Key Takeaways:

- MAS’ “Project Orchid” complete Phase 1 today, meant to explore the benefits of a Singaporean CBDC

- Financial and Government institutions such as DBS, Grab, and Temasek participated in the project

- While it is unlikely that CBDC will be rolled out this year, the proof-of-concept was highlighted the various advantages of blockchain technology

___________________________________________

Earlier today (31 Oct), the Monetary Authority of Singapore (MAS) released a report detailing the uses of a digital Singapore dollar.

This marked the successful completion of Phase 1 of Project Orchid, a multi-year, multi-phase exploratory project. It aims to examine the “various design and technical aspects pertinent to a retail CBC system from Singapore”.

But will the Singaporean government actually move forward with the launch of a Central Bank Digital Currency (CBDC)?

Also Read: 3 New Proposals You Need To Know As A Crypto Investor In Singapore

Understanding Project Orchid

Launched in 2021 by the MAS, Project Orchid sought to assess the need for a retail CBDC and to understand the costs and benefits for such digital currencies.

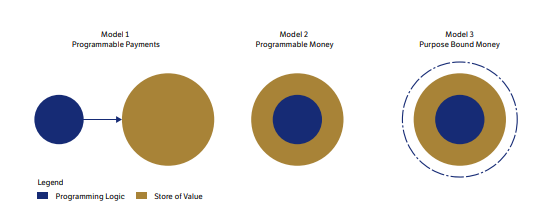

Taking a user-driven approach, it’s first phase explored “Purpose Bound Money”, or PBM, which are essentially the Singapore Dollar version of stablecoins.

The first phase comprised of four trials, namely:

- Government-issued PBMs to be used at F&B outlets

- Commercial PBMs as digital vouchers issued to participants at Singapore Fintech Festival 2022

- Government Pay-outs by OCBC and the CPF Board to a select group of recipients

- Learning Accounts testing the use of PBM to faciliate the current SkillsFuture credit disbursement process

The MAS stated the PBMs enable the “widespread distribution of programmable money in the commercial world” and could bring about many benefits.

Benefits highlighted in the report also included better user experience, visibility, and automatic validation via smart contracts.

Will The MAS Roll Out CBDCs Soon?

The latest report on project Orchid noted that there was not an urgent need for a retail CBDC in Singapore yet. However, the government will still actively explore use cases for such token.

“The introduction of e-money provided the ability to store value electronically and carry it with us. Digital currencies go beyond that, allowing money to be programed and used for specific purposes only.”

Mr Sopnendu Mohanty, Chief FinTech Officer, MAS

While it is unlikely that Singapore will roll out their PBMs this year, the proof-of-concept realized by Project Orchid is a welcome sign.

This is in contrast to recent regulations rolled out by the MAs, that looked to tighten the reigns on local crypto investors.

The proposals included a mandatory risk assessment test prior to using leverage, and the possible barring of incentives that could include airdrops and yield farming opportunities.

Also read: MAS May Ban Trading For Retail – Here’s 4 Other Ways To Profit in Crypto

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief