The Arbitrum $ARB airdrop has been one of the most talked about airdrops of 2023. Airdrop is a way for projects to reward early adopters, increase adoption, generate buzz, etc.

For Abriturm their $ARB token launch and Airdrop also marked their transition into a DAO because holders of $ARB can vote with their tokens.

Arbitrium didn’t just send airdrops to individuals but also to DAOs that are building on the network.

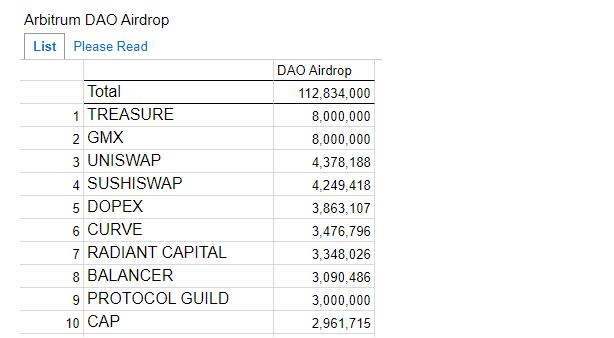

113 million ARB tokens were reserved for DAOs, Arbitrum started distributing these tokens to DAOs on April, 24th, 2023.

The full distribution of the DAO airdrop will take place today with those that have confirmed receiving the test transaction that was sent earlier last week.

— Arbitrum (💙,🧡) (@arbitrum) April 24, 2023

For more details on the DAO distribution, please read the thread below. 🧵👇 https://t.co/naApiR7uT2

At the time of writing 112,834,000 $ARB tokens have been distributed to 137 DAOs. Treasure and GMX received the most ARB tokens at 8,000,000 which is worth $10.5 million.

GMX will receive its allocation from the Arbitrum Builder Airdrop at: 0x0263ad94023a5Df6d64f54BFEF089F1FBF8A4CA0

— GMX 🫐 (@GMX_IO) April 27, 2023

All ARB will be held in the Treasury; utilized once approved by governance.

We thank the Arbitrum DAO, and look forward to continue building the ecosystem together.

Above is the top 10 DAOs that got the most ARB tokens form the airdrop.

Among the 137 DAOs that have received ARB tokens let’s take a look at some projects that benefited the most from the ARB airdrop.

Please Note that the dollar value of ARB token is $1.3 which is the price of ARB as at the time of writing.

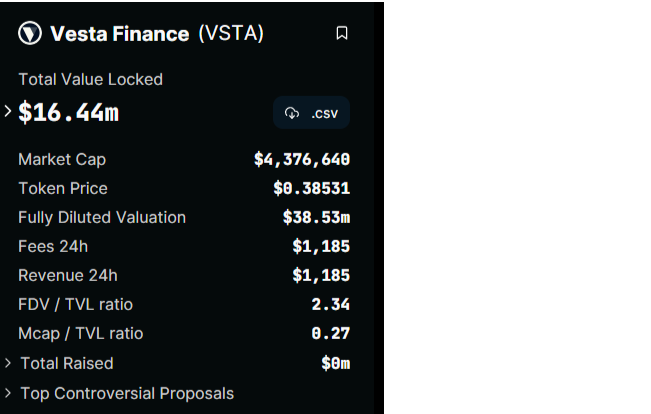

1. Vesta Finance( $VSTA)

Vesta Finance is a DeFi lending protocol on the Arbitrum network that enables users to borrow against their crypto assets without selling them.

The layer 2 lending protocol allows users to obtain maximum liquidity against their collateral at low-interest rates.

Users can participate in the Vesta Finance ecosystem, by using their borrowed or purchased VST the Vesta Finance collateralized stablecoin to contribute to the stability pools there is more than $1 worth of assets backing each VST token.

Vesta Finance received 2,704,175 $ARB tokens worth $3.5 million, with a market cap and TVL(Total Value Locked) of $4.3 million and $16.44 million Vesta Finance received 80% of their market cap and 21% of the TVL from the $ARB airdrop to DAOs.

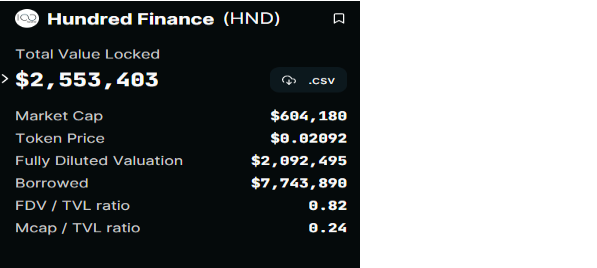

2. Hundred Finance ($HND)

Hundred Finance is a decentralized application (dApp) that enables the lending and borrowing of cryptocurrencies.

The multi-chain protocol integrates with Chainlink oracles to ensure market health and stability while specializing in serving long-tail assets.

Hundred Finance has a market cap of $604,188 and a TVL of $2.5 million the protocol received 386,311 $ARB valued at $502,204 which is just $101,984 shy of HND’s market cap and is 19.6% of HND TVL.

3. PlutusDAO ($PLS)

PlutusDAO is a Layer 2 Governance Blackhole. Plutus is an Arbitrum-native governance aggregator aiming to maximize users’ liquidity and rewards while simultaneously aggregating governance behind the PLS token.

The DAO’s objective is to become the de-facto Layer 2 governance blackhole for projects with veTokens.

PlutusDAO confirmed that it had received 2,705,426 $ARB tokens worth $3,517,053 this is more than half of Plutus DAO market cap which is $6.5 million.

We're glad to announce that we have officially received our $ARB DAO allocation – a grand total of 2,705,426 $ARB tokens that will be used in multiple ways to make Plutus stronger than ever before. 🙏

— PlutusDAO (@PlutusDAO_io) April 25, 2023

We thank the #Arbitrum team for their confidence in us! 🤝💚

It is also 9.7% of PlutusDAO total value locked of $36,101,473.

4. Mycelium ($MYC)

Since its inception in 2019, Mycelium (formerly known as Tracer DAO) has developed expertise and recognition in the industry as a trusted market leader leveraging blockchain technology to make financial markets more efficient with a goal to be open, transparent, and accessible to all.

Mycelium specialises in data provision via the Mycelium Node, and derivatives exchange infrastructure.

We are excited to announce that Mycelium will be receiving 1,158,932 $ARB tokens.@mycelium_xyz will be sharing details soon on how the community can participate in the governance and growth of the @arbitrum ecosystem.

— Mycelium (@mycelium_xyz) March 23, 2023

Mycelium 3/4 Multi-sig Safe address https://t.co/DRzBk7nV2h pic.twitter.com/LS8VK2ibDw

Traders on Mycelium can trade Perpetual Swaps and Perpetual Pools with a range of bluechip DeFi assets including BTC, ETH, LINK, UNI and more hosted on Arbitrum with liquidity, leverage, and low fees.

Mycelium confirmed it received 1,158,932 $ARB tokens which is worth $1,506,611 which is more than their TVL of $861,265 and 28.2% of their market cap of $5,341,875.

5.Y2K Finance ($Y2K)

Y2K Finance is a suite of structured products designed for exotic peg derivatives, that will give market participants the ability to robustly hedge or speculate on the risk of a particular pegged asset (or basket of pegged assets), deviating from their ‘fair implied market value’.

Y2K’s market cap is $3,347,829 with a TVL of $1,901,877 the protocol received 1,416,473 $ARB tokens worth $1,841,414 which is a whopping 96% of Y2K’s TVL and 55% of their market cap.

6. Umami Finance ($UMAMI)

Umami Finance is pioneering the mass adoption of DeFi by creating non-custodial, best-in-class yielding products for core Crypto assets such as $USDC, $BTC, $ETH, $LINK, and $UNI.

The Umami protocol is built on Arbitrum, Ethereum’s leading Layer 2 scaling chain. It is governed by holders of the $UMAMI token. Umami launched its first suite of DeFi Yield strategies in Q1 2023.

See more about Umami Finance here.

Read this🧵by Umami Labs, LLC's @IntrinsicDeFi for an accurate account of what happened at $UMAMI. https://t.co/QjZBSSpvW6

— Umami (@UmamiFinance) February 24, 2023

While Umami was recently hit with a slew of negative news, it has a market cap of $8,928,255 and a Total Value Locked of $11,023 the protocol received 901,392 ARB tokens worth $1,171,809 which is 108x the TVL of UMAMI and 13.1% of UMAMI’s market cap.

7. Saddle Finance ($SDL)

Saddle Finance is a decentralized automated market maker (AMM) on the Ethereum and Arbitrum blockchain, optimized for trading pegged value crypto assets with minimal slippage.

Saddle enables cheap, efficient, swift, and low-slippage swaps for traders and high-yield pools for LPs.

Saddle Finance has a market cap of $4,221,729 and a TVL of $11,109,000.

Yesterday we received our $ARB allocation from the @arbitrum team to our multisig wallet.

— Saddle (@saddlefinance) April 25, 2023

We are very excited and grateful to be part of the team’s mission to decentralization and look forward to seeing how we can help! pic.twitter.com/Nf4h38ZqZF

Saddle Finance received 1,545,245 $ARB tokens worth $2,008,818 which is 47.5%(almost half) of SDL’s market cap and 18% of their TVL.

8. XY Finance ($XY)

XY Finance is a cross-chain interoperability protocol aggregating DEXs & Bridges.

With the ultimate routing across multi-chains, borderless and seamless swapping is just one click away.

XY Finance now supports 14 chains including Ethereum, BSC, Fantom, Polygon, Arbitrum, Optimism, Avalanche C-Chain, Cronos, KCC, ThunderCore, Astar, Moonriver, Klaytn, and Cube.

XY has a market cap of $903,253 and a TVL of $2,152,828. The protocol received 75,000 $ARB Tokens which is worth $97,500 which is 10.7% of XY market cap and 4.5% of TVL.

9. 3xcalibur ($XCAL)

The 3xcalibur Protocol is a permissionless, “liquidationless”, “oracleless” Arbitrum native liquidity marketplace, powered by Tri-AMM architecture to facilitate stable swaps, variable swaps and borrowing/lending.

The Tri-AMM architecture makes 3xcalibur a highly-capable and modular automated market maker.

$XCAL its native token has a market cap of $1,135,857, 3xcalibur received 515,000 ARB tokens worth $669,500 which is 58.9% of XCAL’s market cap.

🗡️ 3xcalibur is thrilled to receive 515,000 $ARB

— 3xcalibur (@3xcalibur69) March 22, 2023

🗡️ We extend our gratitude to @arbitrum for including us and and hope to use our tokens in a way that benefits the ecosystem as a whole!

🗡️ Treasury multisig to receive tokens: 0x5f49174FdEb42959f3234053b18F5c4ad497CC55 pic.twitter.com/alAH2TEzhM

10. JonesDAO ($JONES)

Jones DAO is a yield, strategy, and liquidity protocol with vaults that enable 1-click access to institutional-grade strategies.

These strategies unlock liquidity and capital efficiency for DeFi through yield-bearing tokens.

GM Jonesies!@arbitrum DAO Airdrop received 🫡

— Jones DAO (@JonesDAO_io) April 25, 2023

2,317,864 freshly-minted $ARB tokens were sent to the Treasury 🪙

We remain committed arb maxis and will use these tokens to better the ecosystem 🤝 pic.twitter.com/vsTVj5NP1w

JONES has a market cap of $8,464,219 and a Total Value Locked of $31,864,627. The DAO received 2,317,864 worth $3,082,759 which is 36% of JONES’s market cap and 9.6% of Jones DAO TVL.

Closing Thoughts

With all these thousands and millions of dollars worth of ARB tokens now in the treasuries of these DAOs what are they going to do with it?

Well thats completely left for the DAOs to decide while there are reports of some DAOs selling all their ARB airdrop tokens just hours after receiving it.

🤔@TridentDAO sold all 257,540 $ARB after 4 hours of receiving it from @arbitrum

— Arbitrum Today (💙,🧡) (@ArbitrumToday_) April 25, 2023

👉The distributionn of the DAO airdrop will take place about 14 hours from now. While most protocols keep the airdrops

What do you think? Comment below 👇#Arbitrum #ArbitrumToday pic.twitter.com/i5ACBeeNtL

Other DAOs are delibrateing and engaging with their community on ideas on how to use the airdrop.

Some really good proposals coming from our community that are sparking even more discussions on what the DAO should do with the $ARB airdrop.

— Saddle (@saddlefinance) April 27, 2023

We love seeing this kind of feedback, keep it coming!https://t.co/jXlhA99kR4

Whatever DAOs in the Arbitrum ecosystem decide to do with their ARB tokens be it rewards to users retroactively or incentivize liquidity and usage by rolling out fresh ARB incentives or use it to to participate in the governance of Arbitrum.

I think the decision should fortify the project and push the DAO closer to achieving its goals thereby leading to growth in the DAO in particular and growth in the Arbitrum ecosystem in general.

We're glad to announce that we have officially received our $ARB DAO allocation – a grand total of 2,705,426 $ARB tokens that will be used in multiple ways to make Plutus stronger than ever before. 🙏

— PlutusDAO (@PlutusDAO_io) April 25, 2023

We thank the #Arbitrum team for their confidence in us! 🤝💚

Also Read; Top 10 Arbitrum Protocols to Look Out for in 2023

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief

This article was written by Godwin Okhaifo and edited by Yusoff Kim