In a week, the SEC, IRS and NYDFS have decided to drop a nuke on crypto. Kraken has shut down its staking as a service with a $30M fine, summoned by the IRS for user data. Most recently, the NYDFS has recently ordered Paxos, the issuer of Binance USD ($BUSD), to stop issuing the US-denominated stablecoin.

The SEC’s claim? They see $BUSD as an “unregistered security“, even though that would mean investors expect a profit when investing in $BUSD. While we don’t know what aspects of BUSD might interest the SEC, all I know is that stablecoins are not considered securities.

Paxos issues a statement immediately and hints that they “will engage with the SEC staff on this issue and are prepared to vigorously litigate if necessary.”

How did Binance react to BUSD news?

The founder and CEO of Binance, CZ, tweeted his view on this matter “BUSD is ruled as a security by the courts; it will profoundly impact how the crypto industry will develop (or not develop) in the jurisdictions where it is ruled as such.”

#BUSD. A thread. 1/8

— CZ 🔶 Binance (@cz_binance) February 13, 2023

In summary, BUSD is issued and redeemed by Paxos. And funds are #SAFU!

But how did Binance react to the $BUSD news?

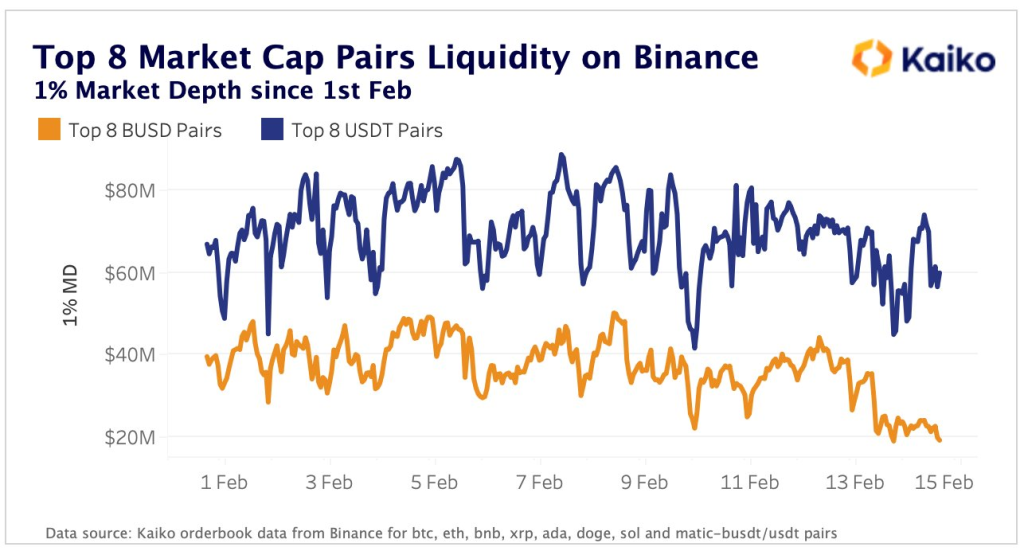

According to Kaiko, liquidity for the top 8 $BUSD pairs plummeted. $BUSD started the 2nd month of 2023 with $40M while Thether ($USDT) has $65M.

We also saw a particular fund withdraw a hefty amount of BUSD from Paxos to Binance before news on SEC plans to sue BUSD was out. It looks like someone has some whispers in their ears before the announcement. Timely or coincidence?

We noticed a fund/institution withdrew 350M $USDC from #Circle and transferred to #Binance in the past 24 hours.

— Lookonchain (@lookonchain) February 14, 2023

This fund/institution withdrew #BUSD from #Paxos to #Binance before the #SEC plans to sue #BUSD news.https://t.co/GsTLei8QuV pic.twitter.com/S0WfFM3CG4

The ramification of Paxos stopping issuing more $BUSD saw its stablecoin counterpart $USDT “grow by nearly $1 billion”, as Decrypt reports.

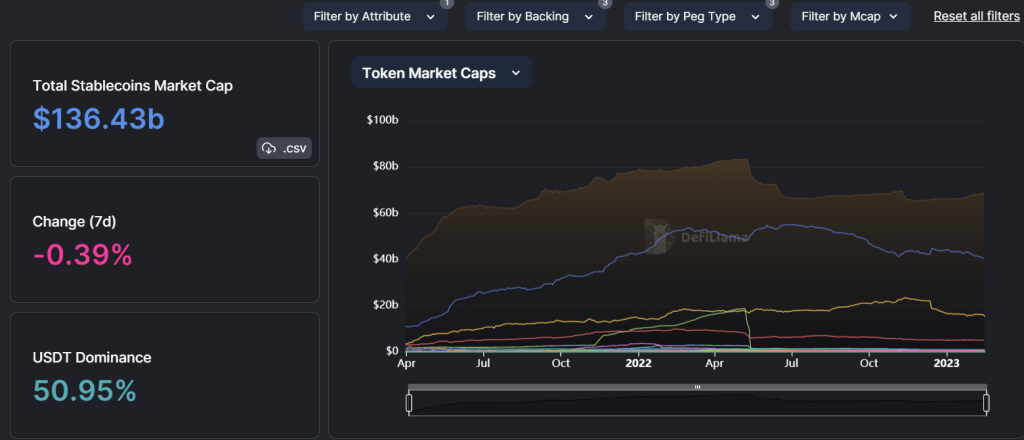

DeFiLlama shows us the 7-day change in stablecoin flows, with only outflows seen in $USDC and $BUSD among the top 3.

Nansen, a crypto analytics platform, also reports the latest (and final) time “Paxos issued BUSD was ten days ago on Feb 4, for $209.3M BUSD.”

Over $400 million $BUSD was burned in less than 20hrs as the New York Department of Financial Services ordered Paxos to stop issuing BUSD

— Nansen 🧭 (@nansen_ai) February 14, 2023

According to WSJ, "BUSD will continue to be redeemable through at least February 2024 for U.S. dollars or Paxos' own stablecoin, Pax Dollar." pic.twitter.com/cpU7jiEG5M

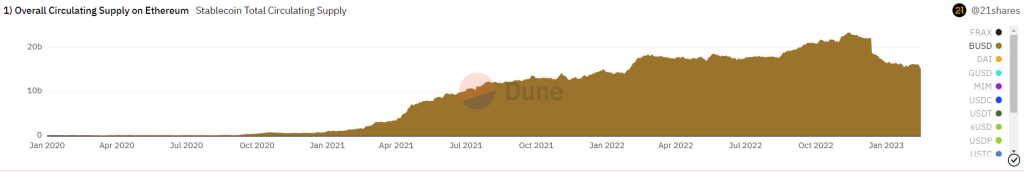

Since then, 842M $BUSD was burnt by the Paxos treasury, and the total has dropped to $15.3B.

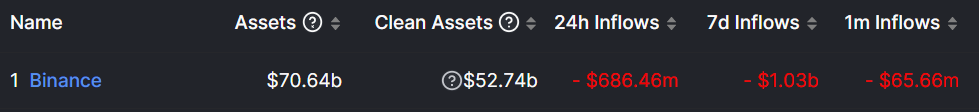

With 90% of $BUSD being held on Binance, we saw massive outflows amounting to over $1B.

Furthermore, we saw Amber group withdrawing $20.75M $USDC from Binance and deposited $14M of it to Coinbase.

On Curve’s 3Pool, which combines this deep liquidity for swapping USDT, USDC, and DAI, saw $USDC liquidity increase. In contrast, USDT liquidity decreases, showing investors looking at USDT as a “safer” alternative for storing their holdings.

Could the recent pumps in the market be a reflection of this event? A mega swap could have been the answer.

Potentially what may have happened this entire run up in BTC is a gigantic swap to ensure reserve status ;

— Skew Δ (@52kskew) February 14, 2023

BUSD pumped BTC to swap from BUSD to BTC (BTCBUSD)

BTC sold off into that same pump for USDT (BTCUSDT)

End results are two wallets:

Wallet A : BTC

Wallet B: USDT

(0 BUSD) pic.twitter.com/FgunuKQy3T

What are stablecoins anyway?

The main purposes of stablecoins are to facilitate payments, act as a store of value and a bridge from traditional finance to crypto and ultimately offer stability in the volatile nature of crypto.

For BUSD, it is categorized as a US Dollar backed stablecoin, which means for each stablecoin out there in the market, there is a 1:1 equivalent for every stablecoin created, which is held in cash.

Finally the rise of decentralized stablecoins?

With the FUD surrounding stablecoins, could decentralized stablecoins make a massive comeback in 2023?

With the global crypto market cap at $1.03T, about 13.24% constitute stablecoins. This means the top 3 stablecoins constitute ~90% of the stablecoin market cap.

While there is legroom for decentralized stablecoins to grow, we look into decentralized stablecoins poised to challenge market share.

1. $DAI by $MakerDAO

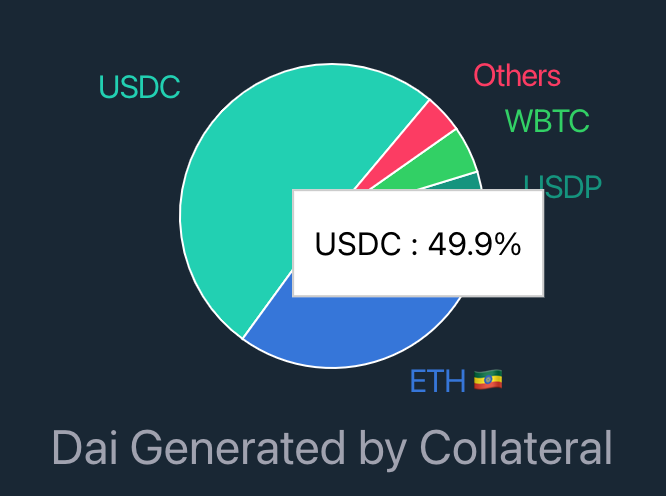

After the fall of $UST, $DAI has been the biggest decentralized stablecoin. It can be minted against most blue-chip assets, including BTC and ETH. But, one concern for $DAI is its backing, where we hear of a familiar stablecoin, $USDC, occupying most of the backing.

This means $DAI is one leg deep in the promise of $USDC not failing, and if the latter happens, $DAI will not be spared.

Another thought of notice should be on MakerDAO itself and its investments in real-world assets. They currently generate 50% of their revenue from RWA, which is something to note.

While the world was watching a centralized crypto institution burn in Q4'22, and claimed it was the end of crypto, a decentralized organization (@MakerDAO) made huge strides towards merging the decentralized digital economy and the traditional economy/markets. pic.twitter.com/DoIPamEAKK

— Johnny_TVL (@john_tv_locke) February 13, 2023

2. $FRAX by Frax

As the name suggests, $FRAX is the first fractional decentralized stablecoin. Its mechanism allows it to, on the one hand, partially stabilize algorithmically and the other half, backed by $USDC.

By utilizing Algorithmic Market Operations (AMO) to maintain $FRAX peg stability and generate revenue, FRAX grew in popularity amongst $DAI in being more regulatory resistant.

🧵[$FRAX >>> $DAI]🧵

— DeFi Cheetah🐆 ¤🫐🦇🔊🌿 (@DeFi_Cheetah) February 14, 2023

Why are stablecoins of @fraxfinance & @CurveFinance regulatory-resistant than @MakerDAO? In fact, @MakerDAO is at a much higher risk!!

Short answer: Algorithmic Market Operations (AMO) + token fungibility + principle of protection of property rights

👇👇👇

Additionally, the growing narrative for LSD and Real Yield all accrues towards FRAX. They even created $FPI, which is said to be CPI-pegged and aims to be inflation resistant.

<$FPI: Crypto-native bond?>@fraxfinance launched CPI-adjusted stablecoin, $FPI, last week. $FXS has been successful through well-pegged stablecoin $FRAX. Now they are trying a new frontier, inflation-hedged stablecoin.

— alphanonce Intern (@alphanonceStaff) April 12, 2022

Thread on $FPI and $FPIS

1/11 pic.twitter.com/LnSCAI9Uap

3. $LUSD by Liquity

I have not dabbled in $LUSD before, but from what I hear, they are dubbed the most resilient decentralized stablecoin.

With their immutable codes penned down in smart contracts, they are accessible through many decentralized frontends. Additionally, $LUSD can only be minted against $ETH.

Having your stablecoin portfolio all in USDC / USDT / DAI is extremely risky.

— korpi (@korpi87) July 28, 2022

It's not fud. It's a responsible risk management.

I've been looking for a stablecoin with the lowest risk and, I think, I've found it.

A thread why you should diversify your stables with $LUSD.

🧵👇 pic.twitter.com/FfUxeA681d

Their liquidation mechanism is handled through the stability pool, allowing users to deposit $LUSD to buy $ETH at a discount.

Closing thoughts

Honourable mentions go out to AAVE ($GHO) and Curve (crvUSD) with plans for new decentralized stablecoins yet to be released. As projects continue to build in 2023, the time for decentralized stablecoins to take over is never better, especially with regulatory factors posting a thread to stablecoins such as $USDT, $USDC and $BUSD.

1/ The DeFi stablecoins took a hit when UST collapsed, but DAI, FRAX, and LUSD held strong.

— Ignas | DeFi Research (@DefiIgnas) February 14, 2023

Now, GHO & crvUSD are preparing to join the space, bringing new innovations.

With regulators cracking down on BUSD – here's the bullish case for #DeFi stablecoins: 🐂

A wise man once said, “Innovation drives crypto forward, but sustainability makes it stay.”

When it feels like centralization comes with certain levels of risk, anything decentralized seems like the “best way to go.” The promise of decentralized stablecoin still has huge potential web3, but for that to come to fruition, careful steps must be taken to ensure its readiness for mass adoption.

Also Read: “I Looked Into The Tokenomics Of Curve, And I Deeply Regretted It“

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chaindebrief