With the collapse of FTX, crypto participants have been looking for a place to trade both SPOT and futures. While both on-chain and centralized alternatives have left users wanting for more, one platform has managed to combine the best of both worlds.

Incubated the Kronos Research, WOO Network has become a favorite for many traders, thanks to their leading in-class liquidity and low cost trading execution. But what are they exactly, and how is the protocol doing?

Let’s dive in.

Also Read: WOO Network: An Introduction To The Next Generation Trading and Liquidity Providing Protocol

Welcome To WOO

WOO Network was incubated by Kronos Research, a Taipei-based trading firm that utilizes High-Frequency Trading in the cryptocurrency markets. They have an overarching goal to provide infrastructure for global trading, investing, liquidity provision, and to create a positive change.

They provide three main services, namely:

- WOO X – a zero-fee trading platform with deep liquidity

- WOOTRADE – A B2B tool for institutions to increase liquidity in their order books

- WOOFi – A Decentralized Exchange for swaps and yield farming

Here, we will be covering WOO X and WOOFI. If you want to read more about WOOTRADE, check out this LINK.

Trading With WOO X

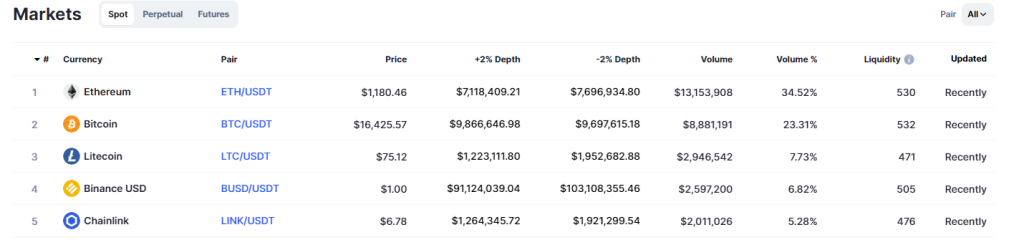

WOOX is the flagship CeFi product built on WOO Network, marketed as having “the best-in-class liquidity and execution”.

To ensure low slippage, WOO X not only sources organic liquidity through its order flow, but also from an internal liquidity pool, a combination of global liquidity aggregated from exchanges, top market makers, and trading institutions partnered in WOO Network.

The site also has a fully customizable interface, where traders can take up to 5x leverage for SPOT, and up to 20x leverage for futures.

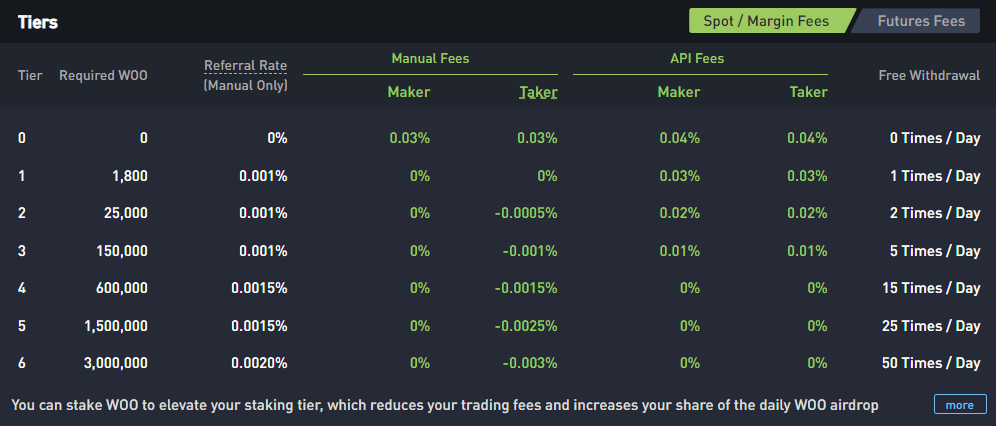

As for trading fees, WOO offers close to zero fees for both futures and SPOT trading. To truly get no fees however, users need to stake a minimum of 1,800 $WOO on the platform, or approximately USD $200 at the time of writing.

Entering DeFi With WOOFi

Acknowledging the growth of DeFi in Web3.0, WOO Network offers something that many trading platforms do not – a direct entry point to DeFi.

Instead of rehypothecating your funds like many CeFi platforms, they offer a direct gateway into the world of DeFi.

Currently, they support five chains, namely:

- Avalanche

- BNB

- Fantom

- Polygon

- Arbitrum

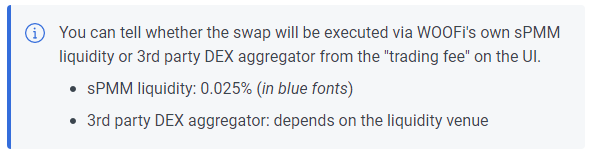

When entering a trade on WOOFI, it first attempts to route the trade through its Synthetic Proactive Market Making algorithm (sPMM). The sPMM helps to simulate a CEX order book in a DEX liquidity pool.

However, should the sPMM not be able to fill your order at the best price, it will route your trade to a 3rd party DEX aggregator.

This means that you are likely to get the best fill on WOOFi for your trade, regardless of whether the protocol processes it or not.

Furthermore, trades on WOOFi undergo price discovery through on-chain price feeds and the sPMM instead of directly through the liquidity pool. This means that users should theoretically be protected against “sandwich attacks”, or front-running by bots.

WOOFI also allows cross-chain swaps. This acts as both an exchange and a bridge.

For example, a user can send $USDC from their Fantom wallet and receive $AVAX on their Avalanche wallet, all in one transaction.

WOO Metrics & Health

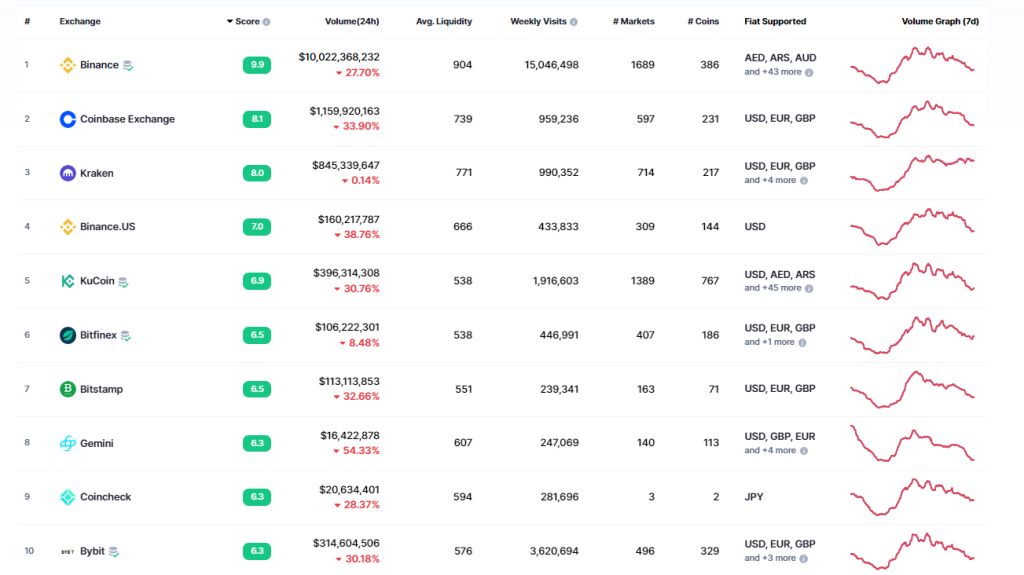

While a great interface, deep liquidity, and low fees are great traits to have on an exchange, we need to dig deeper into the metrics.

Namely, how many users are using WOO, and are they really profitable?

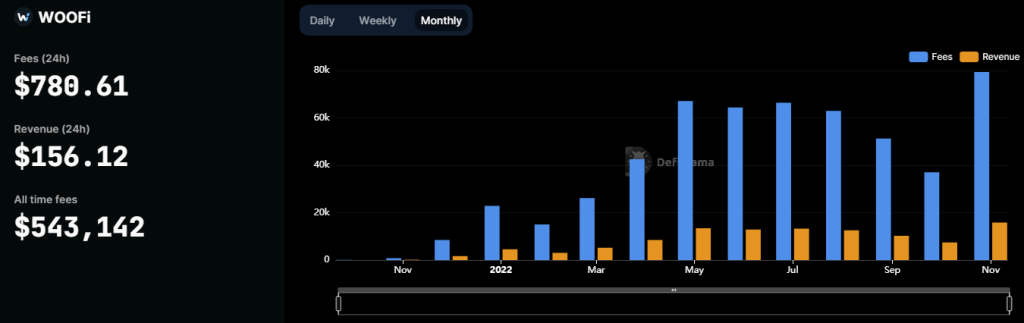

Thanks to DefiLlama, we can see that volume on WOOFi has been picking up, especially since they expanded outside of the Binance Smart Chain.

While they faced a dip in Q3 2022, a sharp spike in Polygon users has led to a resurgence this month. This translated to almost a 100% increase in volume on the platform, with users from almost every chain doubling.

3/ Meet efficiency – on steroids

— WOO Network (@WOOnetwork) November 8, 2022

If you thought the #1 Dex for capital efficiency couldn’t get more efficient – think again.

It’s about time you met sPMM V2 – the next evolution of WOOFi which debuts on @arbitrum today with 4 kick-ass upgrades.

The addition of the Aribtrum Network has come alongside the integration of sPMM V2, which comes with a few benefits, namely:

- Cheaper Gas Fees

- Optimized Smart Contracts

- Support For a Wider Range of Coins

- MEV Resistant Cross-Chain Swaps

$WOO Tokenomics

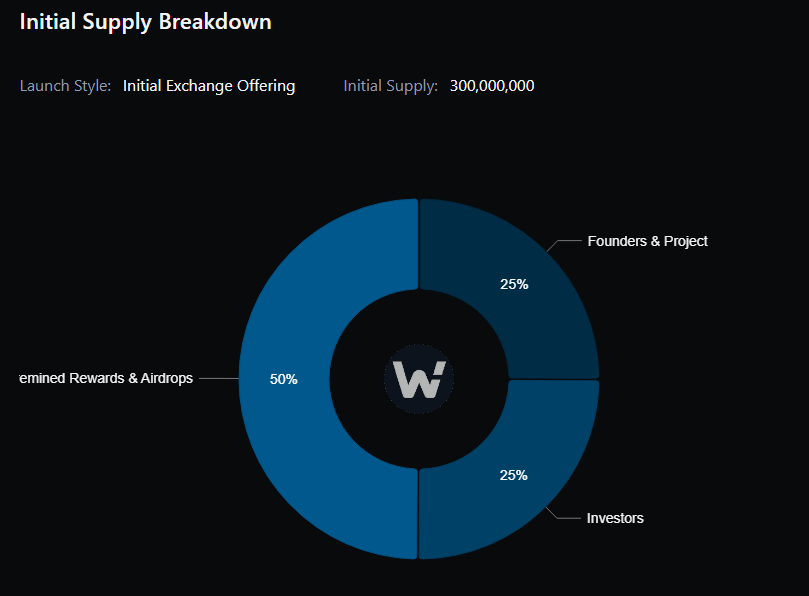

The $WOO token, while originally released on the Ethereum Network as an ERC-20 token, can be staked across all supported Networks.

While only 50% were dedicated for ecosystem purposes, Woo’s buyback mechanism means that the token is set to be deflationary, to the benefit of all holders.

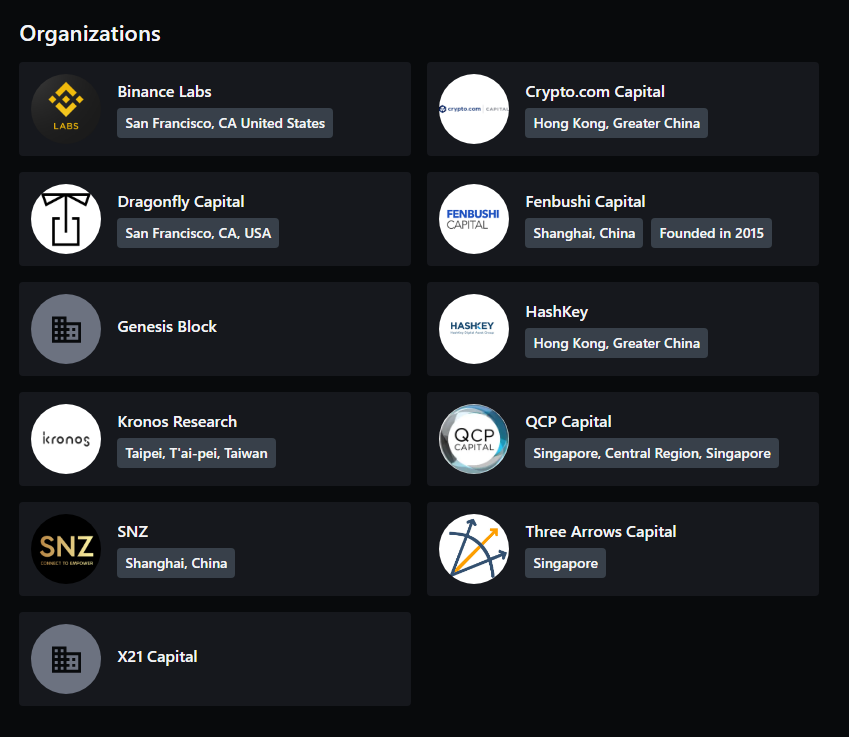

On the investors side, the tokens were allocated to several backers, including Binance Labs, Crypto.com, and Dragonfly Capital.

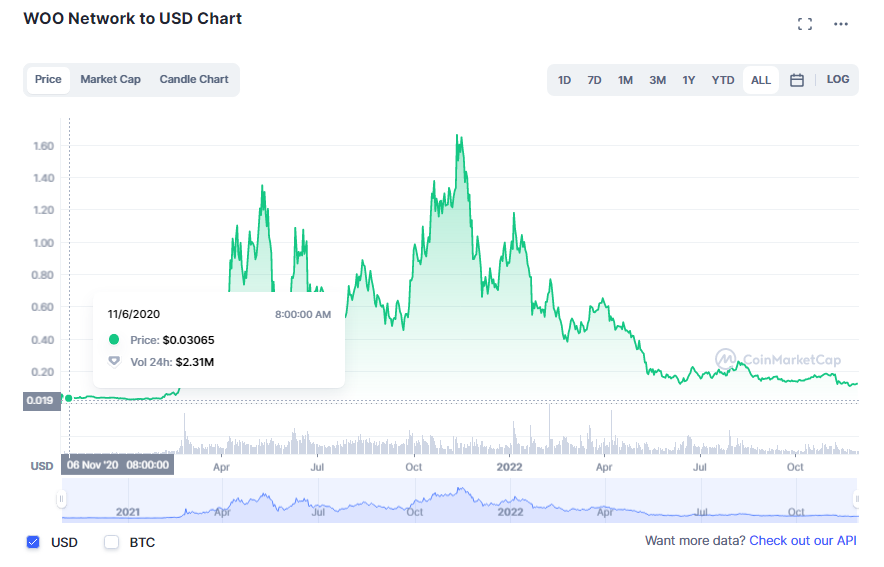

While it is unclear what the distribution of $WOO were amongst them, the protocol previously stated that 10% of tokens were sold to backers, translating to approximately 30,000,000 tokens. They also stated that they received $10 million in initial investments, at an approximate price of $0.30 per $WOO.

This corresponds roughly to the initial launch price of the $WOO token, and finished vesting in October of 2022.

For the 25% team allocation, this can be broken down into 20% for the core team, and 5% for advisors, vested over 3.5 years.

As for the ecosystem allocation, that can be broken down into:

- 20% ecosystem rewards (network usage)

- 10% insurance fund to back user assets

- 10% ecosystem partners

- 5% WOO Ventures

Additionally, 50% of all Network fees on WOO are used for a monthly buy-back and burn of $WOO tokens.

Meanwhile over at WOOFi…

— WOO Network (@WOOnetwork) November 10, 2022

88,234 $WOO has been bought back in the last 24 hours alone.

APRs for $WOO staked on @arbitrum and @0xPolygon are also both above 20% 👀 pic.twitter.com/dtGgoLCCWz

Thanks to these buybacks, and the APRs for staked $WOO, circulating supply of the token has fallen below 40%, a substantial amount, especially given the bear market.

WOO-ing The Ecosystem With Partnerships

One of the WOO’s key strengths is their ability to build partnerships with others, taking advantage of “Defi Money Legos“.

One of their core partnerships has been NEAR, working together to build Orderly, a decentralized exchange protocol built on NEAR. By tapping into WOO Network’s depth of experience, they offer a CeFi level trading experience on-chain.

Is co-op mode the future of crypto trading? 🕹️

— WOO Network (@WOOnetwork) November 24, 2022

Level 🆙 your knowledge of social trading with our latest article that uncovers valuable insights from both $WOO team members and our friends at @STFX_IO 🪐

➡️ https://t.co/Tuaso2GFNS pic.twitter.com/DHPPrILyDM

WOO Network also recently worked with STFX, a social trading platform that allows users to invest in others’ “vaults”, to talk about the pros and cons of social trading.

Could we see the introduction of vaults or social trading on WOO Network? Only time (and a medium post maybe) will tell.

Closing Thoughts

With the fall of FTX, one message has been made clear – it is important to have your funds spread out. While WOO’s trading platform WOO Trade is centralized, their commitment to transparency so far has spurred a trusting community, and rightfully so.

Furthermore, their mission to work with other projects and promote DeFi on their platform speaks towards the Ethos of a decentralized Web, and self-custody.

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief