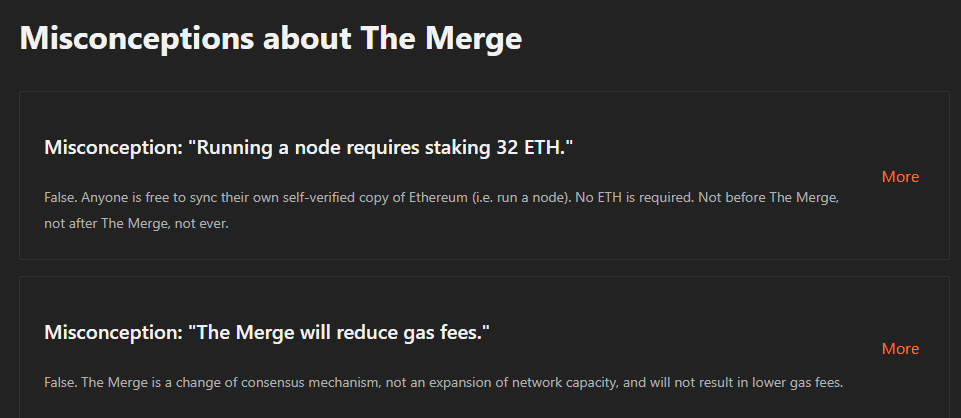

Did you know that the merge will not bring down gas fees or make transactions faster?

While news of Ethereum’s upgrade coming soon is exciting, it also brings about many rumors.

Despite the Ethereum Foundation trying to dispel them, these “facts” are still treated as gospel by many. However, one topic that does not get talked about enough is what will happen to Ethereum’s Proof-of-Work network.

Also Read: What Is Ethereum Classic? Why We Should Look At It Before The Merge

ETC 2.0?

Ethereum has a colorful history.

In 2016, one of the largest projects on Ethereum was exploited, and many on the network lost money.

This led to the fork that birthed the $ETH we know today, with Ethereum Classic ($ETC), left behind as the original network. The merge will lead to a similar situation, with the current $ETH known as ETH1 or ETHPow, while ETH2 or ETHPoS emerges on the other side.

- ETHPow – ETH Proof of Work

- ETHPoS – ETH Proof of Stake

People will realize this regardless of whether I say anything. I think there are better strategies to protect ETH2 and possibly to create benefit to ETH2 from ETH1’s existence.

— Galois Capital (@Galois_Capital) July 29, 2022

While it is expected that most users will move on to ETH2, there will still be assets left on the original network. To make sure this situation is not abused, the Ethereum Foundation created the “difficulty bomb”.

Essentially, the difficulty bomb makes transactions impossible to process on the Ethereum Network, and creates urgency for developers to complete the merge.

However, there is no guarantee that the network grinds to a halt or before the merge, or that transactions are impossible.

Everything Goes To Zero

overnight with the fork, a carbon copy (except consensus unchanged & difficulty bomb defused) of the FULL ethereum ecosystem appears.

— Marc "Aavechan.lens" Zeller 👻 💜 (@lemiscate) August 1, 2022

you have 10 ETH? you now also have 10 ETHPoW

you have a position on Aave? you now have the same position on AavePoW

If the merge occurs even a second before ETH is unusable, there will be billions in unbacked assets.

Currently, $58 Billion in TVL sits on the Ethereum Network, and even more $ETH across other chains. While we could all agree that this $ETH is now valueless, the reality is very different.

These are some aftershocks that could occur:

- Stablecoin supply doubles

- Bad debt on lending protocols (Aave/Maker)

- Bridged assets worthless

Furthermore, if tokens from the PoW network are listed on an exchange, or other networks fail to recognize the merge, they can be off-ramped.

For example:

- Network A does not block ETH1 trading

- User X bridges ETH1 to Network A

- User X swaps ETH1 to another token on Network A

- User X bridges back to ETH1, selling the token for more ETH1

- Repeat to drain entire Network A TVL

With merge coming, there are so many variables to consider to play it right. Assuming PoW ETH has value, how to maximize profit?

— Auri (@Auri_0x) July 31, 2022

thread 🧵

Twitter user @Auri_0x does a good run down on ways to exploit this in a thread.

While these are all theoretically possible, it is likely that MEV (Miner-Extracted Value) bots will front-run all normal users. Furthermore, as ETH1 is technically valueless, they can front-run individuals with 6 figure gas fees.

What’s Next For EthPoW?

Despite the merge, there has been increasing support for ETHPoW.

We currently have more than 1 million #ETH. If #Ethereum hard fork succeeds, we will donate some forked #ETHW to #ETHW community and developers to build #ethereum ecosystem. https://t.co/ee4kGSuVoK

— H.E. Justin Sun🌞🇬🇩 (@justinsuntron) August 4, 2022

Justin Sun’s Poloniex exchange recently came out as supporting the PoW ecosystem, and billions in mining revenue has to go somewhere.

While they may go to Ethereum Classic, it is more likely that they will attempt to validate the ETHPoW network.

Acknowledge that ETH1 can have value and try to work together to reach a minimally damaging situation. Supression didn't work for ETC, but you may think it can work here because forking state is difficult. Also EF and RHG have less dumping power than back then.

— Galois Capital (@Galois_Capital) August 2, 2022

At the time of writing, the Ethereum Foundation has not released a roadmap on how to combat this, or whether there will be a plan.

Furthermore, as the merge is such a novel event, some things are bound to have hitches. Given all this, it is likely that some problems will emerge along the way which eager MEVers will try to exploit.

Also Read: The Four Best Ways To Play The Ethereum Merge

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Cybavo