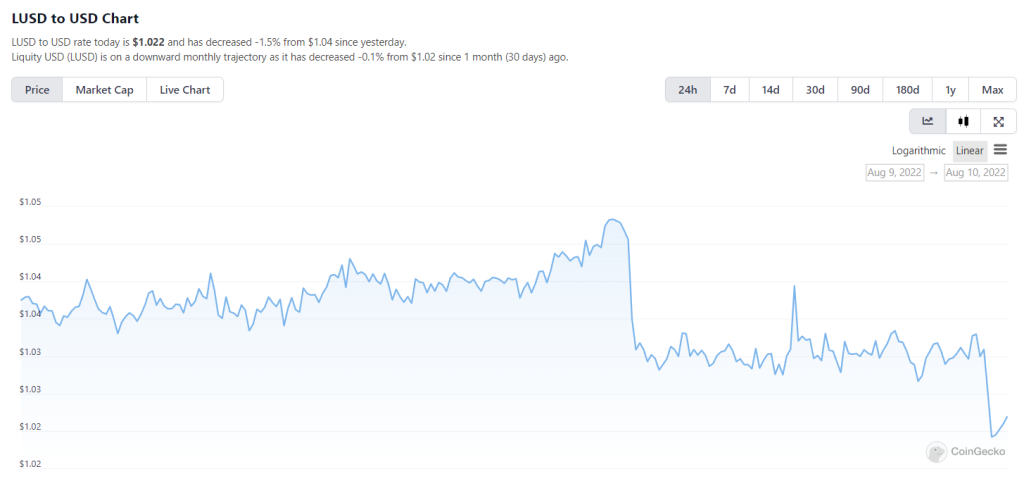

Liquity USD, or $LUSD, is an over-collateralized decentralized stablecoin pegged to USD. It recently rallied, de-pegging to the upside.

It has been trading above $1 for more than 3 months, and is currently at $1.02.

Also Read: Are All Stablecoins Doomed To Crash? Stablecoin Fundamentals You Have To Know

What is Liquity?

Similar to MakerDAO, Liquity is a decentralized borrowing protocol. The non-custodial, immutable and governance-free protocol allows users to draw 0% interest loans against their collateral. Users only have to maintain a minimum collateral ratio of 110%.

The protocol’s first line of defence is the Stability Pool, funded by users. When any position is liquidated, the Stability Pool would send LUSD to cover the position and in return, receive the collateral.

Users can also choose to liquidate positions that drop below the 110% ratio. The initiator would receive gas compensation to ensure that liquidation remains profitable even during a high gas environment.

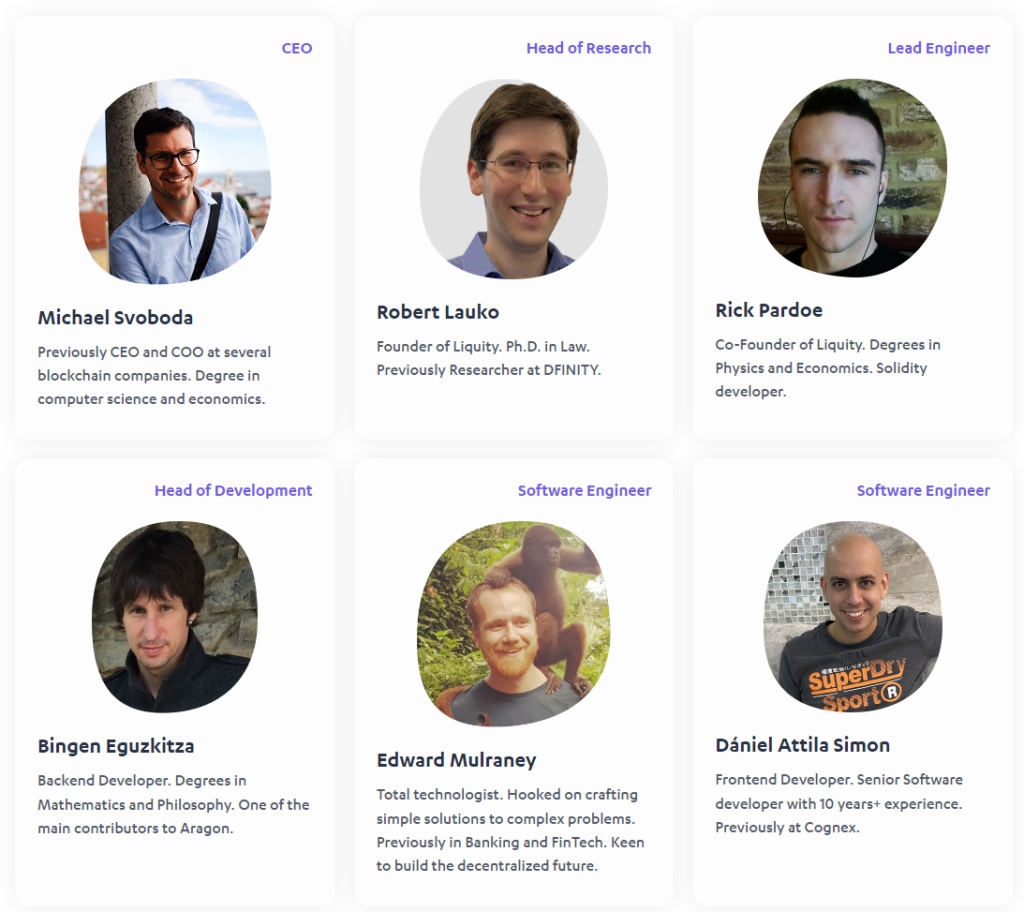

The Brains

Key Members Include:

- Robert Lauko (Founder, CEO) – Previously research @ DFINTY

- Michael Svoboda (COO) – previously CEO & COO of various blockchain companies, co-founder of atpar AG

- Rick Pardoe (Co-Founder, Lead Engineer) – Solidity Developer experienced on Ethereum, creator of DeciMath

Why Use Liquity?

Here are some of the key benefits of Liquity:

- Interest-free borrowing – Users do not have to worry about accruing interest

- Capital efficient – With a collateral ratio of 110%, it is more capital efficient than other similar protocols

- No governance – everything is fully automated and does not require governance to set the protocol parameters

- Fully decentralized – Even the frontend is hosted by different frontend operators.

- Fluid redemption – Users can redeem their collateral anytime at face value

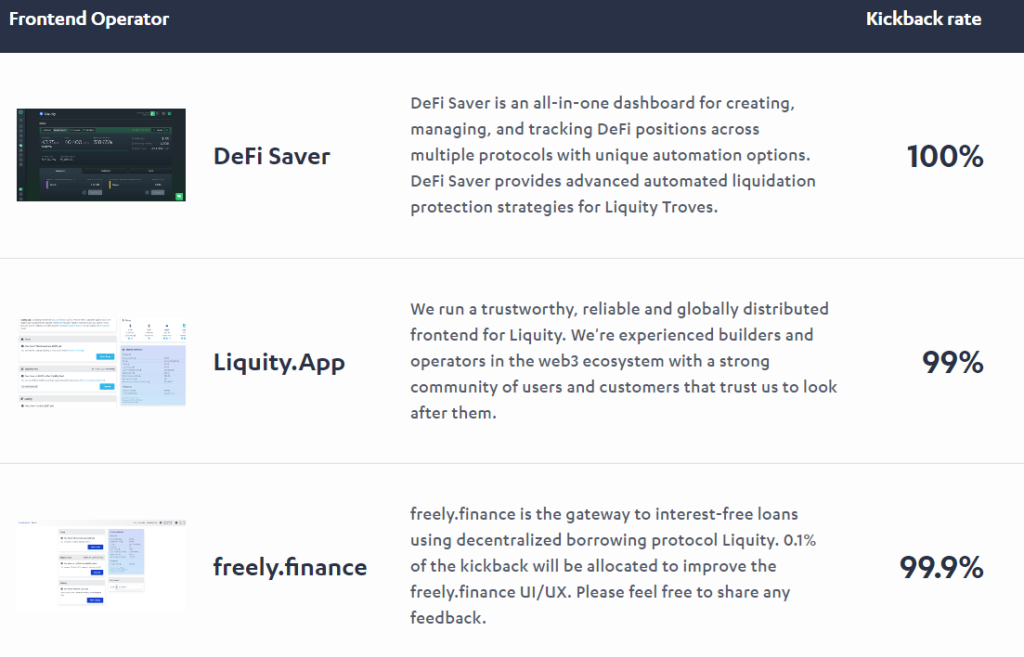

Their Unique Frontend

As Liquity does not run its own frontend, users can choose from a selection of 17 different frontends. The kickback rates range from 90% to 100%.

The rates only applies to stability pool rewards and is how Liquity incentivizes frontends to provide this service. If the kickback rate is 99%, users would receive 99% of the LQTY rewards and the frontend would receive 1%.

Liquity VS MakerDAO

Liquity is often compared to a top stablecoin protocol, MakerDAO. MakerDAO has been around since the dawn of decentralized finance (DeFi) and allows users to generate DAI, the first and leading decentralized stablecoin.

There differences?

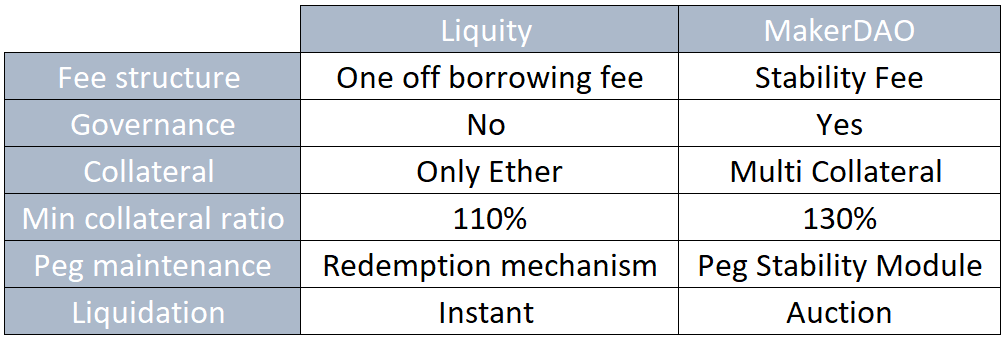

First is the fee structure. Unlike MakerDAO which continuously charges a stability fee on the loan, Liquity only charges a one-off borrowing fee. The difference in fee structure makes Liquity more cost-effective for long-term loans.

6) Lastly – our blog where you can read up on a ton of different material regarding the use-cases of $LUSD & @LiquityProtocol https://t.co/02Y1rcOGXr

— Liquity (@LiquityProtocol) August 9, 2022

Let's not forget about decentralization.

Next is the governance structure. Governance plays a big role in MakerDAO as the protocol parameters such as debt ceiling, minimum collateral ratio are all decided through votes. Liquity on the other hand, does not have any governance. All the parameters are either preset or governed by algorithms.

The collateral type and minimum collateral ratio also differ greatly. MakerDAO accepts a range of collateral with a minimum collateral ratio of 130%. Liquity only accepts Ether with a lower minimum collateral ratio of 110%.

Liquity only accepting Ether will reduce the risk that other collaterals pose. However, this also creates a single point of failure.

Closing Thoughts

With $DAI possibly pivoting to an $ETH backing and Terra’s collapse, the need for a fully decentralized, over-collateralized stablecoin has increased.

However, it is hard to say whether $LUSD will be the final evolution of stablecoins.

No matter what, the creative infrastructure that Web 3.0 brings is always exciting. With every step, we are getting closer to what may be the ultimate iteration for many products and protocols.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Read More: Is Anyone Really Winning The Layer 2 War? Here’s What The Stats Say