If you have been involved with cryptocurrencies, chances are you would have heard of the term wrapped tokens.

What exactly are wrapped tokens? Here’s a quick article to help you understand the importance of wrapped tokens.

What is a wrapped token?

Wrapped tokens are basically tokenized versions of cryptocurrencies that are pegged to the value of the original crypto asset.

The difference between the original and the wrapped version is that the wrapped version can be used on a non-native network as opposed to the original token that can only be used on the native network.

Wrapped version of token help solves an innate issue of blockchain interoperability. Wrapped tokens provide greater interoperability between different blockchain and cryptocurrencies.

Furthermore, wrapped tokens can also help to improve capital efficiency and liquidity on other blockchains. For instance, users can retain Ethereum exposure while participate in yield farming opportunities on the Solana network.

Almost every other major blockchain has a wrapped version of its native cryptocurrency, for instance, Wrapped Bitcoin (wBTC), Wrapped CRO (wCRO) and many more.

What is wETH?

Wrapped Ethereum or wETH is simply the tokenized version of Ethereum. It is pegged 1:1 to the value of Ethereum. Unlike ETH, it is an ERC-20 token and it cannot be used to pay gas fees.

Because wETH is ERC-20 compatible, it can be used for advanced interactions on Decentralised Finance (DeFi) applications. On the other hand, ETH was developed way before ERC-20 was implemented and it does not comply with the ERC-20 standard.

The process to wrap ETH is fairly simple, the user will have to send ETH to a smart contract and it would generate wETH in return. The smart contract in this case the custodian would lock up the ETH such that the wETH is backed by an ETH reserve.

To ensure that the wrapped token is pegged to the price of the original token, wETH will be burned whenever it is exchanged back for ETH.

The easier way to get wETH is to swap another token using a cryptocurrencies exchange. Most popular decentralised exchanges like Uniswap or Sushiswap would have an option to swap tokens for wETH.

Using wETH on OpenSea

Wrapped Ethereum is especially useful on OpenSea. It can be used to make pre-authorized bids on multiple different NFTs.

Wrapped ETH allows the user to bid on many different items using the same pool of Ether. For example, as a user with 1 WETH, I could place a 1 WETH offer on as many items as I like.

The moment my first bid gets accepted, the other offers will be instantly invalidated if I no longer have enough WETH in my account.

Do note that wETH can only be used to bid on OpenSea and cannot be used to buy an NFT using the “Buy Now” function. Vice versa for ETH.

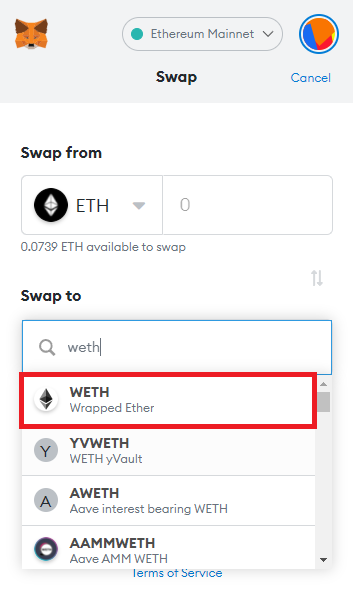

How to get wETH on MetaMask

MetaMask is more than just a digital wallet for storing and transferring cryptocurrencies, it encompasses the function of a decentralised exchange (DEX) that allow users to swap a token for another.

This built-in function enhances the whole MetaMask experience as users can save the hassle of swapping tokens on a DEX.

On the MetaMask dashboard, you should be able to see the swap function right beside the send button.

Pressing the send button would bring you to a page where you can choose from a list of tokens you would like to swap to and from. For this example, I will swap ETH for wETH.

Next, is to input the amount of token you would like to swap and review the swap.

If your swapping ETH to wETH, you should see that 1 ETH = 1 wETH as ETH is pegged to wETH.

All you have to do is to press the swap button and voila the wETH should appear in your MetaMask wallet after the transaction is complete.

If you cant see the wETH in your wallet, all you have to do is to import the token into MetaMask.

Featured Image Credit: Chain Debrief

Also Read: What Are Gas Fees? Why They Get So High On Ethereum, And How To Adjust It On MetaMask