Supercycles are defined as a sustained period of growth and expansion, driven by robust growth in demand for products and services. During supercycles, prices can rally for years, as producers struggle to match the growth in demand.

Historically, the human race witnessed the first supercycle with US industrialization in the early 1900s. Most recently, China entered a huge phase of growth in the 2000s, and we saw prices of commodities explode to meet the growth demand for China.

For more than a decade in the early 2000s, materials including iron ore were in tight supply. Copper, priced below $2,000 a ton for much of the 1990s, broke $10,000 and oil jumped from $20 a barrel to $140.

Fast forward to 2020, blockchain technology may be ushering a new crypto supercycle that could create wealth for early adopters of the technology.

Here are some signs to show that the crypto super cycle is here.

1. Unsustainable macroeconomic practices

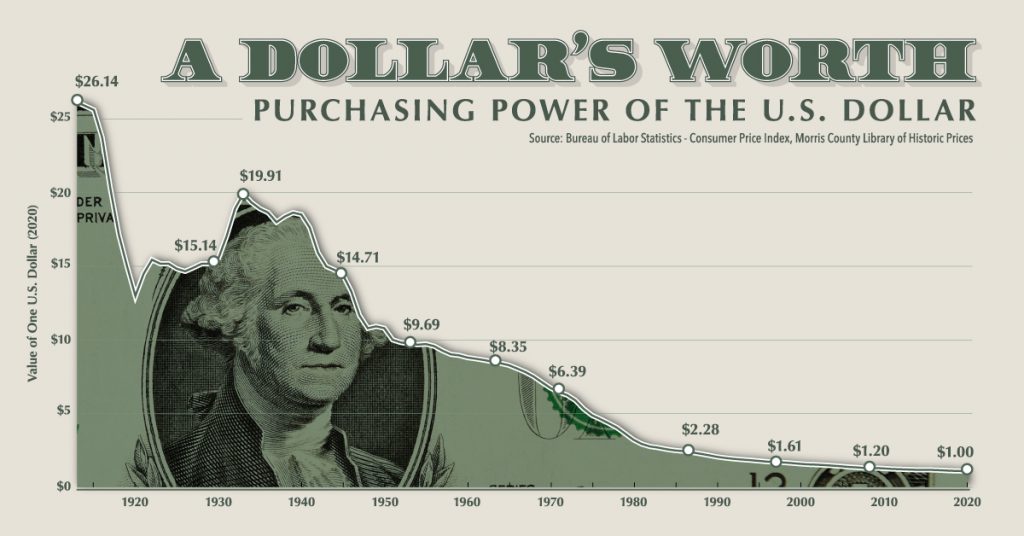

For the longest time, the Federal Reserve has been printing US dollars to support the needs of the country. Due to COVID-19, we saw an unprecedented amount of dollars being printed and released into the economy to help cushion the impact of the virus.

It is important to bring to attention that more than one third of the US dollars in circulation was printed in the last year, with its impact slowly being felt by the United States — prices of assets and goods have increased as the value of the dollar fell.

Real Central Bank Rates (rate minus inflation)…

— Charlie Bilello (@charliebilello) August 11, 2021

US: -5.3%

Saudi Arabia: -5.2%

Poland: -4.9%

Chile: -3.8%

Brazil: -3.7%

Australia: -3.7%

Peru: -3.6%

Norway: -3.0%

Canada: -2.9%

Eurozone: -2.7%

UK: -2.4%

India: -2.3%

S. Korea: -2.1%

Philippines: -2.0%

Mexico: -1.6%

Japan: -0.3%

With trillions of dollars being printed, negative or zero interest rates are now the new normal with fiat currency. Inflation rates are slowly rising.

As there is a finite amount of Bitcoin being mined, crypto offers an alternative asset class for owners to hedge their purchasing power.

2. Regulations are catching up

In recent months, regulators around the world are playing catch up to regulate the industry. Earlier this month, US passed a new $1 trillion infrastructure bill which includes provisions for crypto regulation. The Security and Exchange Commission (SEC) Chair Gary Gensler talked about the SEC’s role in regulating digital assets.

A few key themes have emerged on the subject of new US cryptocurrency regulations: stopping cryptocurrency crime and tax evasion, stablecoin regulation, and the potential for investment vehicles like crypto ETFs and other funds.

A trillion dollar infrastructure bill meant to rebuild the USA… and the most hotly debated items is cryptocurrency.

— The Wolf Of All Streets (@scottmelker) August 8, 2021

We’ve made it.

Cryptocurrency has withstood the test of time, and has now evolved from the government trying to shut it down, to legislating and regulating it.

It is a matter of time before cryptocurrency is regulated and treated as an asset class like every other asset class in existence. As the old saying goes, first they ignore you, then they laugh at you, and then they fight you, and then you win.

3. Fiat on ramps are picking up

Over the past few months, we have seen more and more corporations ramping up services which allow retail investors to easily move their fiat money onto the blockchain (fiat onramp).

PayPal is one such company actively pushing for this. Most recently, the company announced that its product Venmo will now allow holders of its credit cards to automatically buy cryptocurrencies with the cashback earned on their purchases.

PayPal recently also announced that it had increased user’s weekly cryptocurrency purchase limits to $100,000 from the previous $20,000 where users are able to now buy up to 5 times the usual amount of Bitcoin and other digital assets, signaling PayPal’s further commitment into the digital space.

Other than PayPal, Coinme, a cryptocurrency-to-cash exchange based in the US, had been actively launching Bitcoin-enabled Coinstar kiosks around in the United States. This will make buying Bitcoin with cash as “simple as visiting their local grocery store,” the firm said. It is estimated that as many as 42000 bitcoin ATMs will be seen across the United States over the next few years.

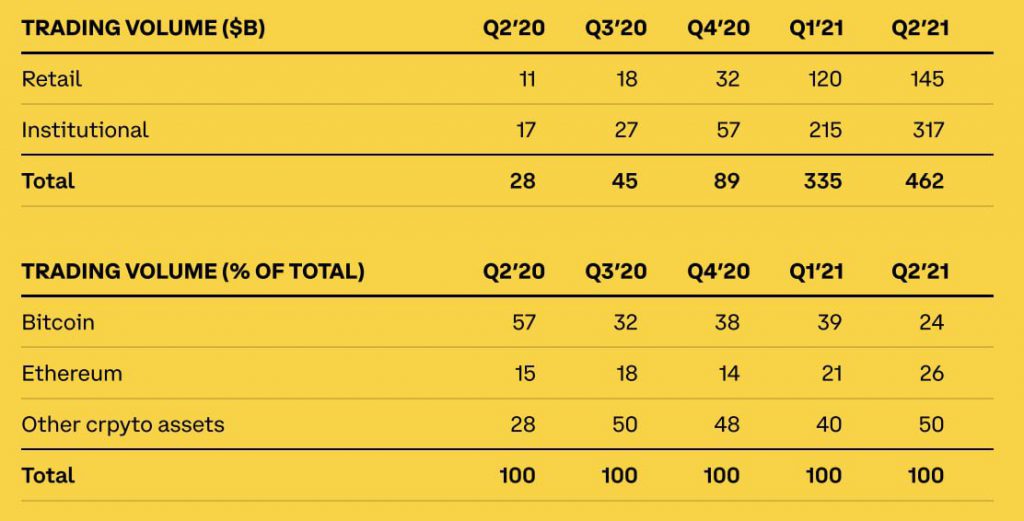

4. Institutions have been actively participating

In Coinbase’s latest earnings report, it was revealed that the trading volume of institutions has swelled as compared to a year ago. In the second quarter this year, the trading volume of institutions was $317 billion, compared to just $17 billion a year ago, representing a 15 times increase in volume.

Over the past few months, more and more institutions and banks have expressed interest in adopting cryptocurrency as a new asset class. Here are some headlines examples:

- Institutional Crypto Exchange LMAX Digital Hit Record $6.6B Volume on Bitcoin’s ‘Black Wednesday’

- Wells Fargo: US bank set to offer crypto fund to rich clients

- Citi Reportedly The Latest Bank To Consider Crypto After Soaring Client Interest

- Bitcoin is coming to hundreds of U.S. banks this year, says crypto custody firm NYDIG

- After Bitcoin, Institutions Finally Turning to Ethereum

- Ark Investment tips $20M into Grayscale Ethereum Trust

- Half of traditional hedge funds considering crypto investments, report finds

- Germany allows institutional funds to invest in cryptos

- America’s Fifth-Largest Banking Institution US Bank to Offer Cryptocurrency Custody

- Carl Icahn Says He May Get Into Cryptocurrencies in a ‘Big Way’

These are all just recent news signalling interest from institutions. As compared to retail investors, institutions have more access to capital and will be able to provide strong price supports to cryptocurrencies.

5. Product market fit

As the cryptocurrency market matures, we are seeing more useful products with massive user adoption.

In recent weeks, we saw the rise of Axie Infinity, the popular play to earn NFT based game which saw hundreds of thousands of users jumping into the new gaming phenomenon and interacting with digital assets for the first time.

So 23% of Axie Infinity players have never owned a bank account before. $AXS is literally banking the unbanked before our eyes and the line between DeFi and gaming begins to blur.

— The Unreliable Narrator ? (@ReliableNarr) August 11, 2021

@AxieInfinity is the first #NFT game to surpass $1 billion in sales. https://t.co/REGv5y8oct

— Chain Debrief (@ChainDebrief) August 10, 2021

Other than Axie Infinity, NFTs are big, with NFTs marketplaces hitting all time high trading volumes and transactions. All of these are attracting new users into the blockchain space by the tens of thousands everyday.

OpenSea has officially surpassed $1 billion in gross market volume after a record few days.

— Oliver Isaacs (@oliverzok) August 14, 2021

More impressively @opensea facilitated $1 billion in volume in 2021 alone!

2018 – $473k

2019 – $8 million

2020 – $24 million

2021 (YTD) – $1.02 billion

Absolutely insane growth. pic.twitter.com/NjTSxp0sqR

Crypto adoption is also the fastest technological adoption in human history. We are currently witnessing the birth of a new asset class which will redefine ownership, finance, identity, communities, markets, real estate and so much more.

Early adopters are actively accumulating these scarce digital assets to jump onto the bandwagon before the mass majority comes onboard.

Also Read: Crypto Market Cap Returns To $2 Trillion After 3 Months, Signals Bullish Sentiments