Have you ever had the feeling that the volatility of cryptocurrency prices is too much to manage?

One moment they are soaring, and the next they are plummeting rapidly. Stablecoins fill that role. Consider stablecoins as that reliable friend who remains calm even amidst chaos. But what exactly are they and why do they hold such significance? Let’s jump in and discover!

What Are Stablecoins?

Stablecoins are like the steady option in the world of digital money. Unlike Bitcoin or Ethereum, which can go up and down in price, stablecoins are linked to real-world assets like dollars, euros, gold, or even smart algorithms. This makes their value more predictable, giving people a reliable choice in the ever-changing crypto space.

Why Are Stablecoins Important?

Imagine you’re an international trader or a business owner handling transactions across borders. Bitcoin might sound like a great option, but its value could jump 20% one day and drop just as much the next. It’s exciting, but not exactly practical for stable busines. This is why they are commonly used for:

- Transferring money overseas: Quicker and more cost-effective than previously.

- Safeguarding your possessions: Ensuring they are secure from fluctuations in the market.

- DeFi and lending: Acting as a steadier form of collateral in decentralized finance applications.

A Bridge Between Two Worlds

Tablecoins are more than just a different form of digital currency. They act as a functional link between conventional finance and the changing realm of digital currencies. By keeping their value steady, they enable users to enter the crypto market without worrying about unexpected price changes.

Stablecoins provide simplicity and accessibility to the digital economy, whether used for everyday transactions or investment management. They merge the trustworthiness of traditional currencies with the inventive capabilities of blockchain technology, producing a distinct financial instrument that attracts a wide range of people.

What is your opinion? Is it possible that stablecoins are the solution for a safer and more equitable financial future?

Stablecoins are not just USDT and USDC!

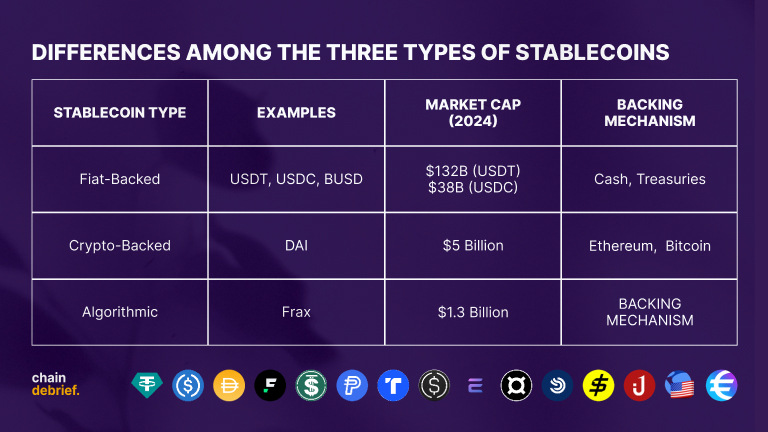

Stablecoins are much more diverse than just the big names like USDT and USDC. They offer a range of options for users depending on their preferences and needs, from fiat-backed to algorithmic models. Each type has its own way of maintaining stability and playing a unique role in the broader financial system.

1. Fiat-Backed Stablecoin

Fiat-backed stablecoins are among the simplest and most popular. Their value is tied directly to traditional currencies like the US Dollar or Euro, with reserves held in trusted financial institutions.

Examples: USDT, USDC, BUSD

How They Work: For every stablecoin, there’s an equal amount of cash or similar assets sitting in reserve.

Why They’re Stable: Because they’re backed 1:1 with real money, their value stays consistent, making them a great choice for payments or savings.

2. Crypto-Backed Stablecoins

These are backed by cryptocurrencies instead of cash. Since crypto prices can swing a lot, these stablecoins use extra collateral to make sure they stay steady.

Examples: DAI, sUSD

How They Work: People lock up more crypto than the stablecoin is worth to handle any price changes.

Why They’re Stable: The extra crypto acts like a safety cushion, keeping their value steady even if the market moves.

3. Algorithmic Stablecoins

Algorithmic stablecoins use technology rather than reserves to manage their value. These coins rely on smart contracts to balance supply and demand, with some models incorporating partial reserves for extra security.

Example: Frax

How They Work: Algorithms adjust the supply of the stablecoin to maintain its target value.

What Keeps Them Stable: Programmatic interventions help balance market forces and ensure consistent value.

Differences Among the Three Types of Stablecoins

The differences between the three types of stablecoins.

What’s Next for Stablecoins?

The stablecoin market is rapidly evolving, with hybrid models like Frax gaining traction for combining decentralization and stability. These innovations appeal to users seeking alternatives beyond traditional approaches.

However, fiat-backed stablecoins continue to dominate due to their simplicity and strong cash backing, offering safety and reliability. The future of stablecoins will depend on balancing innovation with the trust and stability users demand.

Top 5 Stablecoins by Market Cap in 2024

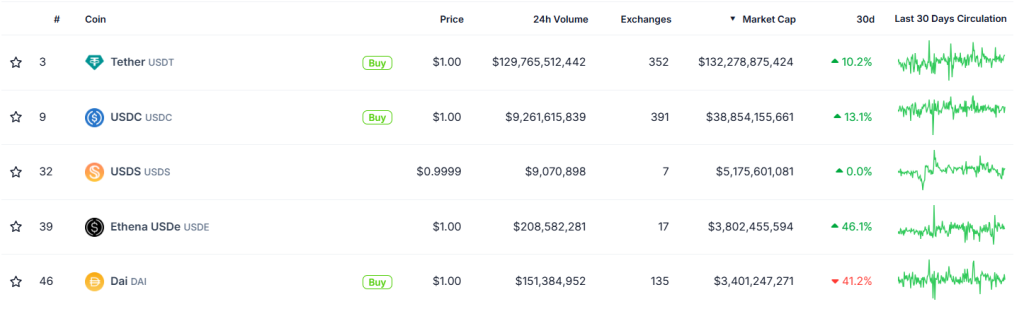

According to CoinGecko, stablecoins are becoming a big deal in the crypto world. They’ve changed the way we handle transactions and save money, giving us some much-needed stability in a market that’s usually all over the place.

In November 2024, CoinGecko’s rankings highlight the top stablecoins that dominate the market, showcasing their vital role in the ever-growing blockchain econom Let’s dive into the top five stablecoins by market capitalization!

With the dominance of stablecoins clear, two names consistently stand out as the giants of the market: USDT (Tether) and USDC (USD Coin).

In the next segment, we’ll explore what makes USDT and USDC the go-to choices for traders, investors, and institutions alike. From their mechanisms to their global impact, get ready to uncover the driving forces behind these leading stablecoins!

Dive Deeper to USDT, The King of Stablecoins

When it comes to stablecoins, USDT or Tether is undoubtedly at the top. Its reputation for stability and unmatched liquidity has made it the preferred choice for traders, businesses, and even institutions. But what sets USDT apart from the rest? Let’s break it down.

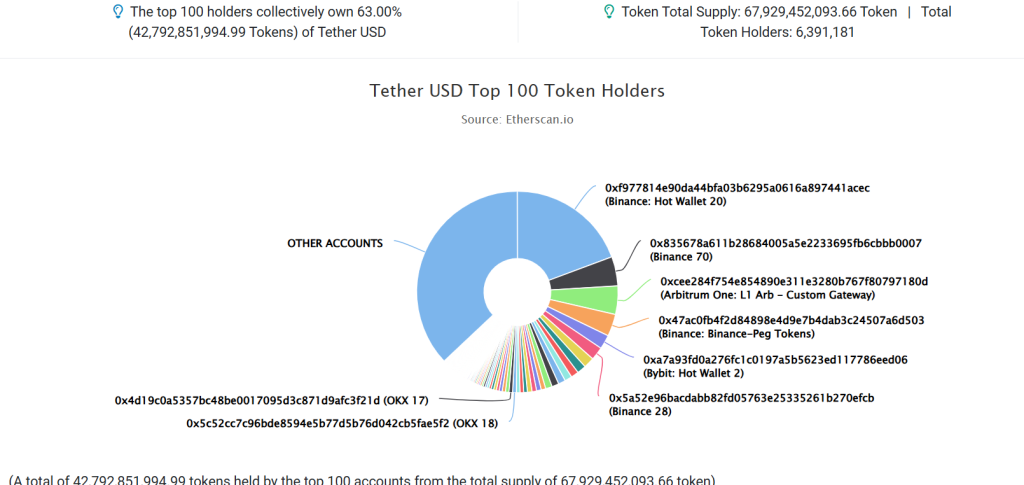

USDT’s Dominance in the Market

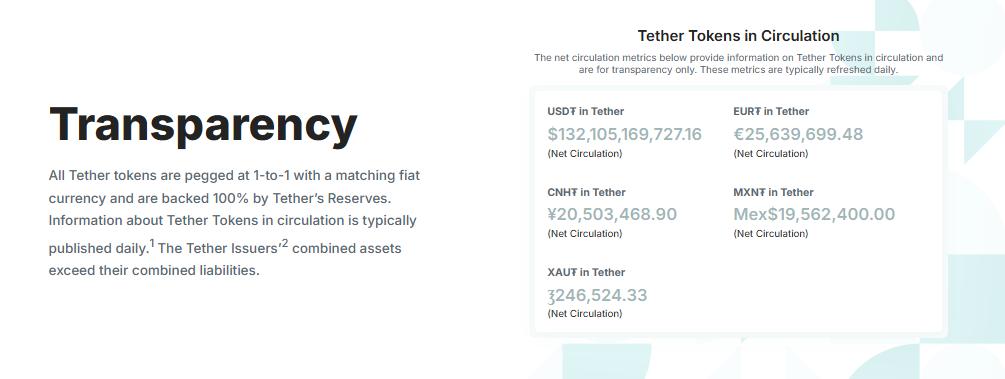

USDT, or Tether, is more than just another stablecoin. It is the backbone of the cryptocurrency market. With an impressive market cap of $132 billion in 2024, it does not just lead among stablecoins but also stands as one of the most actively traded cryptocurrencies globally. So, what makes USDT such a dominant force

Key Reasons Behind USDT’s Popularity

1. Unmatched Liquidity

USDT consistently leads in trading volumes, making it one of the most in-demand stablecoins for both individual traders and institutions.

2. Multi-Chain Integration

Operating on multiple blockchains like Ethereum and Binance Smart Chain, USDT ensures accessibility and smooth liquidity, supported by major exchanges such as Binance and OKX

3. Backed by Real Assets

Each USDT token is fully backed 1:1 by reserves such as cash and short-term investments, with regular transparency reports reinforcing trust and reliability.

Use Cases USDT

- For Individuals

- Offers a stable store of value, especially during volatile A safe haven during volatile market conditions.

- A convenient option for traders hedging risks or engaging in arbitrage.

- For Businesses

- Simplifies cross-border payments with lower fees and faster transaction times compared to traditional banks.

- Offers a way for merchants to accept crypto payments without worrying about price swings.

- For DeFi and Exchanges

- Essential for decentralized finance as collateral and trading pairs.

- A key liquidity provider, ensuring smooth operations for both exchanges and traders.

What Makes USDT Special?

USDT offers unique advantages that have made it a cornerstone in the cryptocurrency world:

- Works Everywhere: USDT is compatible with multiple blockchains, making it accessible and flexible.

- Highly Liquid: Its massive trading volumes ensure users can always trade or exchange it easily.

- Global Reach: Accepted and trusted by users across the globe.

- Backed by Real Assets: Each USDT is fully supported by cash and short-term reserves.

- Regulation Ready: Complies with financial standards to ensure user confidence.

- Transparent Operations: Regular updates on reserves build trust and credibility.

- Always Available Support: Reliable assistance is provided whenever users need it.

What’s Next for USDT?

USDT isn’t just for traders. It has become a vital part of financial innovation, bridging the gap between traditional systems and the crypto world. Its steady growth and strong reputation suggest it will continue to lead the stablecoin market while introducing new features that keep it relevant and trusted.

Up next, we’ll take a closer look at USDC, a competitor with its own strengths and unique approach.

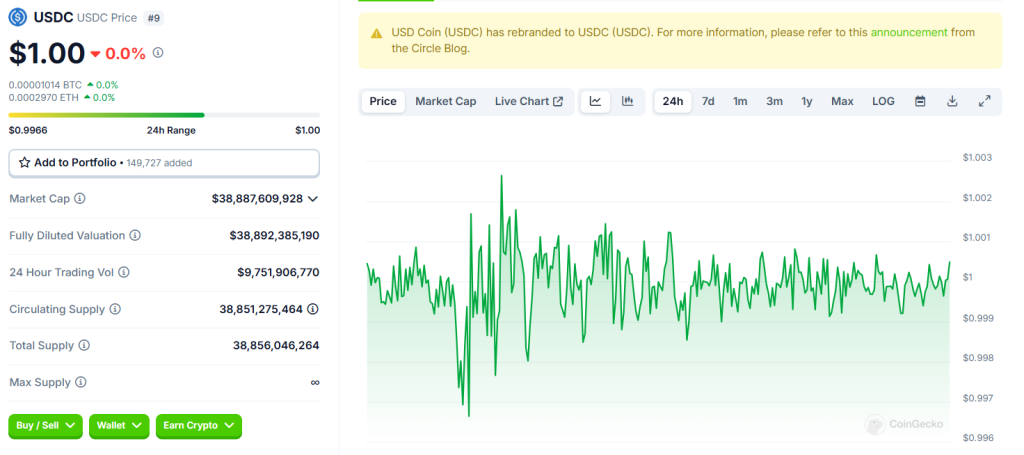

USDC Brings Stability to the Crypto World!

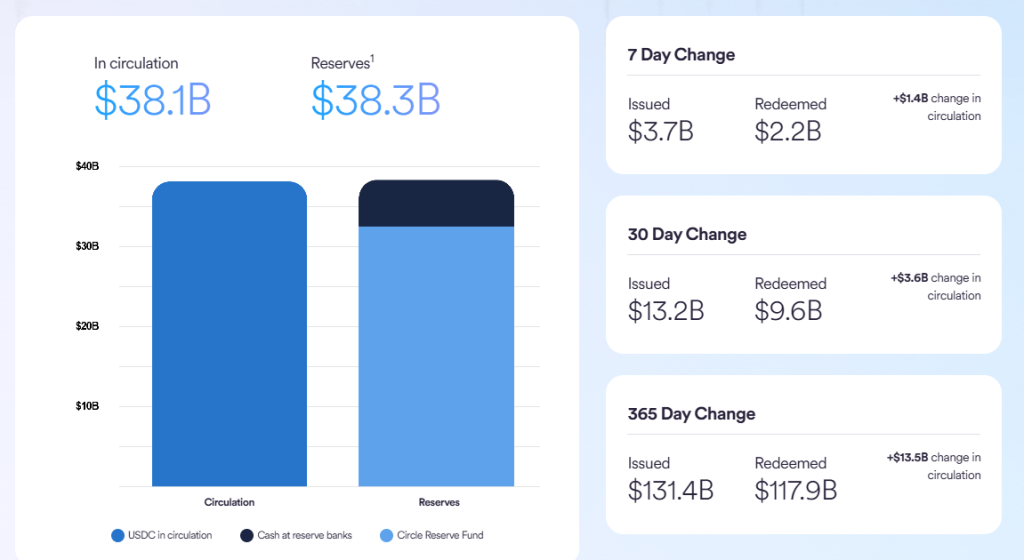

USD Coin, or USDC, stands as a strong contender to Tether (USDT), carving out its place as a trusted and regulated stablecoin in the crypto world. With a market circulation of $38.86 billion, USDC is often seen as the “digital dollar” that blends reliability with compliance.

Related The stablecoin showdown

The Foundations of USDC

Launched in 2018 by Circle in collaboration with Coinbase, USDC is backed 1:1 by US dollars held in reserves. These reserves, comprised of cash and short-term U.S.

- Market Growth: Since its inception, USDC has achieved a remarkable $18.16 trillion all-time trading volume, reflecting its rapid adoption across the crypto ecosystem.

- Liquidity at Its Best: Boasting a $42.18 billion 24-hour trading volume, USDC simplifies trading for institutions and retail investors, ensuring smooth transactions at any scale.

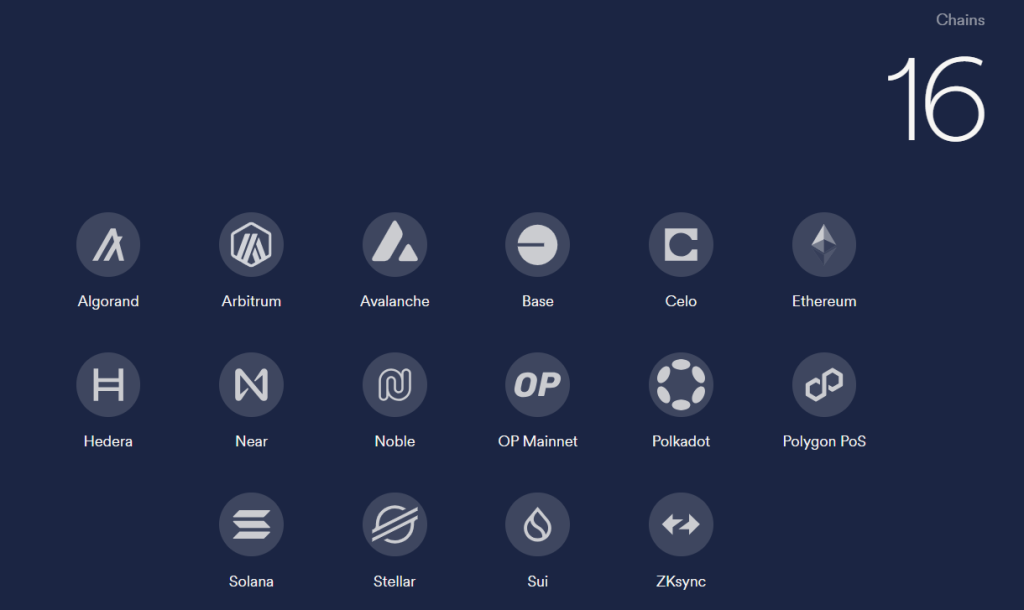

USDC’s Multi-Chain Advantage

One of the key features that sets USDC apart is its wide availability across 16 major blockchains. This includes popular networks like Ethereum, Solana, Polygon, and Avalanche, ensuring seamless integration and flexibility for users across various platforms.

Expanding Global Reach

USDC’s availability in 100+ countries cements its role as a stablecoin for global use.

Why Pick USDC?

USDC is known for being clear and trustworthy, with regular checks and strong support from regulations. It’s a popular choice in the crypto world because it’s easy to use and reliable. Whether you’re trading, using DeFi, or sending money abroad, USDC gives you a stable and dependable option.

As the stablecoin debate heats up, the next focus will be on a closer look at the competition: USDT VS USDC. Which one truly dominates?

USDT vs USDC in the Stablecoin World

While USDT and USDC are both designed to offer price stability and simplify transactions, they cater to different priorities and user needs. Here is a comparison to help you decide which one fits best:

| Feature | USDT (Tether) | USDC (USD Coin) |

|---|---|---|

| Market Capitalization | $132 billion | $38.86 billion |

| Transparency | Backed by cash, equivalents, and other assets with limited audit transparency | Fully backed 1:1 by cash and U.S. Treasury bonds with monthly audits |

| Blockchain Support | Available on major blockchains like Ethereum, Solana, Tron, and Binance Smart Chain | Supports 16 blockchains including Ethereum, Solana, Polygon, and Avalanche |

| Use Case | Preferred for high-volume trading and liquidity | Favored by institutions and DeFi users for compliance and transparency |

Choosing between USDT and USDC really depends on what you’re looking for. If you value flexibility and easy access, USDT might be your go-to. But if trust and solid regulatory support are more your thing, USDC is a strong choice. Both are major players in the growing crypto space, and platforms like PEXX are making it even easier to bridge the gap between crypto and traditional finance.

PEXX, Revolutionizing Stablecoin Payments in Indonesia

As stablecoins like USDT and USDC continue to revolutionize the financial ecosystem, platforms like PEXX stand at the forefront of this transformation. Designed to bridge the gap between cryptocurrencies and traditional banking, PEXX offers seamless cross-border payment solutions, including direct transfers to banks in Indonesia.

Why PEXX Stands Out?

PEXX’s innovative platform provides several key advantages that make it a game-changer in global money transfers:

- Speed: Transactions are completed in under 5 minutes, ensuring efficiency.

- Affordability: Transparent Google Finance rates with zero hidden fees.

- Global Access: Supports transfers to 50+ countries in 16 currencies.

- User-Friendly Interface: Designed for all users, from crypto experts to beginners.

- Enhanced Security: Partners with Fireblocks to provide top-tier asset security.

Tailored for Indonesian Users

In Indonesia, PEXX supports transfers to major banks like BCA, BNI, BRI, Mandiri, and Permata, with transaction limits of up to USD 1 million per transfer. For other banks, users can transfer up to IDR 100 million per transaction, making PEXX ideal for both personal and business needs.

With such tailored support, PEXX opens up a world of possibilities for Indonesians to leverage stablecoins in a practical, secure, and efficient manner. Whether you’re an entrepreneur managing international payments or an individual seeking a reliable remittance option, PEXX offers a solution that simplifies global money movement.

You can start your journey with PEXX here and enjoy fast, secure, and affordable cross-border transfers!

You can also read this DOGE Gains Coinbase CEO’s Backing as a Path to U.S. Economic Freedom

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]