The news of the SEC “shutting down” crypto exchange Kraken’s staking as a service in the U.S. caused the crypto markets to tumble. According to a statement by the SEC, two Kraken subsidiaries failed to register the offer and sale of their staking programs. The exchange had agreed to pay US$30 million to settle the charges.

The SEC has been vocal about its concerns that staking services are the equivalent of unregistered securities according to present regulations.

Today @SECGov charged Kraken for the unregistered offer & sale of securities thru its staking-as-a-service program.

— Gary Gensler (@GaryGensler) February 9, 2023

Whether it’s through staking-as-a-service, lending, or other means, crypto intermediaries must provide the proper disclosures & safeguards required by our laws.

Meanwhile, Kraken was the third largest Ethereum depositor, with about 7.5% market share behind Lido finance and Coinbase.

If you don’t already know, Coinbase and Kraken are centralized exchanges, but how did they end up being in 2nd and 3rd in the entirety of ETH stakers? Well, the platforms they offer are more user-friendly, making it easy for patrons of these exchanges to have a preferred stake in them.

It is only a matter of time before Coinbase will be next, but Coinbase stands strong as sources tell us they are willing to fight the SEC on this issue.

Coinbase says Kraken news will not affect their staking program

— Frank Chaparro (@fintechfrank) February 9, 2023

Sources say they’re willing to fight SEC on this issue pic.twitter.com/6gMES5r50q

Till then, the exit of 1,234,304 ETH staked by Kraken due to the SEC might foreshadow another bumpier road for the market.

This leaves investors three choices if they stake their ETH on CEXs,

- Sell staked ETH – increase selling pressure

- Move CEX ETH to a new validator – staying within the same range-ish

- Move CEX ETH to the LSD project – We print hard

But which is the most likely to happen? Only time will tell, really. If you would love to read more into the fine print of the entire case between SEC and Kraken, the thread below sheds some light.

The SEC complaint against Kraken alleging that its staking program is an illegal offer and sale of securities is available here:https://t.co/9slsCTDOq4

— Meat (🥩,🥩) (@MeatTC_) February 9, 2023

Highlights:

LSD is nothing less than bullish

Most certainly, the news sent bullish signals to LSD tokens such as Lido and Rocket pool. Read how liquid staking derivatives (LSD) are primed for success in 2023 with the upcoming Ethereum Shanghai upgrade.

Furthermore, at least for the short term, LSD protocols will gain market share from the centralized exchanges amounting to ~28% of all stake ETH.

The announcement of Kraken led to a significant increase in prices of $LDO and $RPL, rising on average by 10% and 18% yesterday.

According to Korpi on Twitter, the LSD marker can grow up to 60% even if the total demand of ETH staking stays flat. That is bullish.

Coinbase + Kraken account for 20% of staked ETH.

— korpi (@korpi87) February 9, 2023

All liquid staking providers for 33%.

LSD market can grow by up to ~60% even if total demand for staking stays flat (but it will probably go up).

Beneficiaries:$LIDO$RPL$FXS$SWISE

and other LSDs.

Find some addresses that were accumulating $RPL and $LDO by LookOnChain on Twitter below.

3.

— Lookonchain (@lookonchain) February 10, 2023

The largest holding address(@1kxnetwork) of $RPL staked 9,500 $RPL ($468,540) through 2 addresses today.https://t.co/b5KwYPpyQV pic.twitter.com/TZzDUMUxBl

What does this mean for crypto?

According to Rebecca Rettig, the chief policy officer of Polygon labs, the SEC shutdown of Kraken staking “is another indication of the planned systematic dismantling of crypto in the U.S. w/o due process, w/o the chance to craft laws addressing the realities of the tech, & w/o regard for retail users.”

Staking is incredibly important to any ecosystem, allowing people to participate in blockchain technology. This concept is not new to the SEC, and they are undoubtedly aware of it for years, but why only take action now?

It seems like regulators are finding backdoor paths to shut down the crypto industry while many other policymakers are working on a regulation that protects users and financial stability.

Paragraph 39 distinguishes staking as a service from “staking . . . on your own”. This is a critical distinction, indicating that regulators are starting to differentiate between decentralized, native crypto activity & centralized activity that resembles TradFi.

Also, there seems to be more than meets the eye regarding the SEC and crypto. Allegedly.

Crypto Twitter took this seriously and discussed the past relationship between SEC and SBF, the former CEO of the fallen crypto exchange FTX. According to Adam Cochran on Twitter, “the SEC got buddy-buddy with SBF and almost gave them an exception to offer more services in the U.S.”

He then further talked about how the SEC targeted the two most compliant U.S. exchanges for services that the SEC previously refused to guide on.

When they questioned why FTX did not get this treatment, Adam added how SEC Chair Gary Gensler “is not a regulator. He is an agent of an anti-crypto agenda, who only aims to wield his power as a cudgel for those he doesn’t agree with.”

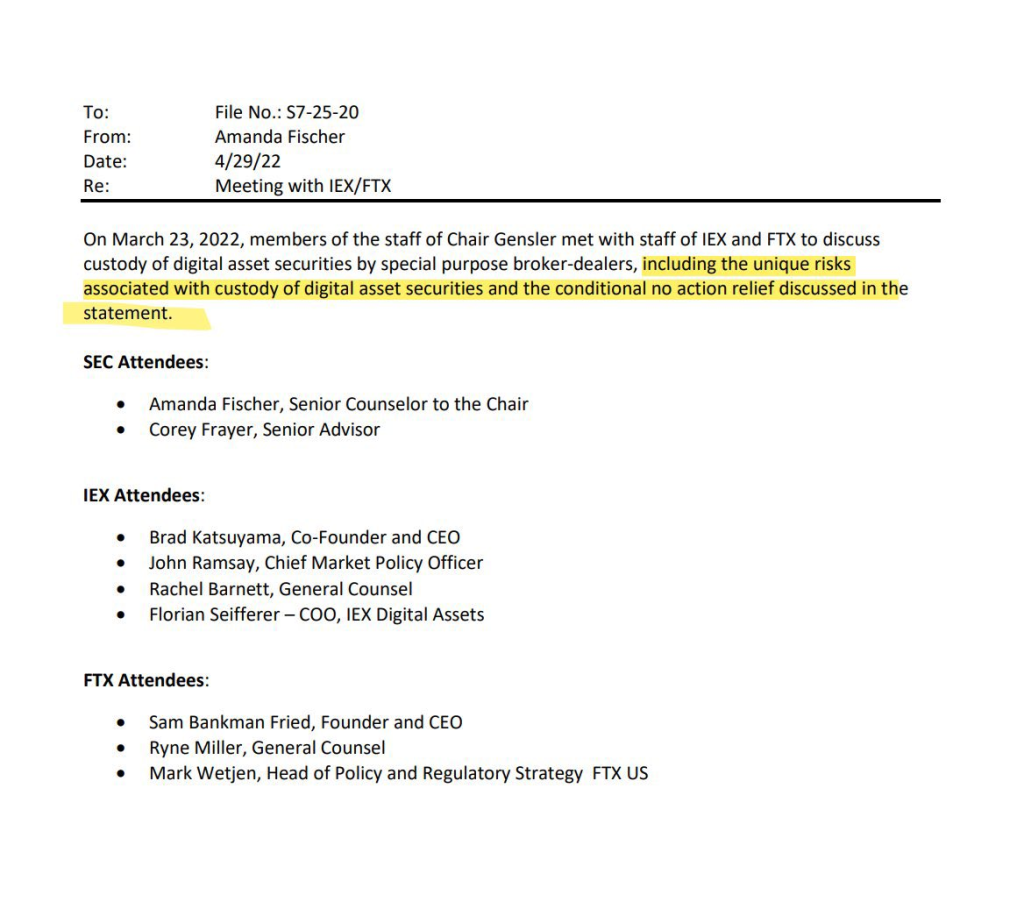

A memo confirming the SEC meeting with SBF and FTX to discuss “no-action relief” plans.

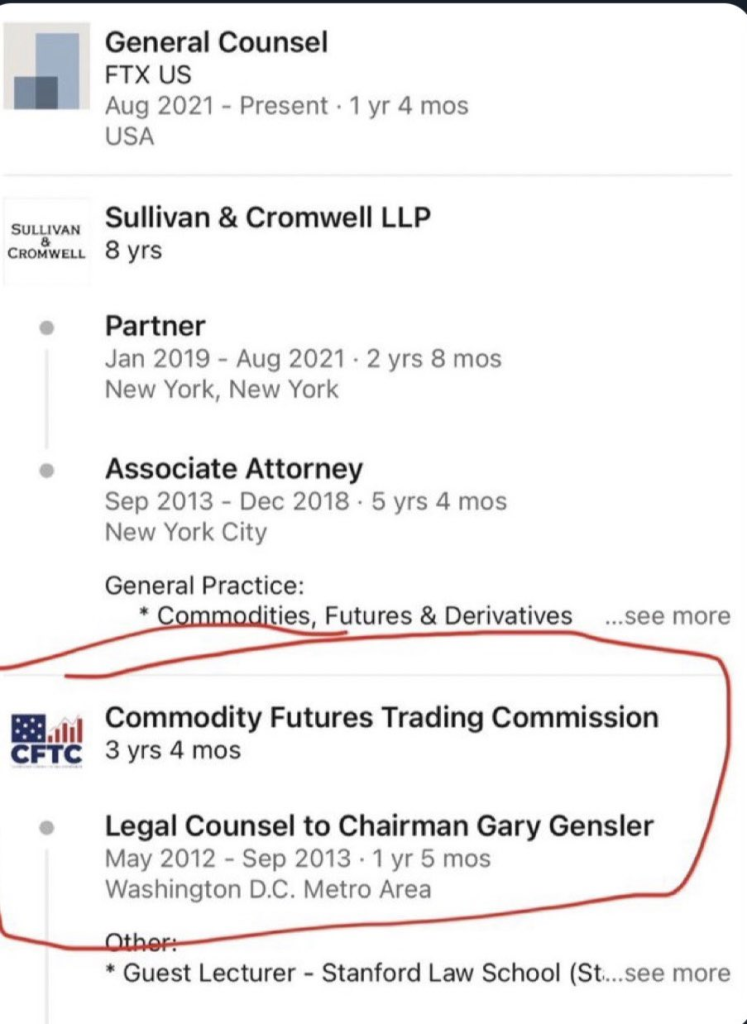

Also, the general counsel to FTX previously worked directly for Gary Gensler.

Bill Huizenga, the representative of Michigan’s 4th Congressional District, recently tweeted the request for documents surrounding the interactions between SBF, FTX and SEC. We’ll see how this plays out, but are we ready to open this can of worms?

Since @garygensler won't abide by his own polices to "come in and talk”, the House GOP will hold him accountable. Today, as promised, our oversight of the @SECGov begins with a request for documents surrounding their interactions with @SBF_FTX, @FTX_Official, and @TheJusticeDept pic.twitter.com/cQ9L66I0t5

— Rep. Bill Huizenga (@RepHuizenga) February 10, 2023

Closing thoughts

When they said crypto regulation would be significant in 2023, I did not think it came as a quadruple whammy. SEC taking down Kraken’s staking was not the only headline this week; we heard of DoJ investigating Silvergate, NYDFS investigating Paxos and Binance suspending dollar transfers.

Gray Gensler and the SEC could have put out clear guidance on crypto staking and could have given U.S. exchanges a month to update their terms. But instead, they use enforcement to cash grab $30M and shut down Kraken staking.

This will follow a string of other exchanges that will voluntarily shut down their staking services to avoid fines and investigations from the SEC. But if that is the case, where will all the liquidity flow to?

As mentioned above, one possibility will be LSDs, but how much of the staked Eth will flow to LSD providers? What if Coinbase, Binance and others get hit by the SEC too?

As we await further developments, imagine SBF ratting out Gary Gensler and instantly turning him from a villain into somewhat of a hero.

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chaindebrief