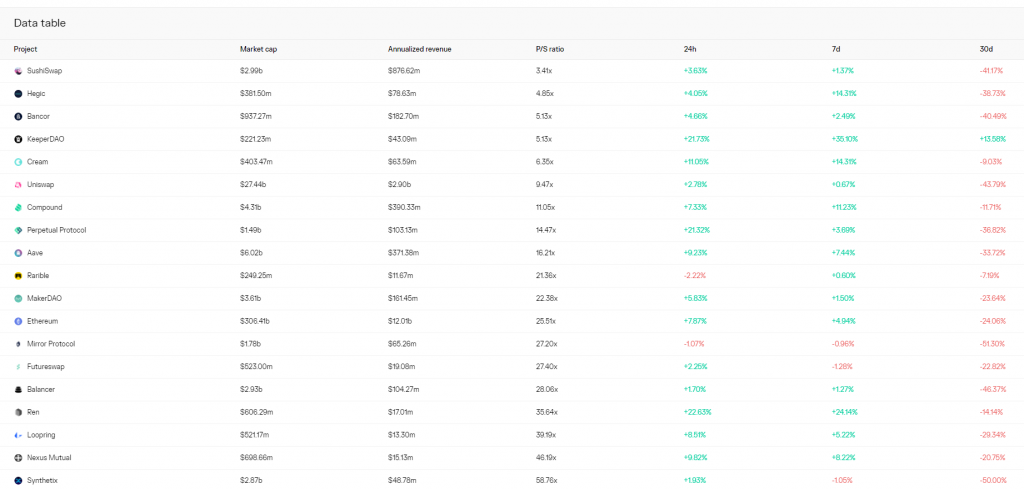

Sushiswap, a decentralized cryptocurrency exchange (DEX) and community-led AMM built on the Ethereum, has a low price to sales (P/S) ratio, suggesting that it may be undervalued.

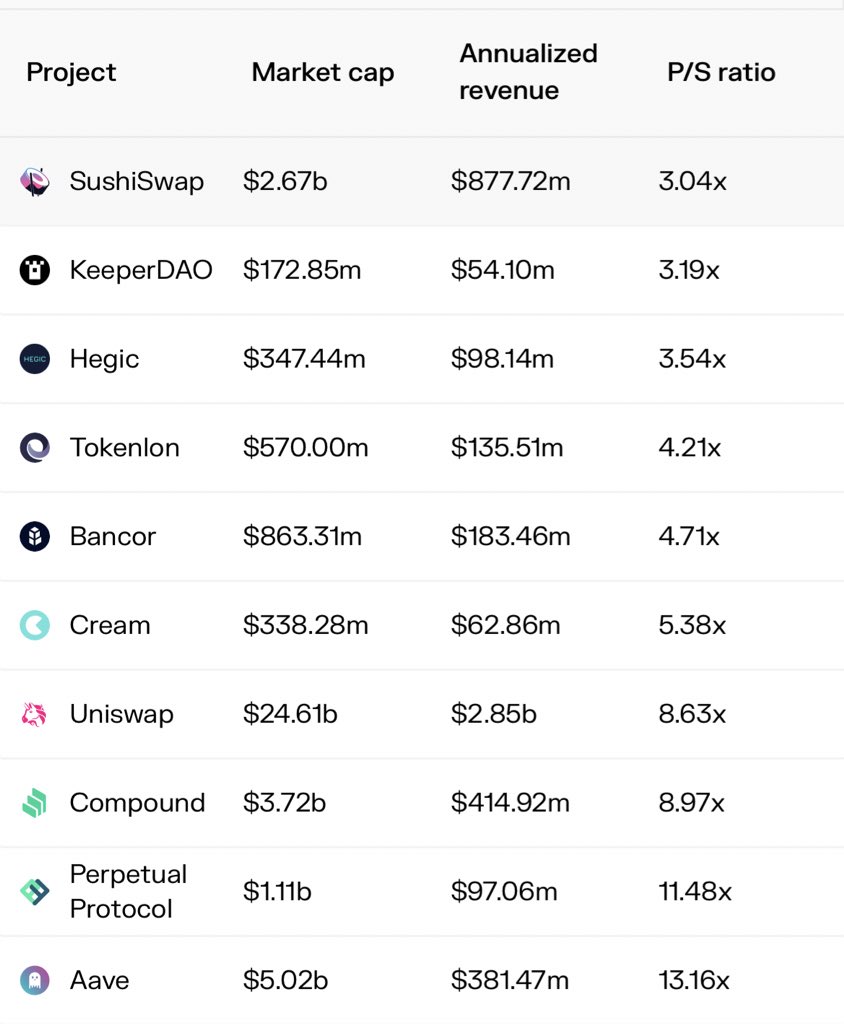

According to Token Terminal, Sushiswap is currently trading at a 3.4x P/S ratio, compared to its main counterpart Uniswap which is trading at a 9.5x P/S ratio. Here are the key metrics surrounding Sushiswap.

Over the last few months, SushiSwap has consistently ranked as one of the largest DEXs by trading volume and total liquidity.

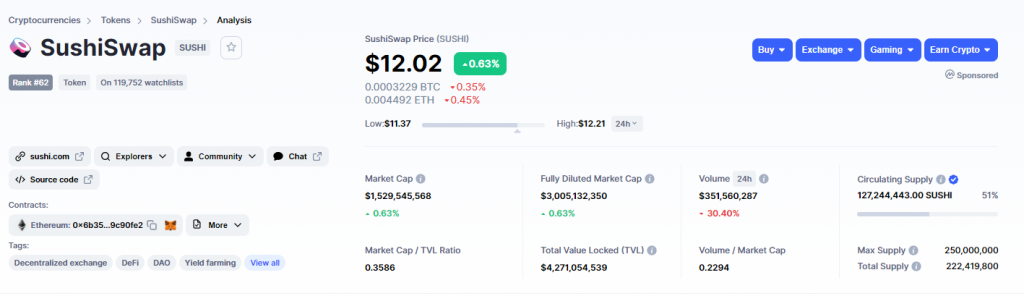

As of the time of writing, Sushiswap has a total value locked of $4.2 billion. Its market cap is at $1.53 billion at $12 per coin.

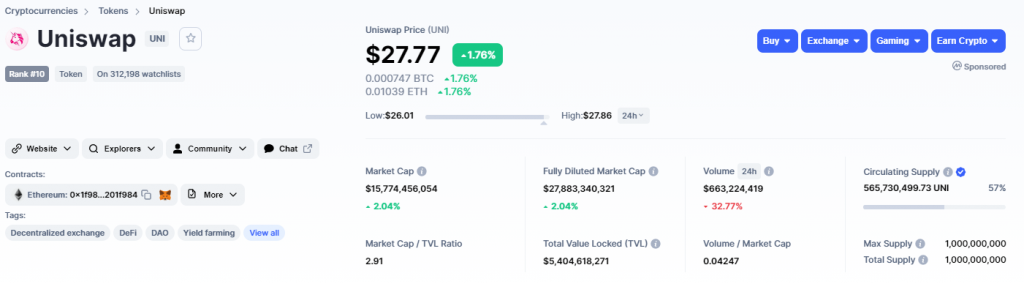

On the other hand, Uniswap has a total value locked of $5.4 billion, with a market cap of $15.5 billion at $27.5 per coin.

| Uniswap | Sushiswap | |

| Price | $27.57 | $12.02 |

| Market Cap | $15,666,992,400 | $1,532,983,808 |

| Total Value Locked | $5,404,618,271 | $4,271,054,539 |

| Mcap/TVL | 2.88 | 0.3558 |

With just 20% more valued locked in Uniswap, it is trading at a 10x market cap more than Sushiswap, suggesting that Sushiswap can be 5x undervalued or worth at least $60 per coin.

On top of the these metrics showing that Sushiswap is undervalued as compared to other tokens, Chief Investment Officer of cryptocurrency investment firm Arca, Jeff Dorman, has also tweeted that Sushiswap is currently one of the most undervalued cryptocurrency, and shared some possible reasons why.

Here’s the thread:

2/ $SUSHI has underperformed both $UNI and the broader DEX market since the beginning of the year.

— Jeff Dorman, CFA (@jdorman81) May 14, 2021

This is most apparent with the 50% peak-to-trough decline in March and April (still down ~30% from ATH’s) pic.twitter.com/c0LmCXXXpb

4/ #1 Impact from Vested Supply

— Jeff Dorman, CFA (@jdorman81) May 14, 2021

Just as yield farming can create traction for a new project overnight, dilution from yield farming can be just as painful when an asset is out of favor.

We saw this with the $CRV launch and with $UNI during their short yield farming stint.

6/ Does supply overhang matter? Yes, absolutely – see $SUSHI price action in April.

— Jeff Dorman, CFA (@jdorman81) May 14, 2021

Sushi started Nov 2020 at $0.60. Yield farmers made a killing waiting out the 6-month vesting period, & unloaded after their massive gains vested. The market had to swallow the supply.

8/ And some of that inflation may be mitigated. An ongoing proposal would lock up add'l $SUSHI into oSushi, similar to veCRV model, where voting power over distribution of pool rewards is based on amount of time a holder locks up tokens.https://t.co/p6TzuzTGyD

— Jeff Dorman, CFA (@jdorman81) May 14, 2021

10/ #2 Impact from Uniswap V3

— Jeff Dorman, CFA (@jdorman81) May 14, 2021

The hype surrounding $UNI V3 likely led to some of the $SUSHI underperformance.

But, Sushi & Uni are moving in different directions.

a) Uni is narrowing in on spot trading; Sushi is expanding vertically w/ Kashi & other future Bentobox products.

12/ c) Again, the V3 overhang has yet to have any impact on SushiSwap trading volumes or CF’s to xSushi holders – metrics that actually matter when valuing $SUSHI.https://t.co/DUoVZT61lx

— Jeff Dorman, CFA (@jdorman81) May 14, 2021

14/ This can be seen looking at unique traders & volume/unique weekly trader – clearly, $SUSHI user's are whales.

— Jeff Dorman, CFA (@jdorman81) May 14, 2021

This is similar to $FTT vs $BNB / $COIN – FTX caters to a few, big customers while BNB / CB cater to tons of smaller customers.$FTT has crushed it w/ this approach pic.twitter.com/2ZlqoFoYzL

16/ But with TVL and Trading volumes both on the rise again from mid-April to today, and BSC likely not a long term solution for $SUSHI's user demographic, this overhang does not likely have a long term impact on CF’s.

— Jeff Dorman, CFA (@jdorman81) May 14, 2021

18/ Meanwhile, $SUSHI has continued to expand, offering optionality of further CF’s to xSushi holders if they are successful.

— Jeff Dorman, CFA (@jdorman81) May 14, 2021

They have launched cross-chain and are seeing traction.

i.e. $MATIC: $400M in TVL (Avg ~$40M/day in about a week)

(Source: https://t.co/M2q57emNYT) pic.twitter.com/vDQ1CS5t1F

20/ Overhangs that do not impact core businesses create opportunities to buy growing projects at depressed multiples.

— Jeff Dorman, CFA (@jdorman81) May 14, 2021

Using any observable metric, $SUSHI is cheap. Really cheap.https://t.co/1KtAHDWY8q

22/ As investors rotate back to into #DeFi (and they are), these are the opportunities to look for.https://t.co/vfNnzJSYJO

— Jeff Dorman, CFA (@jdorman81) May 14, 2021