After looking into many crypto predictions in 2023, one narrative stood out. Real-World Assets (RWA). Yet, it continued to live within the shadows of many other narratives even when poised to bring users the biggest value.

The pursuit of dog coins and animal pictures has often diluted the true purpose of crypto; yes, I agree they bring adoption in a certain way, a community spirit, some may say, but when markets take a turn for the worst, what use do they all have?

Since 2020, the emergence of L1 tokens has gained significant attention. But it almost seems “just a capital rotation game, it creates no real inherent value.” This results from a pure and trustless DeFi ecosystem without a connection to the real external world.

The point of crypto is to improve society, which means providing products/services that people actually want in a superior format

— ChainLinkGod.eth (@ChainLinkGod) January 23, 2023

In regards to finance, this means RWAs (traditional commodities, currencies, and securities)

Without RWAs, what exactly do we aim to achieve here?

What is RWA?

It essentially refers to assets of value in the real world (real estate, traditional securities, commodities etc.) being tokenized and represented on a blockchain, allowing them to be traded and transferred in a digital form.

Tokenizing real-world assets unlocks cashflow unaffected by Crypto’s volatility, and many RWA protocols have caught many institutional investors’ attention.

I am excited about the promise of crypto unlocking global liquidity, and providing RWA for customers globally in ways that traditional fintech institutions are constrained. Focusing on “0-1” access to financial instruments, as opposed to incremental access, will do well.

— Chia Jeng Yang (@chiajy2000) January 25, 2023

RWA is here, but still undiscovered

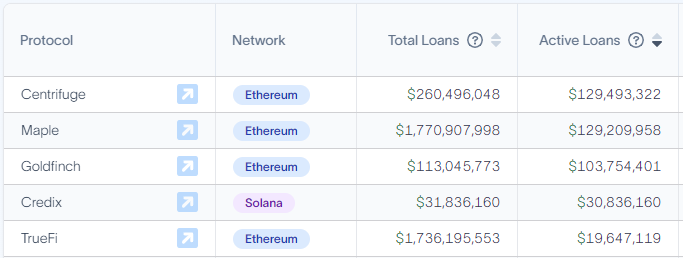

Based on the cumulative fees among the top 10 lending protocols over the past 180 days, four of which consist of RWA lending protocols (TrueFi, Maple Finance, Goldfinch, and Centrifuge).

The mechanics of the most prominent players in DeFi, such as AAVE and Compound, depends heavily on leverage. RWA, on the other hand, offer under-collateralized lending outside the circular crypto world.

Why undiscovered? RWA protocols are all below a $100M circulating market cap. To put things into perspective, the almighty Dogecoin has little to no value and a market cap of $11B.

We have to bridge a huge gap before we see its success, but that leaves plenty of leg space for RWA to grow. If RWA is already good, it’s only about to get better.

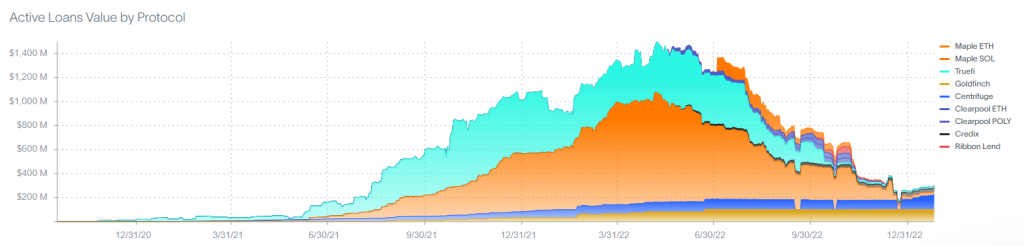

According to rwa.xyz, the value of the active loans recently surpassed $415M, with the cumulative value of all loans reaching $4.4B.

The race towards the RWA throne has been competed by five protocols, with Centrifuge leading the charge.

Greyson Alto on Twitter did a pretty decent analysis on RWA based on data provided by rwa.xyz. He looked into the trends of based interest rates of new loans to the percentage and amount of non-current loans that have defaulted.

Furthermore, he found out that six out of the seven protocols have a listed native token. Using the active loan amount as a relevant driving variable to price ultimately drives revenue.

Looking into the loan-to-market cap ratio also provides value by looking horizontally over time rather than trying to compare protocols vertically. “For example, Centrifuge and Goldfinch have very positive value trends, while TrueFi and Maple show troublesome trends over time.”

2023s top blockchain narrative, RWAs in the form of private credit, is rapidly growing in terms of sentiment, education, and value created

— Grayson Alto (@AltoGrayson) January 25, 2023

I continue to look further, this time going through data from @rwa_xyz on 1,400+ loans

Below are several insights🧵

lmk your thoughts/

With an average APR of 11.66%, here is a breakdown of active loans by sector. The top 3 sectors are Fintech, real estate and carbon projects.

Goldfinch’s carbon project yielding 27% APY

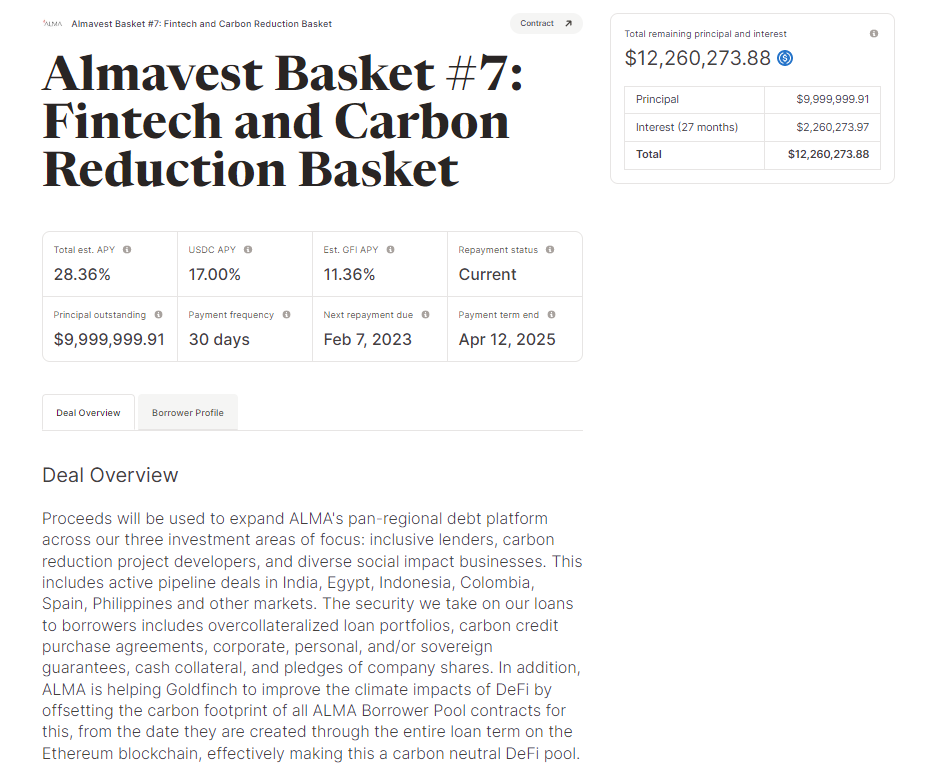

We talked about Goldfinch in our previous article. They are a decentralized lending protocol allowing crypto borrowing with off-chain collateral. It targets emerging markets and aims to bring the world’s credit activity on the chain.

One of the many baskets they have is managed by Alamvest, which focuses explicitly on Fintech and Carbon reduction. It is essentially a credit fund that deploys capital for sustainable development into high-growth, impact-oriented companies in emerging markets.

Another basket, managed by Cauris, is the Africa innovation pool, which currently provides a 28.53% APY with 17% USDC APY.

This may be a good alternative for generating yield through tokenizing real-world assets, but it has certain downsides and risks.

The risk

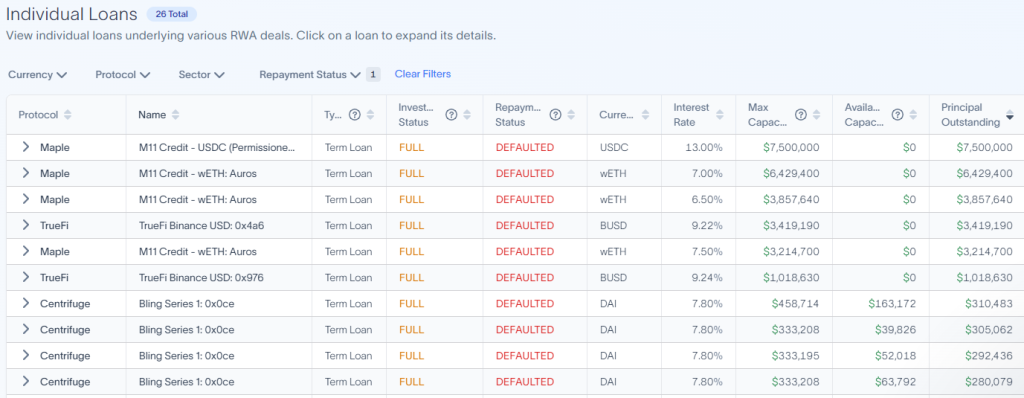

By looking at the total defaulted loans by protocol, Maple has the highest score of $68M. This was mainly due to the contagion spillover with the collapse of FTX, where creditors on Maple defaulted their loans.

Read more about how Maple Finance Found Itself In A Sticky Situation.

Defaulted loans – A default on debt happens when a borrower fails to repay the funds according to the initial agreement.

When a loan defaults, protocols in varying approaches would either stop supplying more capital to any of a Borrower’s pools or kickstart a liquidation mechanism.

In the case of Maple, their 2.0 upgrade is aimed at handling defaults more quickly by the loan managers, aka pool delegates, who would be the first ones to take the loss in the event of a default.

On the other hand, Goldfinch mitigates risk through a system of auditors who vote to approve borrowers and a mandatory “unique entity check” for all loan participants. This will come in the form of SBT, Soulbound tokens, basically a non-transferrable NFT.

TrueFi utilizes portfolio managers who independently manage their funds and make lending decisions, including setting loan terms with borrowers. To become a portfolio manager, any applicant would need to go through the approval of TrueFi governance.

Hopefully you've heard of #TrueFi, our upcoming uncollateralized DeFi lending platform, by now. 👀

— TrueFi (@TrueFiDAO) November 18, 2020

Here's a TL;DR on how it works 👇 pic.twitter.com/Olobz6d9na

RWA Case study: MakerDAO and a Huntingdon Valley Bank

As of August 2022, the Maker Protocol has amassed over $600 million of real-world asset collateral. One significant milestone is the Huntingdon Valley Bank (HVB) partnership. They pioneered the first commercial loan participation between a U.S. Regulated Financial Institution and a decentralized digital currency.

HVB, impressed by MakerDAO’s access to deep DeFi liquidity, proposed a partnership to fund 100M DAI. The partnership with Huntingdon Valley Bank (HVB) allows MakerDAO to put their idle DAI to work, real-world bridge assets, use RWA as underlying collateral when lending DAI and leverage HVB’s established regulation with the government.

The first collateral integration from a US-based bank in the DeFi ecosystem is getting closer.

— Maker (@MakerDAO) July 4, 2022

The Maker Governance votes to add RWA-009, a 100 million DAI debt ceiling participation facility proposed by the Huntingdon Valley Bank, as a new collateral type in the Maker Protocol pic.twitter.com/fOdusdjCFS

Here’s a TLDR on how the partnership works

-HVB sends loan requests to MakerDAO’s trust “Ankura.”

-Ankura approves or disapproves of them.

-When approved, HVB can access funds from the RWA Master Participation Trust.

-Interest generated from the loans is split 50/50 between the two entities.

According to Messari, despite accounting for a relatively small portion (12%) of MakerDAO’s balance sheet, RWA generates a significant amount (nearly 60%) of the protocol’s annual revenue.

Closing thoughts

The market faces fierce competition, and with crypto falling behind AI in mindshare, it becomes clear what crypto has to do. That is, creating clear value for consumers is clear, and it is by no means impossible.

RWA would be the likely answer. We saw DeFi had proliferated in recent years, with its TVL rising from 0 to a high of 60 billion. Still, including RWA in DeFi could improve liquidity and risk profiles in the market, bringing more reasons for people to get into DeFi.

As interest in crypto leverage decreases and interest rates in the real world increase, Real-World Assets (RWA) are becoming more prominent as a potential opportunity for DeFi users to incorporate into their portfolios and access different asset classes.

RWA protocols aim to provide capital to real-world businesses and expand the possibilities of DeFi, but this comes with its own set of challenges, namely regulation. Success in RWA will depend on obtaining legal licenses and addressing the lack of legal enforcement, which currently hinders the growth and tokenization of underlying collateral in the space.

Despite these challenges, the potential for RWA is clear.

Also Read: I Looked Into The Historical Cycles Of Crypto, Here’s What I Found

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief