One of the biggest opportunity provided by the rise of decentralized finance (DeFi) is yield farming.

In short, yield farming refers to committing your cryptocurrency into a central pool in exchange for a yield. The pool is commonly known as a liquidity pool. The amount of cryptocurrency you put into the pool earns you liquidity pool tokens, which represents your percentage holding of the whole pool.

The pool then becomes a “marketplace” where users can exchange, borrow or trade cryptocurrency. Each transaction in the pool earns a transaction fee, which is returned to the liquidity pool, and this is where you get your yield or interest from.

The interest and yield is distributed to liquidity providers based on their ownership of the pool, which is determined via the liquidity pool token.

Yield farming is very attractive to cryptocurrency owners because it provides a way for them to earn passive income on their idle cryptocurrencies. For relatively new currencies with limited liquidity, the percentage yield can be as high as 4 to 5 figures annually.

List of yield farms on Fantom

Fantom is a decentralized network built on an aBFT consensus mechanism. Fantom transactions are confirmed in one second, and they cost a fraction of a cent.

It is one of many blockchain networks built to provide an alternative to Ethereum.

Here’s a list of yield farms on the FTM Network where you can supply your FTM Token into in order to generate returns on your digital asset:

| Pool Provider | Reward Tokens | Website |

| Popsicle | ICE | https://popsicle.finance |

| Spooky | boo | https://spookyswap.finance |

| Spirit | SPIRIT | https://app.spiritswap.finance |

| Borg | SON | https://ftm.borgswap.exchange |

| Hyperjump | ORI | https://hyperjump.fi |

| Ester | EST | https://ester.finance |

| Froyo | FROYO | https://frozenyogurt.finance |

| Ghost | GHOST | https://www.theghost.finance |

| Beefy | Various | https://fantom.beefy.finance |

| Liquid driver | PQDR | https://www.liquiddriver.finance |

| Mushrooms | MM | https://mushrooms.finance/farms |

| Greenhouse | SEED | https://thegreenhouse.finance |

| Stake Steak | STEAK | https://stakesteak.com |

| Frankenstein | FRANK | https://frankenstein.finance |

| Waka | WAKA | https://waka.finance |

| Elk | ELK | https://app.elk.finance |

| Paintswap | BRUSH | https://paintswap.finance |

| Tomb | Various | https://tomb.finance |

| Shadow | Various | https://shadowswap.app |

| Borgswap | KLING | https://klingftm.borgswap.exchange |

| Opera | OPERA | https://www.operaswap.finance |

| Chad | CHAD | NA |

| Guru | ELITE | https://ftm.guru |

| Rediant | RDT | https://rediant.finance |

| Mlnl | Various | https://milfinance.xyz |

| Yorocoon | CATNIP | https://yorocoon.com |

| Balloon Farms | BALLOON | https://www.fantomballoons.com |

| Spoon | SPOON | https://app.spoon.finance |

| Bullrun | BULL | https://fantom.bullrun.finance |

| Strangebrew | BEERMONEY | https://www.strangebrew.finance |

| Uniron | UNIRON | https://www.uniron.finance |

| Shade | SHADE | https://shade.cash |

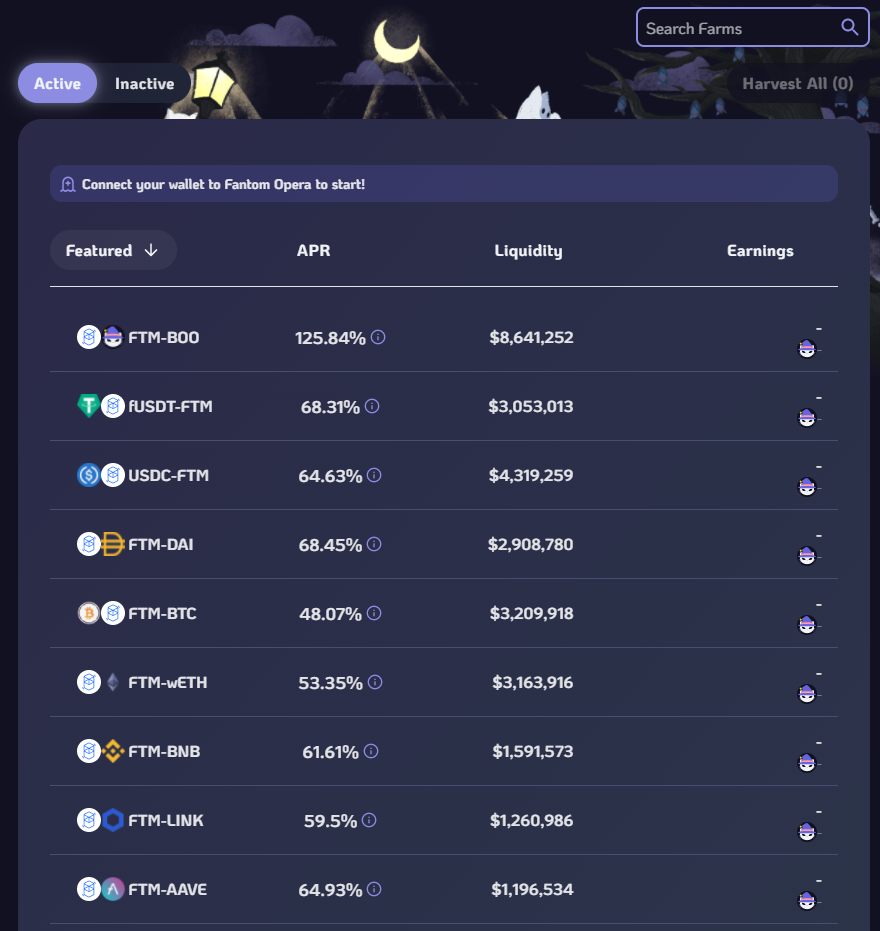

Here’s a quick look a the Spookyswap liquidity pool:

How to choose a liquidity pool

There are new yield farms being created everyday, so it is important to ensure that a yield farm is reliable before committing large amounts of cryptocurrency to a new farm.

Here are some factors you can take note of:

- Volume: the daily volume of the pool is important to because we make money only when there are swaps happening

- Reserves: it is important to know the size of the liquidity pool to ensure that the pool is not subject to wild price swings. The lower the reserves, the more susceptible it is to price swings.

- Ratio of volume to reserves: this ratio gives us the sense of the APY rate. This number should be increasing, or staying constant over time, and not decreasing. 4 – 7 digit APYs generally means the liquidity pool is relatively new and less there are less stakers to split the pool rewards.

- How long the liquidity pool has been around: The longer the liquidity pool is around, the safer it is.

Also Read: The Full List Of Yield Farms On The Polygon Network