With the rise of rebasing DAOs and projects like Curve coming to the forefront recently, the rush for liquidity has been thrown into the spotlight. As platforms aim to bring more users in, liquidity is spread thinner and thinner — and those who have more can continue to win without innovating.

The WOO Network, developed by Kronos Research, is aiming to solve just that by connecting smart liquidity across platforms, protocols and even exchanges at little to no cost. This helps build up their order books and facilitate trade with less slippage.

Welcome to WOO

The WOO Network is the brainchild of Kronos Research, a Taipei-based trading firm that utilizes High-Frequency Trading in Cryptocurrency markets.

The firm is currently aiming to provide infrastructure for global trading and investing and providing liquidity to create positive change.

The Network itself currently has three different Applications,

- WOOX – a trading platform with deep liquidity

- WOOTRADE – A tool for institutions to increase liquidity in their order books

- WOOFi – A Decentralized Exchange for swaps and yield farming

WOOX

WOOX is the native KYC-enabled trading platform of WOO, supporting trading on at least 85 different coins to a maximum of 5x leverage. The exchange’s deep liquidity, low fees, free withdrawals and smooth user interface offers a competitive edge compared to other major exchanges.

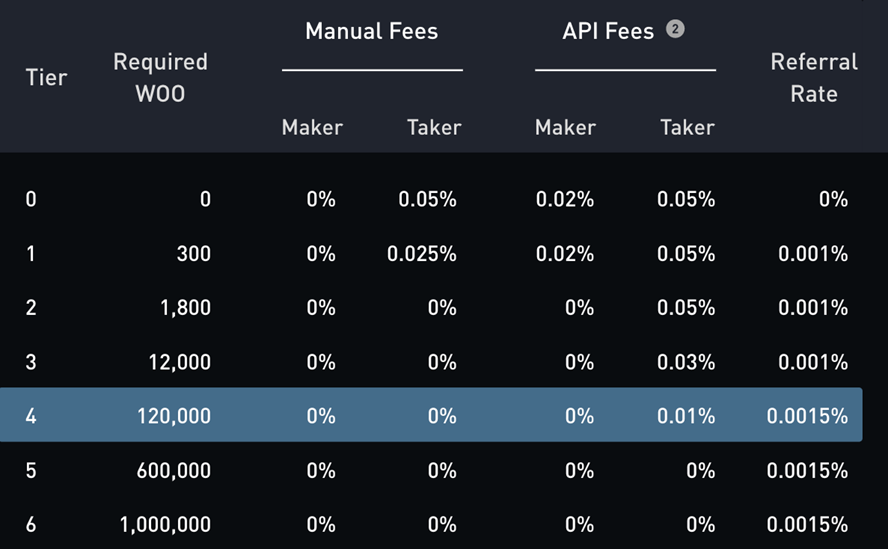

For retail traders, staking 1800 $WOO (roughly $1000 at the time of writing) also means absolutely zero maker or taker fees.

WOOTRADE

WOOTRADE is the network’s Liquidity-as-a-Service application for institutions. With 70% of centralized trading volume occurring on the top 3 exchanges, users of smaller exchanges are eventually siphoned away when their orders are not met. WOOTRADE helps to facilitate buy and sell orders to democratize liquidity.

Currently, WOO has partnered with top exchanges such as Binance, Kucoin and almost 40 other platforms to provide liquidity. These platforms will either have to pay a fee or stake the $WOO token for this service and access to the API required.

WOOFi

WOOFi is the network’s answer to decentralized exchanges and will eventually offer multi-chain swaps and DeFi yield optimizers. Though many decentralized exchanges only use Chainlink as a price oracle, WOOFi actually adds a custom on-chain market data fee. Combined with a Synthetic Proactive Market Making (sPMM) algorithm, it help to source the best prices for users.

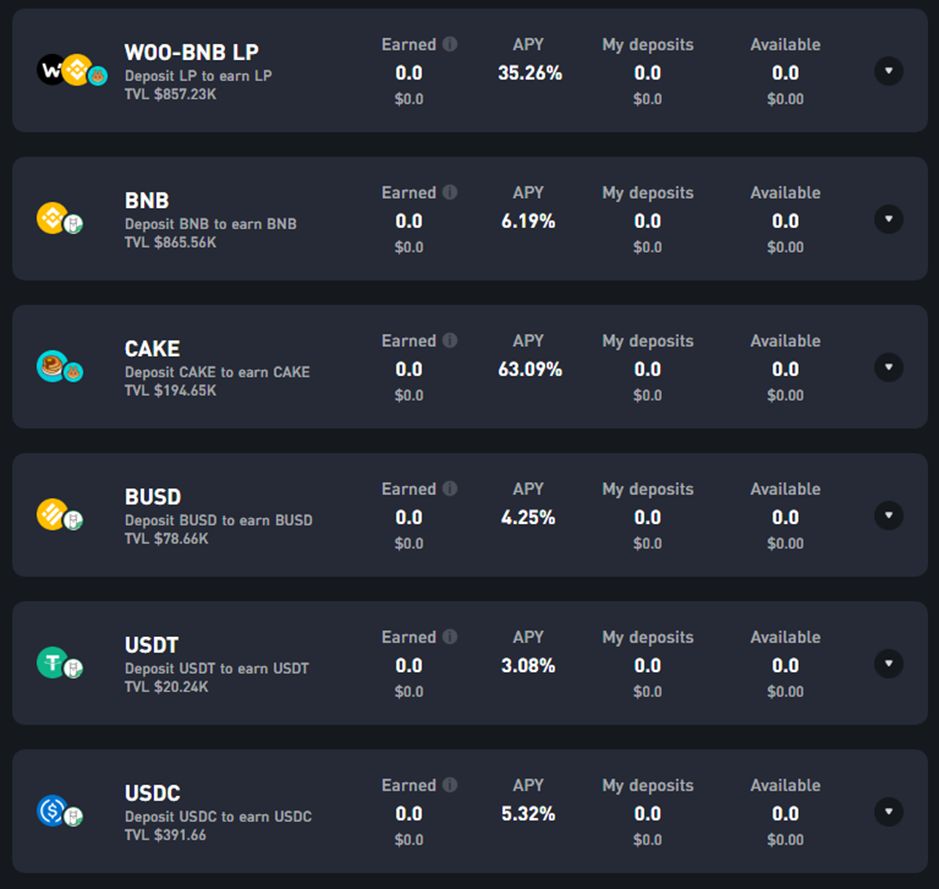

Currently, the application operates only on the Binance Smart Chain, with a TVL of US$2 million on its DeFi side. US$24 million in $WOO is also being staked on the application.

The Network also offer single-sided staking assets, with more than 5% APY auto-compounding on stablecoins. Once they eventually bridge out to other networks, TVL will be sure to grow exponentially.

$WOO Token

$WOO is the utility token of the network, which can be:

- Used to participate in governance

- Staked to reduce trading fees and gain access to their API

- Qualify for airdrops

- Collateral for borrowing

$WOO will also eventually allow stakers to gain access to social trading — where they can emulate trading strategies or top performers and institutions can get discounts on fees.

Bought. Burned 🔥

— WOO Network (@WOOnetwork) February 10, 2022

The January monthly burn has been completed, forever removing 669,814 $WOO from the total supply. Transaction below 👇https://t.co/eOzt0ghJ7A pic.twitter.com/vDJOhSDAyR

50% of WOOTRADE revenue is also used to buyback and burn $WOO from the open market, rewarding holders as the platform grows and about 10 million $WOO has been burnt since January of last year. However, its price has not been reflecting this, likely due to the vesting rate from early investors.

Conclusion

While the WOO Network and token have not yet seen exponential growth, their applications are still young and starting to snowball.

With their recent partnership with Binance and liquidity becoming harder to come by, WOO is positioned well to solve these problems – and make a hefty profit while doing so.

Featured Image Credit: Tech Story

Also Read: All You Need To Know About Hundred Finance: The DApp For Lending And Borrowing Crypto