profits going around.

At the end of the day, actual demand and utility are the key growth drivers. ETC now has a “Second chance” to become more attractive, especially when projects that prefer PoW consensus mechanism for decentralization purposes.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief