Editor’s Note: This article was updated on 28 January, 11:25 GMT+8 to include other developments in the Wonderland controversy. The initial article published on 27 January 2022 only included Wonderland pivoting to a SPAC model, which can be found below.

Over the past week, there have been great controversy surrounding Wonderland TIME. In this article, I will try my best to cover all you need to know about what is happening with TIME in 3 different parts. The first, the decision to merge with SPELL. Secondly, the unravelled management of TIME and thirdly, TIME’s pivoting toward the SPAC model.

1. Merger with SPELL

MAJOR FROG NATION ALPHA

— The DeFi Edge (@thedefiedge) January 26, 2022

There is a proposal to COMBINE Wonderland and Abracadabra into ONE protocol.@danielesesta conducted an AMA on the proposal.

• Details of the merger

• The upside for both protocols

• The # and $

• What I think of it

Here's the alpha:

🧵 pic.twitter.com/paZ7uUBoTs

There is a proposal to combine TIME wonderland and Abracadabra. This would mean Wonderland would not exists anymore and instead, TIME would fall under the umbrella of Abracadabra’s SPELL.

Details of the merger

/1 Wonderland Today

— The DeFi Edge (@thedefiedge) January 26, 2022

• They used rebasing as a tool to raise $835m in its treasury

• They have started investing in projects such as $BSGG and $CFA and soon Wormhole.

• Their treasury farming has been beating the market in the dip

Is Wonderland Successful?

Wonderland will be using a rebasing tool to raise US$835m in its treasury. In doing so, they are also investing in projects such as $BSGG and $CFA.

Wonderland’s goal was to use OHM mechanics to raise funds, and to invest in DeFi projects. They were relatively successful in that department but communication has rather been lacklustre.

This merger, was mentioned by @TheDeFiEdge on twitter that it is not a rescue mission, instead the combined protocol will be more powerful with greater synergy.

Outcome of merger

The expected outcome from this merger is postulated to garner US$200-300M a year from Abracadabra.

US$800M will come from the war chest in Wonderland along with a treasury farming mechanism. The outcome of the merger would also be supported with a Venture Capital Investment Firm arm.

How would this benefit Wonderland?

- Easier access to capital

- Preferred rates of access

- Easy onramp, with $SPELL being on Binance and Coinbase.

The merger will increase cash flow into the treasury and better leverage by roping in other protocols to invest in their project. Inflow of money will increase treasury funds and potentially making the project a successful one.

What would the merger offer?

- Borrowing and Lending

- Listing Access

- Farming via Sushiswap

Wonderland will no longer exist if the merger proceeds. Wonderland bascailly becomes abracadabra and all wMemo will be transformed into $SPELL. The entire business model of wonderland will be changed.

(Also Read: What Is Abracadabra? An Introduction To The Land Of Spells And Magic Internet Money)

Exchanging wMemo for SPELL

It is unknown for now what the exchange rate will be, but the team would want it to be as fair as possible.

They would need to do an audit on Wonderland’s Treasury as prices of wMemo and Spell are fluctuating amidst the news.

Rebasing

There is also news that there will not be rabasing anymore. Instead, a transition to a revenue share system.

This system includes

- Spell tokens getting 30% APR from fees

- Treasury which will be farming

- Revenue share from investments

My opinions on TIME merger with SPELL

In my opinion, TIME’s previous rebase model was a good way to attract users onto their platform. It got people to invest in its treasury with the (~80k%+) APY.

You might feel betrayed with the merger but we all have to realize that wonderland rebase was an experiment.

In my opinion, TIME’s previous rebase model was a good way to attract users and raise capital on their platform. It got people to invest in its treasury with the (~80k%+) APY, but currently faces constant selling pressure.

I guess we have to properly think about this move and when it is time to vote (DAO) on the merger, you would do so accordingly.

2. Wonderland was run buy a Felon

A decentralized-finance project called Wonderland is being rocked by controversy following the disclosure that it was being run in part by a felon with ties to Quadriga, one of the biggest crypto scandals https://t.co/EA1L09uwOd

— Bloomberg (@business) January 27, 2022

Less than 48 hours ago (Current date is 28 Jan), the wonderland protocol was under attack. Most of it seem to believe it was a liquidation cascade setting off to target @Danielesesta.

His plan for the @Wonderland_fi debacle was to merge it with @MIM_Spell. Their marketcaps would combine, and affected users would get new $SPELL tokens. Dani led us to believe he would be footing the bill for most of this personally.

No doubt @danielesesta is a wonderful developer and he did not do it all alone. @0xM3rlin helps him on $SPELL, @squirrelcrypto is his chad, @AndreCronjeTech and Dani has a new upcoming project.

But @0xSifu is his CFO for @Wonderland_fi.

8/ Well, really, his REAL name is Omar Dhanani. KNOWN criminal and scammer. Rap sheet?

— MidasTheFool (@MidasTheFool) January 27, 2022

2005: Credit/bank Fraud

2007: Theft, burglary, more computer fraud.

But in 2018 he and his co-founder partner "lost" access to $100M of canadian exchange's user's funds…

@0xSifu‘s birth name is Omar Dhanani, who has committed multiple fraudulent related acts. He has since changed his name twice, one notably to Micheal Patryn, a convicted white collar criminal.

Micheal Patryn was the Co-founder of QuadrigaCX.

QuadrigaCX is the Canadian exchange that collapsed in 2019 after the founder Gerald Cotten died in December 2018 due to complications from Crohn’s disease while traveling to India. It was found that Cotten was the only one with access to $135 million of investors funds.

QuadrigaCX was unable to locate or secure a significant amount of cryptocurrency reserves and led to the mystery of @0xSifu‘s co-founder of has been missing or “dead” after a trip to India.

You may also hear about QuadrigaCX scam on CBC Listen here.

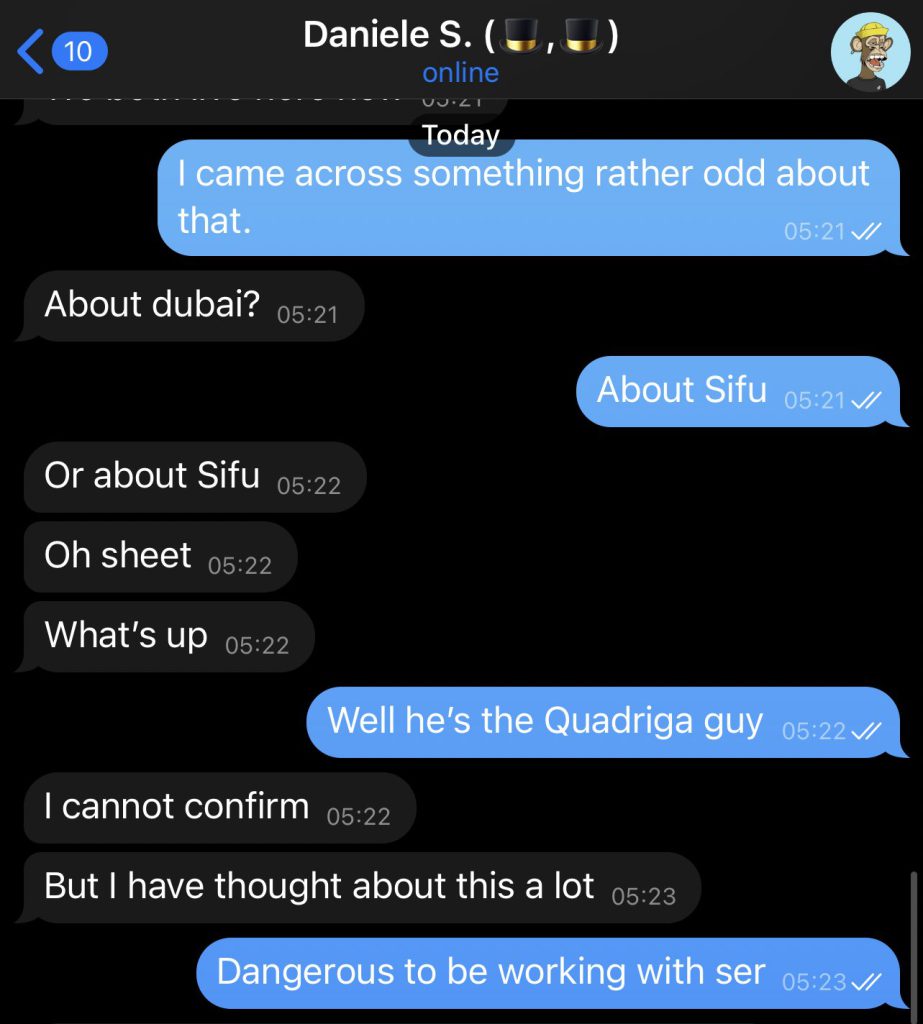

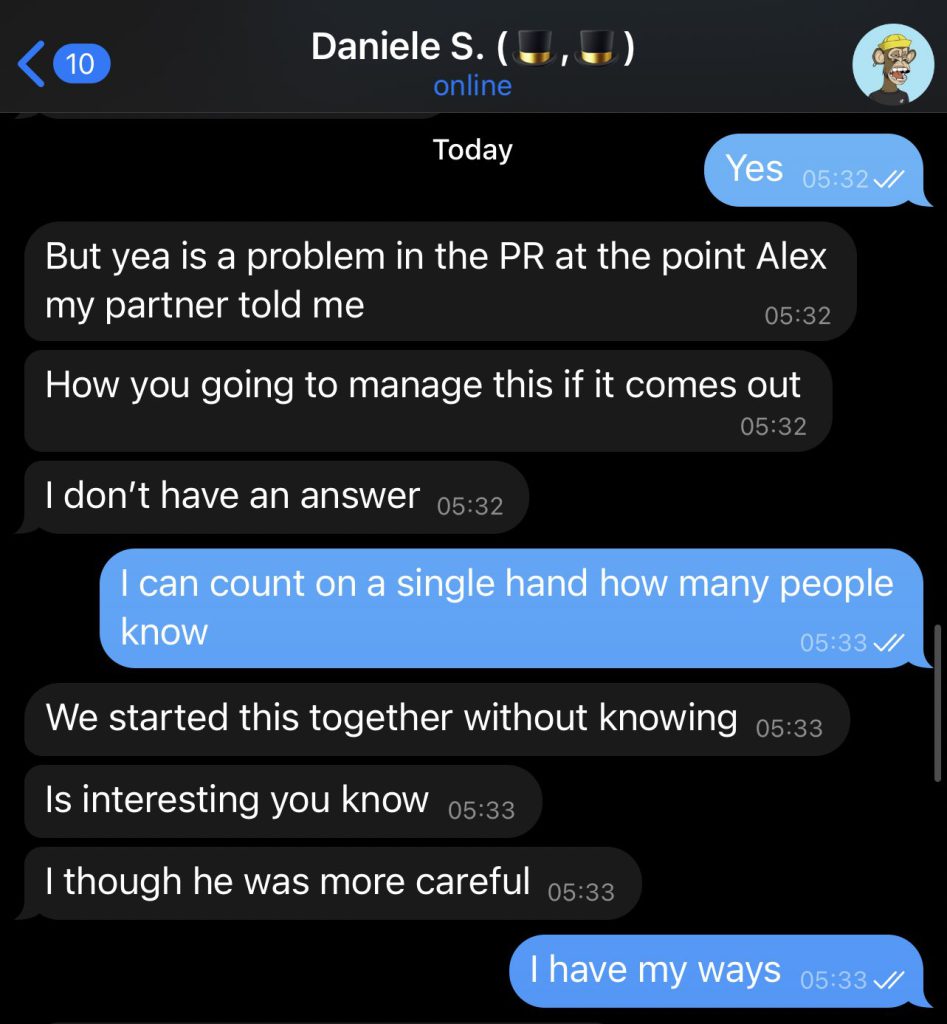

The news leaked that indeed @0xSifu is the criminal Omar Dhanani. Dani states that he didn’t know at first, but once he found out he kept it quiet as he believes “people can change”.

1/ This needs to be shared @0xSifu is the Co-founder of QuadrigaCX, Michael Patryn. If you are unfamiliar that is the Canadian exchange that collapsed in 2019 after the founder Gerald Cotten disappeared with $169m

— zachxbt.eth (@zachxbt) January 27, 2022

I have confirmed this with Daniele over messages. pic.twitter.com/qSfWNnQPhr

Prior to Quadriga, Michael helped run a identity theft ring called shadowcrew in which he later plead guilty to. While Dani insists it is fine he puts both his rep on the line along with most importantly all the money people have deposited in his protocols at risk.

Quadriga ties back to Sifu.eth https://t.co/Ugb1I5J6gw

— zachxbt.eth (@zachxbt) January 27, 2022

Although Dani sees the good in people, investors do not seem to agree. The frognation took a huge hit on its price action.

Notable DeFi personalities have spoken out on Omar saying that even if he has changed, you would not put him in charge of a multisig with access to a $800M treasury.

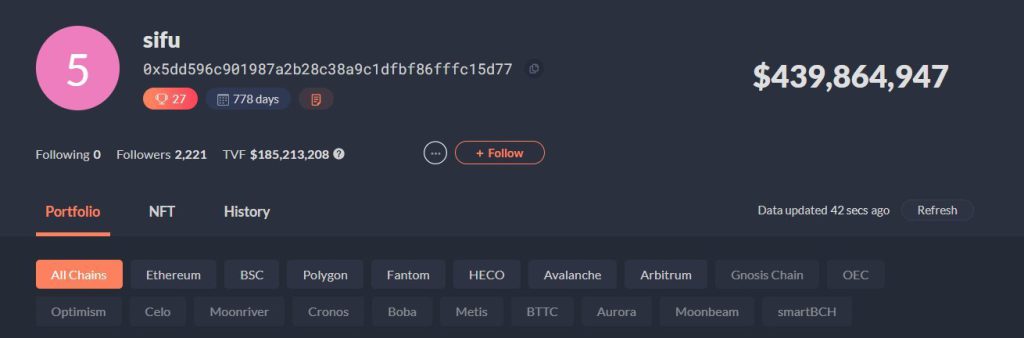

Here is the best part, @0xSifu aka Michael Patryn aka Omar Dhanani’s personal wallet has gone from 45M to 450M in one month.

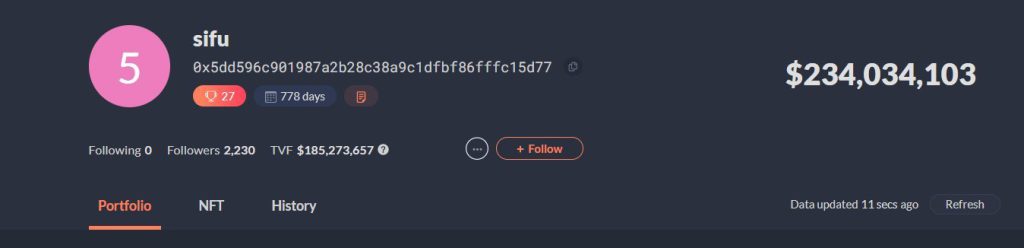

Money has also been transacted out of the wallet, down to US$200 million.

Read more about who exactly is @0xSifu in the thread by @MidasTheFool below.

Who exactly is @0xSifu? aka Michael Patryn? aka Omar Dhanani?

— MidasTheFool (@MidasTheFool) January 27, 2022

I've had the unfortunate pleasure of following this criminal for years. A thread on why we need this guy out.$TIME $WMEMO $SPELL pic.twitter.com/YXV5NckIfX

My Opinion on Wonderland now

In my opinion,@danielesesta is at the receiving end of all of this.

From his tweets, he is always concerned and worried about his investors and supporters. He has spent his own money to make things right in the past. And focuses both on product value and price action.

However, putting a criminal in charge of users funds in the hundreds of millions is not a good move.

3. $TIME pivots towards the SPAC Model

1/ @danielesesta announced today that $TIME is exiting the (3,3) space and pivoting toward the SPAC model

— The Giver (@lazyvillager1) January 18, 2022

As a former investment banker, I've worked on SPAC transactions & pitches, and have friends who work in business dev. at such co's post de-SPAC

Herein lies my thoughts:

Introduction

So much has happened over the past few days. This might be old news the moment to you read this, but it also gives insight as to what Wonderland Founder Daniele’s potential future plans are.

TIME Wonderland has plans in moving from their current (3,3), where it uses staking as a primary resource for accruing value to TIME to achieve store of value status, towards a SPAC model, a relatively new concept in the cryptocurrency space.

In this article, we summarize the thoughts of ‘The Giver’ and how the future would be for the Wonderland.

What is a SPAC?

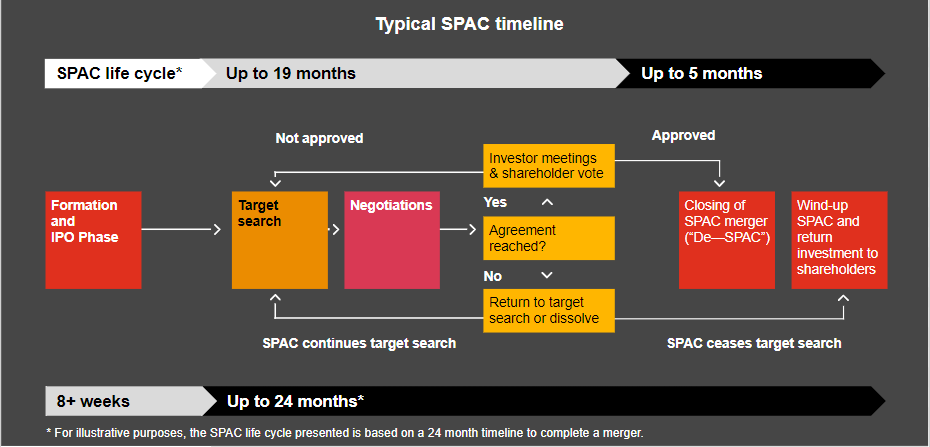

A SPAC (Special Purpose Acquisition Company) is when a company is formed to raise capital through an initial public offering (IPO) to acquire an existing company.

At the time of their IPO, SPACs have no existing business/commercial operations or even stated target for acquisitions.

SPACs are also known as ‘blank cheque’ companies where investors of the SPAC would have no idea what they would be investing in. Investors can range from well known private equity funds and celebrities to the general public.

Funds raised would be placed in an interest-bearing trust account. During this time, SPAC founders would have two years to acquire a company.

The funds in the trust can only be released for two reasons, firstly, completing an acquire of a company. Secondly, to return the money to investors if they do not complete any transaction in two years.

Wonderland venturing into SPAC

SPACs are usually formed by sponsors or investors with expertise in a particular industry with an intention of perusing a deal. It is also important to know that founders of SPAC put very little of their own capital.

It would be a mystery on what the SPAC target for TIME would be. The SPAC target would presumably be focused on Web3/Meta-verse related.

Above is the typical timeline of a SPAC life-cycle.

The SPAC has two years, at maximum, to identify and complete a merger with a target company. If the SPAC does not complete a merger during this time, IPO proceeds will be returned to shareholders. This hasn’t been touched on, and indeterminate to how this could be executed with $TIME.

A good example of a company that may seek SPAC capital is an electric vehicle company. A great narrative with lots of capital needed for research and development.

This comes with a very long time away before being profitable however SPAC investors would willingly sign up for this speculation.

So this begs the question — what narrative is TIME searching for in its SPAC acquisition?

Risks involved in SPACs

1. Illiquidity Risk

A study published in the Yale Journal of Regulation found that the average rate of redemption per deal was 58%. Additionally, in more than one in every three SPACs, over 90% of investors pulled out.

2. Structural Risk

The sponsor usually targets a fundraising goal and with that structure in place, offers investors X number of shares at a par value of US$10 per share. This acts as a warrants that allow them to buy shares in the future at some price typically US$11.50 per share.

This represents a very clear path to profitability moving forward. Specifically, warrants are critical in aligning risk between the Sponsor and investors.

This structure allows for return profiles to match risk tolerance, and is completely devoid in the fundraising vehicle that $TIME is branding itself as.

3. Funding Risk

Often, SPACs will raise PIPEs (private investment in public vehicles) to validate their investment thesis. To both bridge committed financing and have a large institutional name effectively providing a vote of confidence for the clause.

4. Accountability Risk

What are the backgrounds and the profiles of the $TIME team that are supposed to drive forward what is typically an intensely complex transaction?

Seasoned operating executives and board members with demonstrated experience in governance are essential and backgrounds and names are fully exposed in the public domain.

Till date, Daniel is the only person I know who is working on time. Very little information on the size and individuals is given on his team.

5. Alignment Risk

SPAC tools are seen by many as an easy “get-rich” scheme for Sponsors and Underwriters. Underwriters get chunky fees (usually the bank with the most “constructive” view are selected) and the Sponsor can typically exit in a very short-time frame post de-SPAC with money in hand.

According to a strategist from Renaissance Capital, “as many as 70% of SPACs that had their IPO in 2021 were trading below their $10 offer price as of Sept. 15, 2021.”

The frothy valuations that comes with SPAC is driven by immense popularity (no different from meme coins), with large volatility and over-optimistic projections being covered up.

Is this a healthy change?

“The Giver” found it very difficult to see how this is successful. Not only is this not what $TIME shareholders signed up for when they purchased supply (a perpetually rebasing coin w/ large yields above a t-backed price) within Web3, SPACs are not a compatible idea in either need or origin.

The “DAO” part of Wonderland is supposed to reflect democratized voting toward treasury deployment, and yet it hardly seems feasible to have investors now put on their researcher hats after-the-fact.

To completely discontinue yields is admitting to a lack of foresight. The high APY presented (~80k%+) were likely to be based on rosy projections and a forever-continuing bull market, that this represents a failure to reasonably chart out market conditions.

Are t-backed coins dying?

Is Daniele Sesta a brilliant developer with a large vision for blockchain-driven technologies and protocols? Yes, he is a visionary — but are t-backed coins dying? The Giver’s sentiment is no.

Nominal prices are falling and they do in a vacuum as an inflationary token but real prices (price divided by a moving index) are falling much slower than it appears. This becomes even more true with high-yield protocols.

If the goal of t-backed coins has always been a vision by @ohmzeus to supply protocol-owned liquidity to avoid mercenary capital and create a foundation for upcoming instruments to not overpay in capital-seeking.

If $TIME seeks to move away from this model, then their mission statement and advertising as a “decentralized reserve currency protocol” has never been true.

My Opinions for SPAC Model

What does this mean for TIME holders like myself?

Be prepared for rough and choppy waters to arise as the business model of TIME completely revamps. If you are in TIME, you are basically betting on Daniel’s direction to chart the seas. However, it also brings loom to what TIME initially stands for, the move toward SPAC goes against the reason why I entered TIME in the first place.

It almost seem like the roadmap and direction of TIME changes along with the current narrative. First, it was the high APY following of Wonderland being a fork of OHM, then, the gaming sector they wanted to be expand towards, and now, SPAC.

It is no doubt the team in TIME is putting in the effort behind the scenes, but transparency with it investors grow bleak and blur. We will see where TIME positions itself over the next few months and how their shift to SPAC will play out in 2022.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Also Read: All You Need To Know About The Changes Coming To Wonderland ($TIME) And Its Upcoming Airdrop