Harmony is a blockchain-based platform that was built to solve the issues of scalability and decentralization of the blockchain without compromising each other.

Launched as an IEO on the Binance Launchpad in May 2019, its development is focused on data sharing and the creation of marketplace of non-fungible and fungible assets.

Its technical focus is on resharding and securing staking through a decentralized randomizer method. This is a technique used to split the blockchain network into parallel chains, to improve the speed and efficiency of the Harmony network with a lower cost.

This strategy has allowed transactions to be confirmed on the blockchain within two seconds and costing less than 100x of neighboring networks like Ethereum.

Harmony also has four shards, meaning cryptocurrency can be sent to different locations. By default, most people’s wallets are set to Shard 0.

Harmony’s Strengths

Secure, random state sharing

Harmony solves the blockchain trilemma by using sharing to scale the blockchain without compromising its security and decentralization. Network nodes and blockchain states are divided into shards that all scale linearly.

In addition, each shard has a minimum of 250 nodes, and uses Verifiable Delay Function (VDF). This essentially makes validation unbiased and unpredictable.

Fast consensus with instant finality

Harmony has an extremely low transaction fees and a 1-block-time finality on the Harmony MainNet. They use a complex BLS signature to commit blocks in single cycle of consensus messages.

Effective PoS and token economics

Like most new Ethereum competitors, Harmony operates a proof of stake (PoS) mechanism. PoS is inexpensive, consumes lesser energy and enables better decentralization than proof of work (PoW).

Users also have voting power in Harmony and can earn passive income by staking. Its widespread acceptance is also due to its unique validation technique where tokens staked is linearly related with the amount of nodes a validator can run. Nodes with large amounts of tokens staked also have the chance to get elected after some epochs.

Up till March 2020, Harmony had a dynamic inflation schedule. However, this was changed to a fixed annual inflation rate, and Harmony Economics Model caps the annual issuance at 441 million tokens.

This is about a 3% rate long term. In addition, all transaction fees are burnt to offset issuance, which leads to zero inflation with high network usage.

Key features of Harmony (based on roadmap and vision)

- Noncustodial Wallet – The Harmony team is working on a wallet that will greatly help with retail adoption. If they get it right, the wallet will be able to be accessed via 2FA, for example Google Authenticator. As to how it would remain secure remains as a large question.

- DeFi Protocol – Harmony is looking to produce a DeFi token which produces an exciting interest rate of 20%. We all know how this yield was offered by Anchor on Terra, which has resulted in Terra Network’s TVL and crypto price skyrocketing in value.

- A unique Cross-Chain Platform for Bitcoin – No longer an if, but when? BTC bridge is coming to ONE on January 24. The only other network to achieve this feat is THORchain.

How to Buy Harmony tokens ($ONE)

ONE can be bought from Binance, KuCoin, Gate.io, and almost any other CEX exchange. They can also be bought from exchanges like Pancake Swap.

It is recommended not to use exchanges that don’t have duo pairing, as typically these exchanges do not allow users to transfer funds out. This can be cumbersome if users wish to stake Harmony elsewhere.

Bridging notes

Due to the lack of bridges currently, transferring funds to the Harmony Network is relatively easy, but transferring other currencies out are generally very troublesome. This is due to a variety of factors such as low liquidity, high price impact, confusing stable coin terms (resulting in wasting of gas) and changeable addresses. This may be confusing for newer user to the Harmony network.

Changeable Addresses – Harmony has a unique feature that allows user to interchange addresses inside the network. This can be taken advantage of if properly used. For example, the user wants to import Harmony funds from a centralized exchange Binance to a MetaMask hot wallet on the Harmony Network.

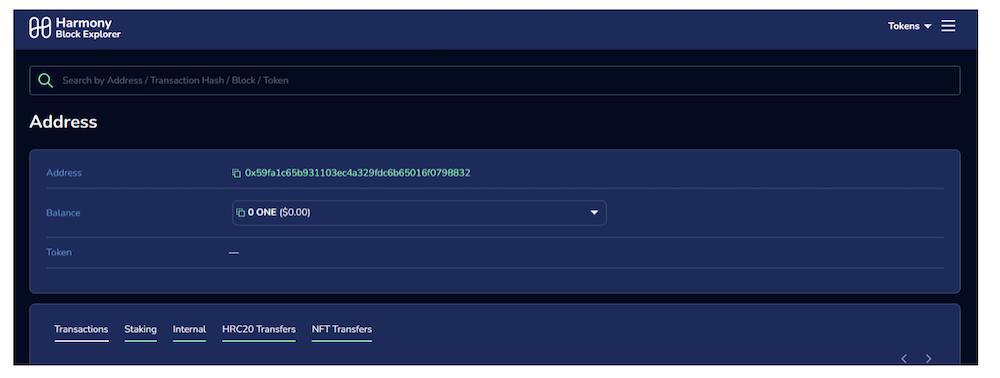

Take for example this address : 0x59FA1c65b931103eC4A329FDc6B65016f0798832. This is a MetaMask address that will not support receiving of Harmony via a centralized exchange like Binance.

Binance does not allow Harmony to be transferred. This can be easily fixed in a few steps.

- Go to the Harmony Explorer via this address. https://explorer.harmony.one/

- Under the Search by Address / Transaction Hash / Block / Token, input your MetaMask wallet address.

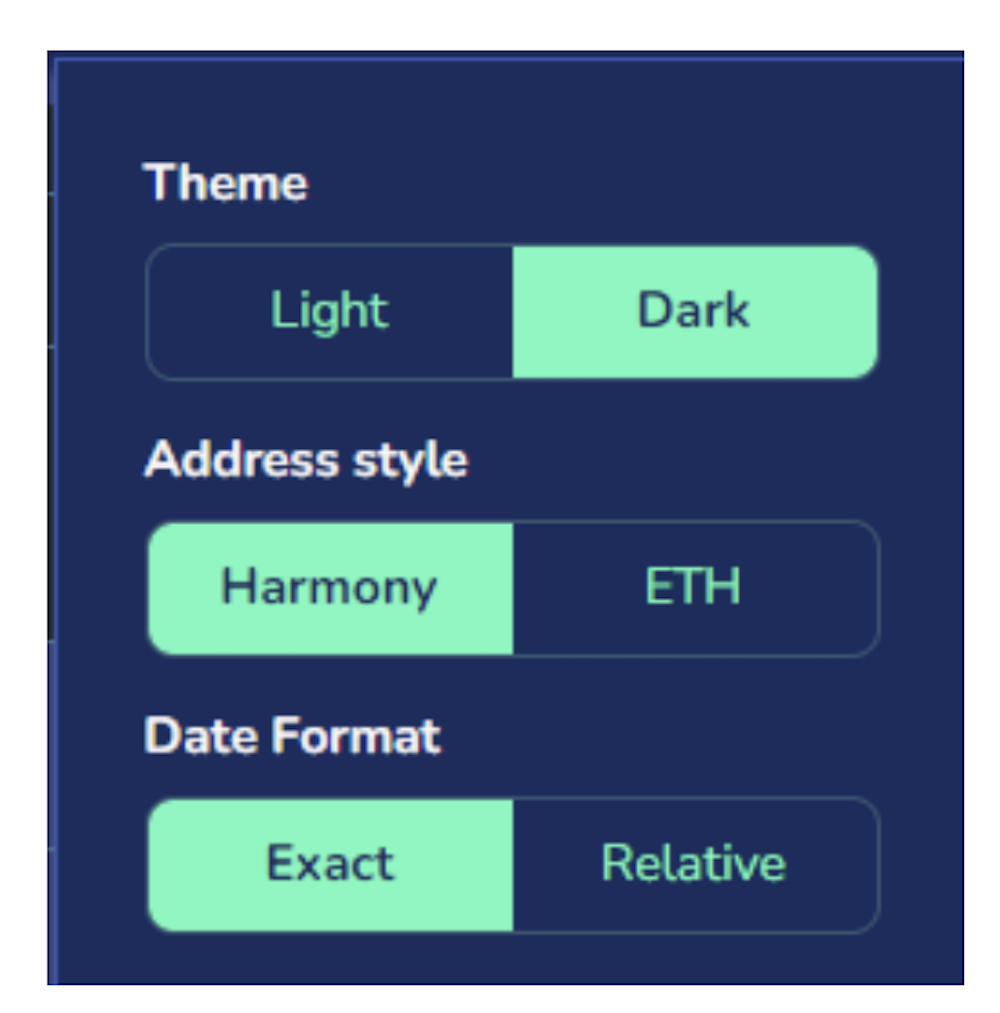

3. At the top right corner, there is an option to change the network type. Instead of ETH, select ONE.

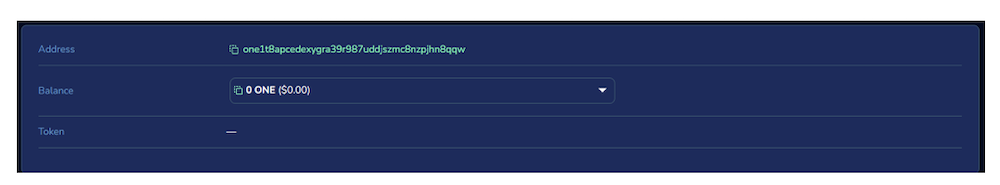

The address type is now a Harmony address instead. Binance will accept this address and will be able to send funds to your MetaMask

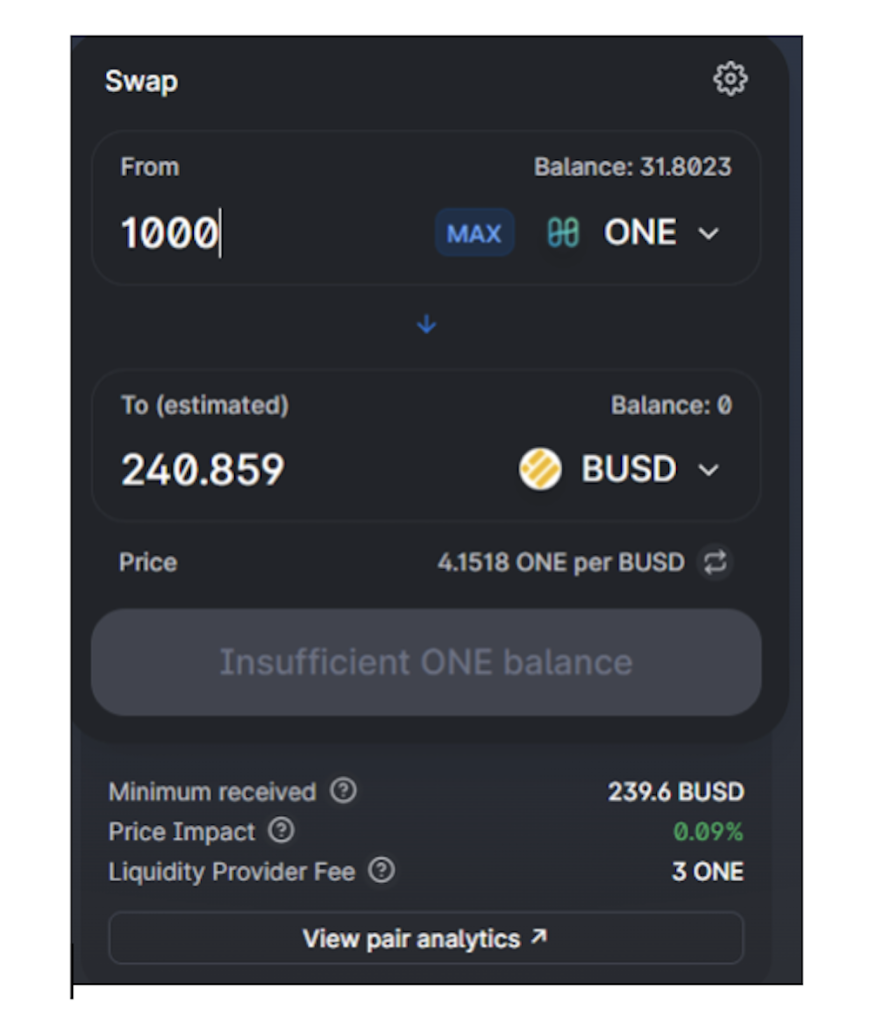

High Price Impact – Sometimes, users wish to convert cryptocurrencies to stablecoins. This may not be feasible as the price impact for conversion may be extremely high. Unfortunately, there currently aren’t many solutions for this problem. It is recommended to convert funds when there is better liquidity or try another DEX. As a rule of thumb, a price impact less than 1% is alright. Sometimes price impact can be close to 30%, but this should be better in the future.

Stablecoin options – Stablecoin options on Harmony are vast, but for high liquidity, it is recommended to use USDC, USDT, or BUSD. UST, however is gaining popularity thanks to Terra and is an option that can be considered also.

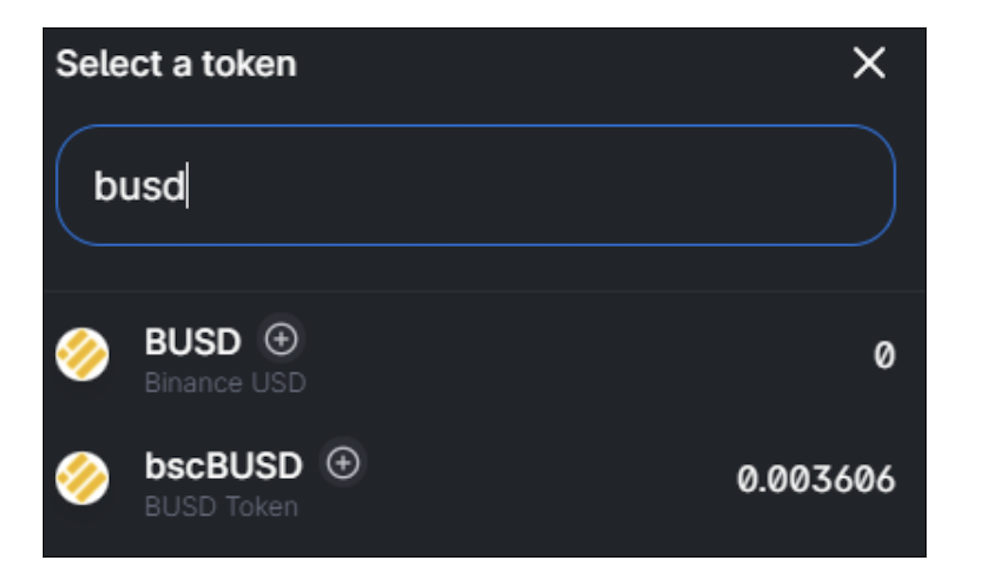

Another thing to note is that harmony has many sub-categories of BUSD. This can be extremely confusing for users when they want to bridge stablecoins to a centralized exchange like Binance.

There are a whooping 6 options available for BUSD. In addition, please note that it is recommended to send it to your MetaMask address first before sending to Binance. Fees are negligible to send from MetaMask to Binance.

In this example to bridge the stablecoin BUSD to Binance, the 1bscBUSD is the correct one to bridge. When converting funds on a DEX, you may notice several options. Note that BUSD is not the correct one and bscBUSD is. (bscBUSD = 1bscBUSD)

This should allow you to bridge funds to Binance Smart Chain. Note that although fees on Harmony are cheap, bridging fees usually cost close to 5-6 ONE. This is thanks to the burning mechanism on the Harmony Network. This is beneficial in the long run, but may be painful for users if the price of Harmony skyrockets in the future.

Harmony Team

The team behind the Harmony network is impressive, with a combination of experts coming from the likes of Google, Amazon, Apple, and Microsoft. They have also worked on some of largest technological systems in the world such as AWS infrastructure and Google Maps.

The CEO of Harmony is Stephen Tse, who has spent his life working on security protocols. He transitioned from a career as a Microsoft Researcher, to a senior infrastructure engineer at Google, and to a principal engineer at Apple. He later founded a startup called Spotsetter which was acquired by Apple.

The additional co-founders also have impressive backgrounds as veterans of artificial intelligence. The Harmony team is also transparent with the community, something many appreciate. Status update meetings over Zoom are available to the public for viewing via YouTube. This has made the community more understanding and supportive of Harmony, despite delays in some areas of this impressive project.

Closing thoughts

Harmony is a project that aims to solve the dilemma of poor scaling and interoperability. It aims to be a top crypto network known for its speed and effectiveness and stays true to its promise currently of inexpensive gas and transaction fees.

As with every other project, Harmony will get more valuable with mainstream acceptance, and perhaps then we may see more use cases. Many people are also excited about the ChainLink integration on Harmony, as it is well known that Aave only accepts ChainLink oracles. This would hopefully increase the TVL and ROI on Harmony. (Note: This is not financial advice. Please do your own due diligence)

Although it is a crowded space, Harmony has leveraged this by opting Ethereum’s huge user base instead of competing with it. Harmony needs to be able to prove that they can deliver upon its roadmap in order to remain relevant in the competition.

The largest threat to this project would be competition, and Harmony needs to remain ahead of existing competitors such as Zilliqa (ZIL) and any potential future competitors such as IOTA. That being said, Harmony is a unique protocol and its decision to solve the fourth trilemma of privacy unbeknownst to many may be a unique competitive selling point for this project.

Featured Image Credit: Chain Debrief

Also Read: Growing Your Bag Of LUNA: Here’s A Guide To Yield Farming In The Terra Ecosystem