To understand the demand for Lido Protocol, we first need to understand what is Ethereum 2.0 and Ethereum 2.0 staking.

Ethereum 2.0 is an upgrade for the current Ethereum blockchain. It aims to improve the network efficiency, speed security and scalability. Ethereum 2.0 will see a shift from the traditional proof of work consensus to a far more energy-efficient proof of stake mechanism.

The Proof of Stake consensus model revolves around validators to validate the blocks. Here is the catch, users will need to stake at least 32 ETH to become a validator and earn rewards for validating blocks.

The high barrier to entry and illiquidity of ETH is too much for the average individual. This is where Lido comes into play:

So what is Lido?

Lido is a staking solution that lowers the barriers to entry for Ethereum 2.0 staking. Instead of staking ETH in multiples of 32, it allows users to stake a fraction of the ETH and still earn rewards from Ethereum 2.0

Setting up an Ethereum validator also need a decent amount of technical knowledge. Lido negates the technical burden as it stake on behalf of the user.

Other centralised platforms like Binance also offer the same feature but Lido is decentralised in nature, which means it is non-custodial. Furthermore, the centralised exchange takes a hefty cut on the reward earned through staking.

The illiquidity is solved by the issuance of Lido’s very own stETH. It is the tokenized version of the staked ETH and it can be used in other DeFi protocols. Users that stake ETH on Lido will be able to mint stETH on a pegged 1:1 ratio.

How is Lido doing?

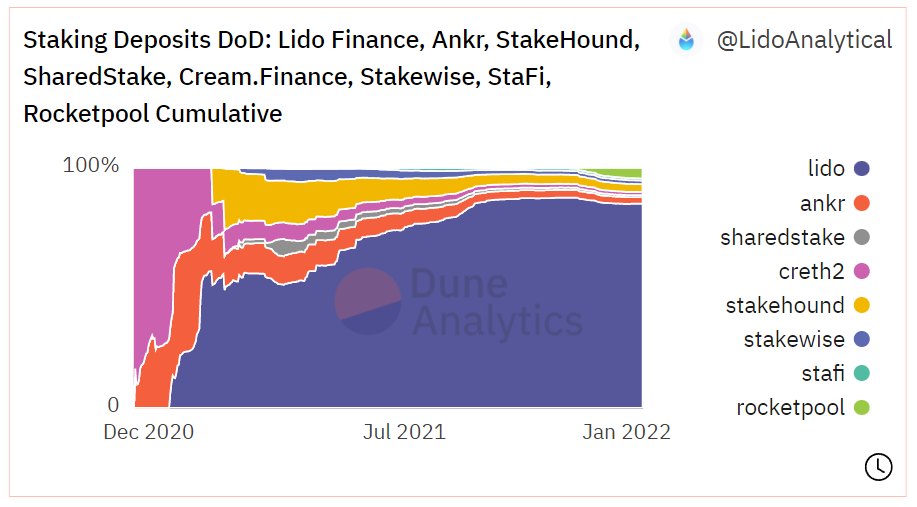

If we look at the current landscape, Lido is currently the market leader for the staking derivatives sector. It is the dominant provider with over 85% of the market share.

With over 1.6 million ETH staked on Lido, it represents 18% of all ETH staked in Ethereum 2.0.

Lido charges a 10% fee on staking rewards, with 50% paid to validators and the other half paid to the DAO.

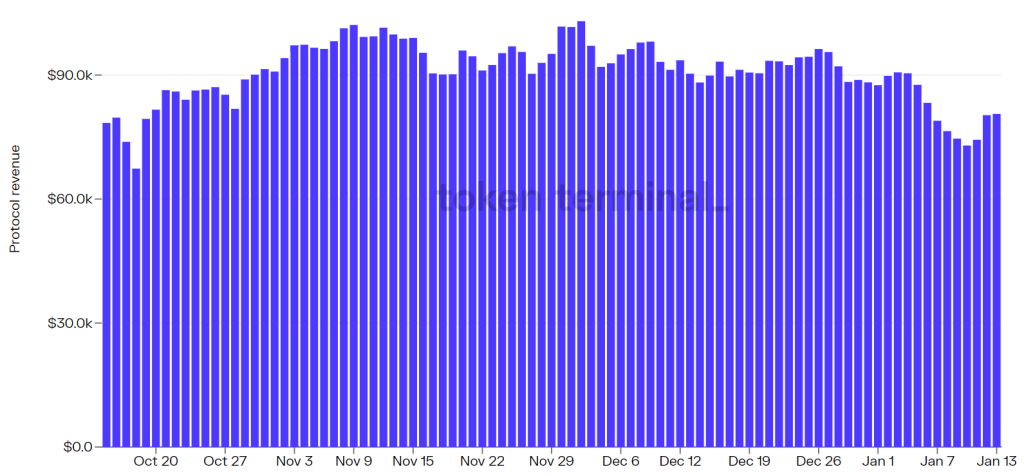

When we look at the revenue breakdown, the protocol is generating a healthy DAO revenue of an average of US$80,000 per day with a cumulative DAO revenue of over US$14 million.

Looking at the current market position and its future plan to include other blockchains, there’s no doubt it would grow in TVL and still maintain its market lead over the other protocol.

How to stake on Lido?

You can stake ETH on Lido in just four easy steps:

- First, connect your trust wallet to the site. Lido support a range of wallets, from hot wallets like Metamask to cold wallets like Ledger.

- Enter the amount of ETH you want to stake. It will also display how much stETH you’re getting and the transaction fee.

- Confirm the trasaction so it will be broadcasted to the blockchain.

- You will be able to see stEth in your trust wallet. The staking process is done.

In a nutshell, Lido protocol solves the issue of staking commitment, illiquidity and high barrier to entry to Ethereum 2.0 staking.

It is also tapping into the other large layer one blockchain and providing liquid staking services. Moving forward, Lido will definitely be a vital protocol of the DeFi ecosystem.

1/ Thread on my investment thesis on the number one liquid staking protocol @LidoFinance pic.twitter.com/9mB6tYi4QQ

— Dyslexic Ventures (@DyslexicVenture) December 21, 2021

3/ Why Liquid Staking?

— Dyslexic Ventures (@DyslexicVenture) December 21, 2021

Currently, as an owner of a digital asset you are incentivized to go where the highest yield occurs.

Staking ETH is great and helps secure the Ethereum blockchain, however you could throw ETH into different Defi protocols and earn a higher % yield.

5/ Currently, Lido allows users to stake $ETH, $SOL, and $LUNA, three of the largest layer one blockchains.

— Dyslexic Ventures (@DyslexicVenture) December 21, 2021

Chains Lido is currently working with include $MOVR, $MATIC, $DOT and $AVAX along with the DAPP $AAVE for future liquid staking services.

7/ Lets dive into the numbers. "His name is Yang!" pic.twitter.com/s7Qdx5enFY

— Dyslexic Ventures (@DyslexicVenture) December 21, 2021

9/ Lido is in the top 11 protocols for both TVL and revenue.

— Dyslexic Ventures (@DyslexicVenture) December 21, 2021

Lido has over $11 Billion in TVL, currently ranked number 7, ahead of $COMP, $YFI, and $UNI. pic.twitter.com/CEIkNaJO5j

https://t.co/GMROe7sq6A

— Dyslexic Ventures (@DyslexicVenture) December 21, 2021

11/ Even JPMorgan (yes the guys who fudded crypto for years) wrote a report about a $40 Billion staking industry by 2025.

13/ If you believe in a multi chain world, Lido has a TAM that is unfathomable. We do not know how big these Proof of Stake networks will get in the future. However, Lido has an uncanny first mover advantage in the liquid staking derivatives business. pic.twitter.com/h9SdlwA7y6

— Dyslexic Ventures (@DyslexicVenture) December 21, 2021

15/ As Lido continues to integrate with Blockchains and DAPPs its TVL will swell to unfathomable heights. The more staking that occurs in Lido, the more revenue the protocol generates from the staking rewards.

— Dyslexic Ventures (@DyslexicVenture) December 21, 2021

Think of it as a staking service if you don't run your own node.

17/ Put simply, Lido is a new era service for digital asset liquidity in a multi-chain world.

— Dyslexic Ventures (@DyslexicVenture) December 21, 2021

Featured Image: Lido

Also Read: Understanding Ethereum’s Roadmap After EIP-1559: Will ETH Become Deflationary?