Get the PEXX app

Get the app on Play Store or App Store

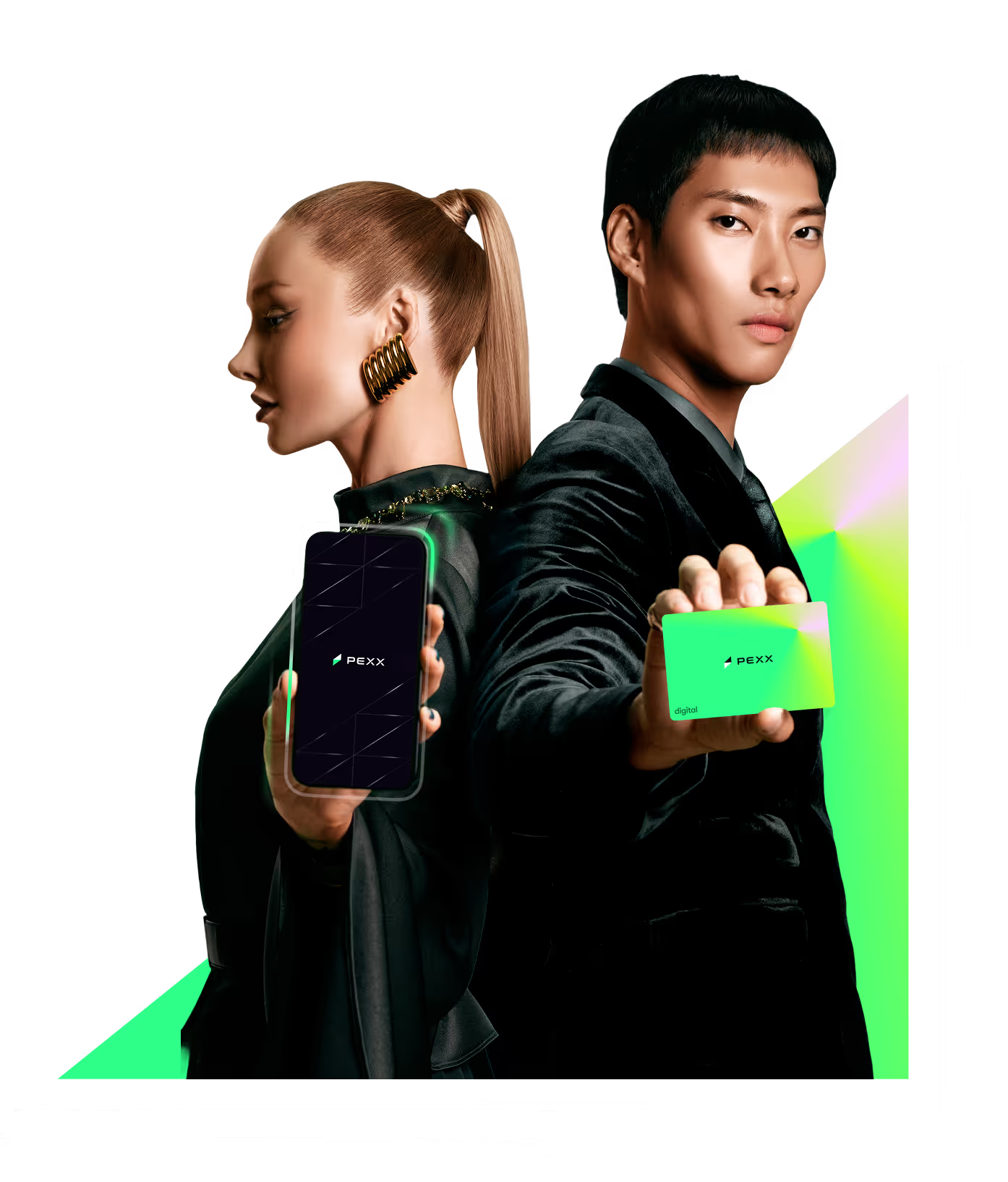

The new world, demands a new card. Pay Different

USD and stablecoins. Physical or virtual. Tap, swipe, and earn anywhere. The all-new PEXX Cards are here.

Get Your Card

As featured in

Easy

Signup

Three easy steps, one epic card.

Sign up

Get set up in minutes.No delays. You’re in.

Top up

Top up with USD, USDT, or USDC. Funds land. You’re good to go.

Tap, swipe, done.

Your PEXX card is ready—digital or physical.

Pick your

Card

CARDS TO RULE THEM ALL.

Physical, virtual, or both — PEXX unites crypto and fiat, giving you total control across worlds, borders, and networks.

PEXX Physical

Load up with USD and stablecoins. Accepted globally, swipe and tap anywhere.

PEXX Virtual

Instant access, seamlessly connect with online platforms. Effortless spending - tap, pay, go.

PEXX

Security

Bank different. Sleep better.

With PEXX, security isn’t a feature — it’s the foundation. Your money stays yours. No surprises. No compromises.

Encryption

Bank-grade encryption keeps your data locked tight. Because privacy isn’t optional—it’s essential.

Instant Alerts

Real-time alerts, across borders. Know exactly what’s happening, the second it happens.

Total Control

Manage your funds your way. Your money, your rules—always clear, always secure.

24/7 Security

Protection around the clock. We never sleep, so you always can, wherever you land.

Easy

Signup

A little extra,

a lot different.

Stable FX

No hidden math. Every transaction at true mid-market pricing, the way global money should move.

App integration

Real-time balances, smart insights, instant controls. Your money, your moves, wherever you are.

Flexible top up

Top up with USD, USDT, or USDC. Ready to spend the moment it hits — soft landing, no standing in line.

Jordan P.

PEXX Card is perfect for my freelance gigs abroad. No more weird bank forms—just load and go.

Chris M

I was worried about complicated verifications, but PEXX made it so easy. Seriously, no boundaries!

Alex G.

PEXX saved me a ton in foreign transaction fees when I traveled. I’m never going back to my old bank

Testimonials

Freedom feels different.

How can I make bank transfers to Indonesia, Vietnam or India?

To send money abroad with PEXX, first deposit USD, USDT, or USDC into your wallet. Choose the destination country and currency, enter the amount, and add the recipient’s bank details. PEXX shows the live FX rate and fees before you send. Transfers are fast and trackable in real time.

Does PEXX support transfers globally?

You can send money to 17+ countries with PEXX, including India, Vietnam, Philippines, China, and the U.S. Supported currencies include INR, VND, PHP, CNY, USD, EUR, and more. Full local currency payouts—no wallet needed on the recipient’s side.

Does PEXX support real-time transfers?

Most PEXX transfers arrive within 15–30 minutes. In rare cases involving compliance checks, it may take up to 1 business day.

Are e-wallet transfers available on the PEXX app?

E-wallet transfers are currently not available at the moment, but may be added in a future update. PEXX supports transfers to your own bank account, someone else’s personal account, or a business account. Options may vary depending on the payout currency and destination country.

What makes PEXX cheaper than Wise or Western Union?

PEXX is cheaper than Wise or Western Union thanks to regulated liquidity partners and better-than-Google FX rates. Our INR and VND routes beat Wise by 1.35% and 1.9%, respectively.

What is the PEXX Card?

The PEXX Card is a debit card available to any verified PEXX user. You can use it instantly worldwide—online, in-store, or through tap to pay Anyone with a valid ID and phone can access global spending—no waiting, no paperwork.

How quickly can I get my virtual debit card after signing up?

You’ll get your virtual card within 1 minute after your deposit is confirmed—either on-chain or by our partner bank. Fast, automated, and ready to spend instantly.

Does PEXX have the cheapest card fees in the market?

We strive to give you the best pricing in the market. PEXX charges a 0.6% platform fee on every card transaction. For non-USD purchases, a 1.2% FX markup applies when converting currencies. No hidden fees—just clear, flat pricing.

Does the PEXX card have spending limits?

There are currently no spending limits, so you can use your balance freely worldwide.

What is the PEXX USD Account?

Our USD virtual bank account gives you real USD banking details—routing and account number—without needing a US address. Open it in minutes with just your passport or ID. Receive, send, and hold dollars globally.

Can I deposit USD with SWIFT or ACH?

You can deposit funds via ACH, Fedwire, and SWIFT payment rails. PEXX provides full banking details for each method. Choose the option that suits your sender or region.

Do you support instant deposits into the USD account?

Standard ACH: 1-3 U.S. business days.

Fedwire: A few hours to 1 U.S. business day

SWIFT: 1-5 U.S. business days

Fedwire: A few hours to 1 U.S. business day

SWIFT: 1-5 U.S. business days

Can I open a PEXX USD Account if I am not in the United States?

Any PEXX user who completes level 1 KYC can open a U.S. virtual bank account. No U.S. address, SSN, or residency required. Just a valid ID and phone number.

Are my USD account deposits insured?

PEXX USD account deposits are not FDIC-insured, but your funds are held with licensed partners and protected by top-tier security protocols. Your money stays secure, even without traditional bank coverage.

How safe is my interest account deposit with PEXX?

Your principal is backed by low-risk U.S. Treasury Bills, but it's not FDIC-insured. While PEXX partners with regulated providers, market and counterparty risk are still present.

Does my interest credit daily?

Interest is calculated daily based on your wallet balance and credited the next day. You earn in the same asset—USD, USDT, or USDC—with no action needed on your part.

Is there a minimum deposit to start earning interest?

There’s no minimum balance, no lock-up period, and no withdrawal penalties with PEXX Earn. You earn daily yield for every day your funds stay, and can withdraw anytime—no strings attached.

What happens to the interest account rate if US Treasury Bill rates change?

PEXX yield is pegged to U.S. Treasury Bill rates, so it may adjust if market conditions change. Rates are reviewed regularly and updated as needed. You’ll be notified via app or email before any changes.